i am absolutely clueless

Welcome to the Forum BMelton, there is a wealth of information and advice on here.

First of all, I would ask what they can do for 1/4 or 1/5 royalty, I would not sign a lease for 1/8 royalty and, depending on circumstances, I would possibly sign the 3/16 royalty.

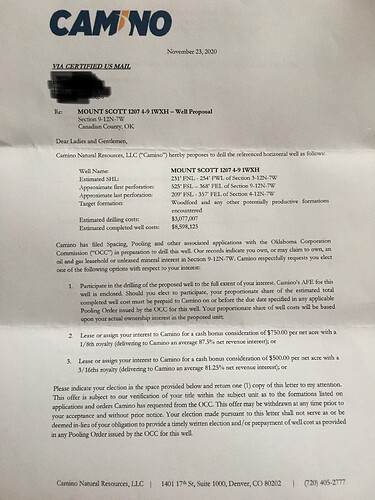

You actually do not have to do anything. That is a courtesy letter and indicates possible activity (my note-when prices come up a bit). Camino and Nosley Scoop LLC (who might be leasing for Camino or someone else) have quite a few leases at 1/5th posted over the last few months. So don’t go for less than that. You can either lease with Camino or wait for others to offer. The draft lease they send will not be in your favor and will need some negotiation.

Camino pooled those sections back in Dec 2019 at $1500 1/8th, $1250 3/16ths, $1000 1/5th and $0 1/4th. They did not drill, so need to pool again. You can ask for their 1/5th and 1/4 offer and negotiate a lease with them.

Personally, I would probably take the $0 and 1/4th offer if they pool it again on the new pooling. A higher royalty on every well that is drilled is much more preferable to a bonus that only comes once. The sections on either side of 4 (3&5) both have increased density orders-although they have not yet been drilled. .

thank you for the replies. So, just to be clear, I don’t have to respond to this without forfeiting any further options??

You can either contact Camino and start working on a lease, or you can wait for a pooling order. I file those sorts of letters in my files and use them for historical purposes. The lease will cover all rights from below the surface of the earth to the middle of the earth unless you put a depth clause on it. You will some other clauses to protect you such as a “no deductions” clause and a few others. The pooling only covers the reservoir of interest, so there are some advantages to it. But ask for higher royalties on the lease. They are giving them.

I do not know anything about Oklahoma mineral law. However, I’m curious and asking other members of the form: isn’t it in her best interest to contact this operator and negotiate a lease? In Texas, if she doesn’t, she will become a working interest owner and her interest will bear a proportionate share of all drilling costs and operating costs thereafter. The effect will be that she probably won’t see any income for many many years. I recognize that Oklahoma law may be very different.

Not in Oklahoma-law is completely different. If she does not lease with someone, and does not answer, she will be pooled at 1/8th and be only a royalty owner. If she answers the pooling, she can pick either the WI option (not a good idea) or any of the royalty interest options. I usually pick the highest royalty.

Appreciate being educated, thank you!

Do I negotiate for 1/4 net or gross? Or does it even matter?

I negotiate for 1/4 or 1/5 gross. You will need a very exact “no deductions” clause. Best if you get an oil and gas attorney involved.

This topic was automatically closed after 90 days. New replies are no longer allowed.