I inherited mineral rights in 2011 when my Mother passed away. I am arranging to sell my rights, but I need a basis (the value of the rights when I inherited them) for when I get ready to pay taxes. I have done a little research with the on line assessor website, but I really don't know where actual sales of mineral rights are recorded or if the records of sales amounts are kept online. Does anyone have experience with establishing a basis for the sale of mineral rights and where should I look for that information?

You should read this forum for what mineral rights are bringing. Offers you might have received in the mail could be half of what you can get.

If you post the location of your mineral rights there a lot of knowledgeable people that are familiar with the market.

I would talk to an attorney that handles leasing in Kingfisher. He should know what leases were going for in 2011 and be able to advise you on what can get. I used Ralph Harrison in Kingfisher.

Peter --- I'm guessing there was not a federal estate tax return but what about a state of Oklahoma estate return? Assuming none. Also assuming you are an Oklahoma resident. In the past during the days of Oklahoma estate taxes and valuations, have seen valuations placed from 3yrs to 6yrs of actual royalty receipts accepted by both the State of Oklahoma and IRS as a basis depending on whether you wanted that basis to be low or high. I would use the above as a starting point for tax basis. I agree with Rick Roberts, your best bet will be to contact a local attorney such as Harrison to help establish that value. In addition to the taxation angle, the outright "sale" of a mineral interest in Oklahoma is usually considered to be a capital gain asset subject to very low rates (15%) on the federal side and excludable 100% from Oklahoma taxation. As in all things taxation, subject to change without notice and your mileage may vary -- grin -- Be sure to make sure your situation qualifies for the exclusion and capital gain treatment.

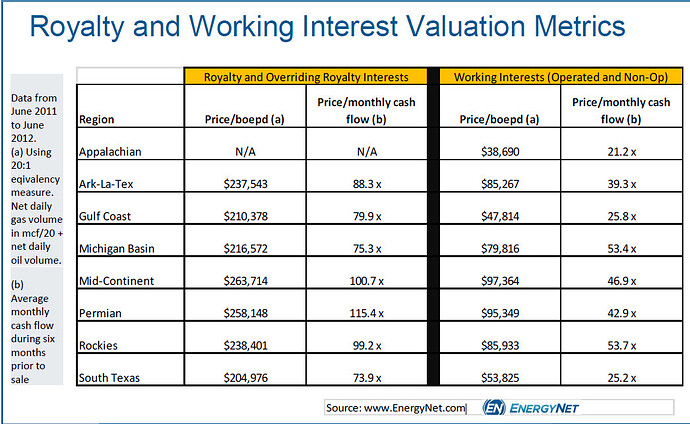

Peter --- Here's another starting point to hang your hat -- six years as I mentioned earlier would be 72 and the table above has some much higher points depending on where you are. For what it is worth.....

With ObomaCare, I believe it added another 3.8% to Capital Gains Tax; so, 18.8% today.

Okcnhra said:

Peter --- I'm guessing there was not a federal estate tax return but what about a state of Oklahoma estate return? Assuming none. Also assuming you are an Oklahoma resident. In the past during the days of Oklahoma estate taxes and valuations, have seen valuations placed from 3yrs to 6yrs of actual royalty receipts accepted by both the State of Oklahoma and IRS as a basis depending on whether you wanted that basis to be low or high. I would use the above as a starting point for tax basis. I agree with Rick Roberts, your best bet will be to contact a local attorney such as Harrison to help establish that value. In addition to the taxation angle, the outright "sale" of a mineral interest in Oklahoma is usually considered to be a capital gain asset subject to very low rates (15%) on the federal side and excludable 100% from Oklahoma taxation. As in all things taxation, subject to change without notice and your mileage may vary -- grin -- Be sure to make sure your situation qualifies for the exclusion and capital gain treatment.

Thanks Rick. Good advice.

Rick Roberts said:

You should read this forum for what mineral rights are bringing. Offers you might have received in the mail could be half of what you can get.

If you post the location of your mineral rights there a lot of knowledgeable people that are familiar with the market.

I would talk to an attorney that handles leasing in Kingfisher. He should know what leases were going for in 2011 and be able to advise you on what can get. I used Ralph Harrison in Kingfisher.

Wow. A lot of good data. Does this all come from Energynet.com?

Okcnhra said:

I am a Maryland resident, so I have to figure out where to file. It never gets less complicated. Are mineral rights sold often enough around the Kingfisher area to be able to establish a basis ? And if rights are sold with some regularity, does the county/state maintain those sale prices?

Not that I am aware of --- usually you'll see a "$10 and other valuable consideration" in most official records. Same with leasing --- if my neighbor is happy with $500/acre and I hold out for $800, then why would they want to make it public...<grin> As to filing, you will probably have a "Non-resident" Oklahoma return for just the property sold and then will include it also in Maryland with a "tax credit" for the taxes paid to Oklahoma -- that's the way most states work such transactions. And federal-wise, a schedule D long term capital gain transaction. Again, you'll have to get someone "in the fray" to know what current going rates are and they change daily --- lots of activity going on here --- so the local attorney is a good reference. One other place you might take a look at --- www.energynet.com --- which I believe is an "on-line" buy/sell of mineral interests nationally --- will probably have some listings I would think for Oklahoma --- just don't know what you have to jump through to get some numbers --- and might be your best bet for selling --- just have to check it out and see. Good luck!

Yeah, I see that "$10 and other good and valuable consideration" clause a lot. I thought that perhaps the property records might be a little more transparent, but apparently not. I will check that Energynet.com site. I might have to bite the bullet and contact the lawyer. Hope he/she won't eat up whatever tax savings I might gain by getting the basis above zero. It's fixed so that one can't win, I think.

Peter --- if you don't mind disclosing, how many acres are involved here? Some of the "purchase" amounts can be several thousand/acre where you are selling them outright and way higher if they are in a strong location. From a positive side, have only seen the IRS question a mineral valuation one time in the past 10 years and that was back in the day when it was a 50% estate tax on the line and on 800 acres in the Kingfisher area --- they took the 60Xmonth royalty value that time with no problem. Don't make it harder than it needs to be -- but the number of acres does have a factor here I would guess. Historical reading of this forum might provide you most of what you need to substantiate.

Thanks. 17+ acres of an undivided interest on 150 acres. In the southeast corner of Kingfisher County.