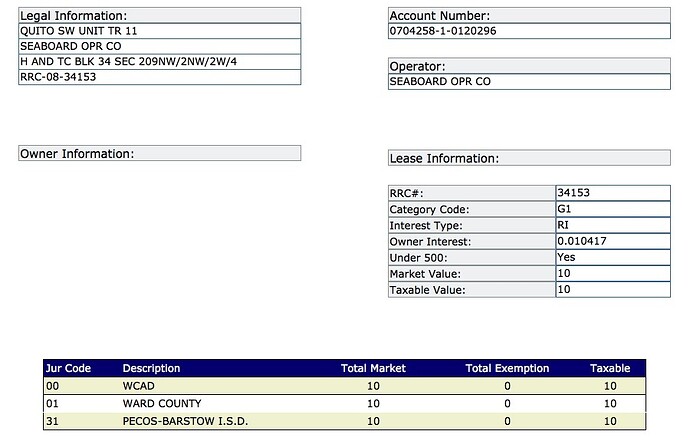

My siblings and I have recently been contacted by a Shell Oil Co rep, concerning property we apparently own in Ward Cty, TX. Problem is, we really know nothing about it. We think our dad inherited this back in the late 60's, along with his brother and sister (all deceased) and, we do remember our mom (also deceased), receiving dividend checks for years from our "oil well". They had dwindled down to $26/mth and, once she passed, none of us even thought about it . . . until now. However, we don't know if we even own the land, the mineral rights, or both, or the size of it, and have no idea where to start looking for those answers.

The rep did send us a "first look" map (and, I think I found our 'claim'), along with a "Surface Use Agreement and Subsurface Wellbore Easement Agreement". Right now, he's just asking our permission to survey and, after that, says they'll "have an idea of the size of pad site and its' location" and, has mentioned compensation "according to the University Land's Rate and Damage Schedule". I've been googling, and poking around your pages for two days, but haven't really found anything that describes how this process works. Any suggestions?

He's also asked if we have any of the other landowner's information (which we do) but, part of me even wonders if this is legit. He also seems to be in a hurry to get permission to survey. Is there a time constraint they're working under? Sounds like we could use an Oil & Gas lawyer? But, is there preliminary info I could/should gather?

Thanks for any insight you might provide! Sorry if I rambled!