Hi everyone -

My wife just inherited Mineral Rights from land that is located in Louisiana and we just started receiving royalty checks. We live in Pennsylvania. I am trying to figure out where all I need to pay taxes and how. I am not sure if we need to pay Louisiana State Tax as well as Pennsylvania State Tax. I also know that I most likely need to fill out a 1040ez quarterly and send that in for Federal.

Thanks!

JB

Income from royalties derived from Louisiana sources is taxable to Louisiana. You will need to file an IT-540B with Louisiana. You can find the info on this form here.

I live in Oregon and have to pay taxes for the county where mine is from. The state of Oregon gets their slice and also the fed. Best bet is to go to a good accountant that specializes in royalties. Otherwise, you can get screwed royally if your taxes are not prepared properly. We had to learn the hard way.

Andrew said:

Income from royalties derived from Louisiana sources is taxable to Louisiana. You will need to file an IT-540B with Louisiana. You can find the info on this form here.

In most states you will get a credit on your home-state taxes for royalty taxes paid to another state, so you shouldn’t be double-taxed on the state level.

Thank you all for your help! I have been sending estimated tax payments to Louisiana State as the Feds. Good to know that I will need to file a 540B with Louisiana. I typically do my own taxes but am considering a professional next tax season. I don't want to mess something up. I did talk to an accountant and was told that I don't have to pay taxes on my royalties since they are not considered earned income and that royalties are considered passive.

You do have to pay taxes on your royalties. On the federal level you pay ordinary income tax on 85% of your royalty income, with the other 15% being offset by a depletion allowance. Louisiana's taxes mirror federal.

Best to pay a CPA in my opinion, mine doesn't charge much.

What Pete said. Louisiana happens to be one of the states that does not assess ad valorem taxes on minerals.

Pete, I wrote a law review article on the subject that was published this spring. Let me know if you want to read it (which would knock me out of my chair...)

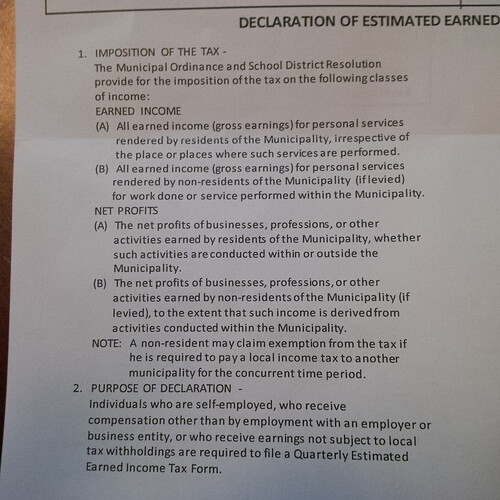

I meant that the accountant said that I don't have to pay LOCAL taxes on the royalties. Sorry for the confusion. I know that I have to pay Louisiana State and Federal taxes. I have been doing so. However, yesterday I received a blank estimated payment voucher from my local township. How would they know to send that?? I attached a section of the note saying what I have to pay the tax on. It just says I have to pay it on EARNED INCOME or NET PROFITS. Royalties are neither.

Andrew said:

You do have to pay taxes on your royalties. On the federal level you pay ordinary income tax on 85% of your royalty income, with the other 15% being offset by a depletion allowance. Louisiana's taxes mirror federal.

Actually, I think they sent this for another reason. My wife's employer (last year) forgot to withhold the right amount of local taxes and withdrew $50 from each paycheck for a couple months. There is a note about it on the form I missed.

Yes, sir, I would like to read it. Friend request forthcoming.

Andrew said:

Pete, I wrote a law review article on the subject that was published this spring. Let me know if you want to read it (which would knock me out of my chair...)

You're right, royalties are neither earned income nor net profits. So from reading this image that you uploaded, self-employed persons have to pay a local income tax in Louisiana? Did I read that right?

I'm not sure about Louisiana. I live in Pennsylvania. This document/image is from a township in PA not LA.

Unfortunately, that is correct. It's not a lot but it's still a tax.

Yep, I agree my friend.

Pete Wrench said: