T13S, R35E Sec 35, Lea Co, nm Would like to add family trust name to GOM mineral ? rights How to go about it? Is there any leasing going on close to that area in Nov 2023?

Welcome to the community:

You asked a great questions, by transferring the minerals into your trust your heirs can avoid probate. Too many estate plans are written by attorneys who do not understand how to “fund” minerals into a trust. The result is often an avoidable probate is needed.

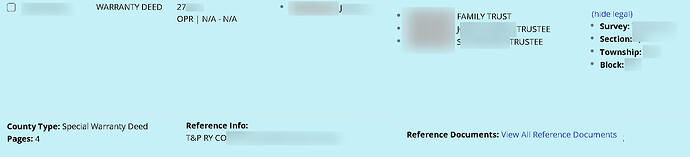

In most states minerals are considered to be real estate. Therefore, the proper way to fund a trust is to have the minerals deeded from the current owner to the trust or trustee and recording the deed with the land records. You should visit with your estate planning attorney. If he or she is not licensed in New Mexico, you should have a NM attorney prepare the deeds and paperwork.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Well I understand you are wanting to “add” the Trust to the already owners of the deed. So that Trust becomes part owner, if thats what your saying, or like Richard says, are you adding the property to the Trust ?

Richard, I agree that many attorneys don’t know how to transfer minerals into a trust or never ask if there are any interests that need to be considered. I had a cousin who set up a trust for his second wife. Minerals weren’t added as his attorney told him they had bern “lost” his in a tax sale. My cousin’s reverter rights were not considered. When the lease expired, and there was no will that could be probated, the “lost” rights returned to his estate’s heirs under intestacy.

I’m not a lawyer so take this a grain of salt.

In Texas, a lawyer is needed to deed this over to anyone including a trust. It should be an easy task though. It would require that the deed be recorded with the county clerk and a copy of the recorded deed be sent to the operator and /or one who writes the check. Basically transferring the name to reflect the trust instead of ones self. The checks are now paid to the trust and not to you.

Again this is not legal advice made by my self just what I have seen was done in the past. MK

This topic was automatically closed after 90 days. New replies are no longer allowed.