I’m trying to make sense of all of this. We have inherited mineral rights, and I can find the fields on the GIS server site, but can’t figure out how to get more info on production, never mind how to come up with a value.

I have this info from prior statements:

W 0180576

Allen 21x-17

W 0180577

Raymond 21x-05

W 0181757

Allen 21x-17a

W 0181758

Allen 21x-17b

W 0181759

Allen 21x-17e

W 0181760

Allen 21x-17f

W 0182092

Raymond 21x-05a

W 0182093

Raymond 21x-05axb

W 0182094

Raymond 21x-05e

W 0182095

Raymond 21x-05fxg

How do we begin quantifying what all of this means?

1 Like

Go to NDIC site. Then click on General Statistics. Then click on Monthly production on oil and gas. You can then look up the field you are located in. And the producer and your wells should be on there. It’s always 2 months in the rear with reports and production. That’s how its reported. Tells how much was sold. Reports come out around the middle of the each month.

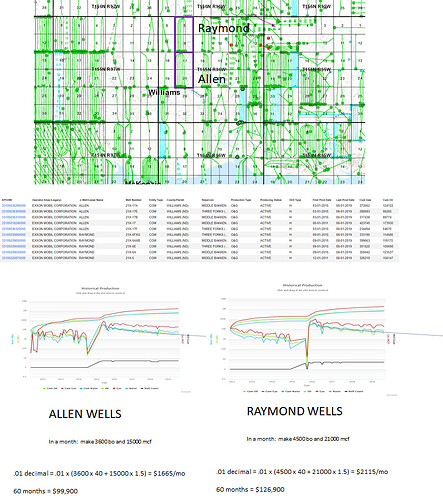

Here is some information on your wells. Basically XTO has developed the W/2 of those two units. Alternating wells between Middle Bakken and Three Forks. The wells are not very good. Not my fault, I was the Dunn County engineer for XTO  . I doubt they are rushing out to drill the E/2 anytime soon.

. I doubt they are rushing out to drill the E/2 anytime soon.

Right now the Allen unit is making a bit over 100 bopd and the Raymond is making around 150 bopd. Plus some gas. Charts of the total production for each unit are below on a monthly basis.

If you want to come up with a value, I put some back of the envelope math at the bottom for a sample decimal of 1% (.01). That’s roughly what the current production is worth at net (after prod taxes and gathering) pricing of $40/bo and $1.5/mcf. 60 months current cash flow.

There is value in the undeveloped E/2 of the unit as well. But not a ton, as I really don’t see them drilling these wells unless something changes markedly. I’d guess that increases the value by about another $60-70k for the same .01 decimal (roughly $1250 per undeveloped NRA) in either unit.

Again, that was assuming 1% ownership in the wells which is pretty high. Scale to whatever you see on your checks/division orders.

Take with grain of salt, but hope that helps on some level.

1 Like

Hi David,

You typically need to subscribe to the NDICs Premium Services in order to capture production numbers. Those Raymond wells were drilled in 2015 and the Allen wells in 2014 and here are some production numbers for you:

RAYMOND 21X-5A - 123,000 cum bbl and 1,000 bbl in August

RAYMOND 21X-5FXG 114k cum

RAYMOND 21X-5E 100k cum

RAYMOND 21X-5 150k cum

RAYMOND 21X-5AXB 118k cum

ALLEN 21X-17E 95k cum

ALLEN 21X-17 173k cum

ALLEN 21X-17B 89k cum

ALLEN 21X-17F 64k cum

ALLEN 21X-17A 124k cum

Note, XTO has drastically improved their well results in the area as the technology has improved over the past couple of years. Each of these units do have some room for additional wells (prob 4-5 more wells max). Valuation can be a tricky issue because the question becomes at what time are you trying to value the interests? If you just inherited them, then you may want to establish a valuation that you can use to support your basis in the asset. Hope this helps.

If you are trying to establish value as a curiosity, you can do it one way, but if you need to establish value for IRS purposes for an estate or for a sale, there are rules you have to follow. The novice could run into some trouble and get sideways with how the IRS wants it done. You can get an evaluation done by a experience appraiser that will follow those standard rules.

Hi I received Township 158 North, Range 101 West, section 15:SW4.

I received the mineral rights from my Father but I know absolutely nothing to what I actually have. I just got the paperwork but I do not understand it. Can anyone help explain ?

There are producing wells located under this tract that were drilled back in 2012. Here are a few basic questions you need to get answers for, in order to better understand your position:

What do you mean when you say you received the rights from your Father? Did you inherit them or did he gift them to you while he was alive?

Exactly what paperwork do you have? A Mineral Deed, an Assignment, a Lease Agreement, or something else?

Was your Father getting royalty payments?

If so, then your minerals are probably leased and you should have a copy of the lease. The only thing you would need to do is record your ownership with the County, and notify the oil company of the change in ownership.

If he was not getting payments, then he was most likely force pooled and then it becomes a little more complicated. He could have been force-pooled for a number of reasons: Was he unlocatable? Did he refuse to lease? Did he decline the offer to participate, or was he simply unresponsive? In each case, your options might be different.

Thank you So much for the reply. It was gifted to me from him and he is still alive. I have the mineral deed that was transferred to me. The document was notarized and it looks like the county recorder in Williams County has signed on it as well. Honestly my dad said he has been receiving royalties but he isn’t clear or at least I don’t feel he fully understands what he gave me (it was a wedding present) . Is there somewhere I can go or call to help me navigate these documents?

I should add my dad recieved this from inheritance in 2016.

You can learn quite a bit from the North Dakota oil & gas commission. www.oilgas.nd.gov You can look up your section and see what wells are there. If your dad was receiving royalties, then you need to contact the operator to move them into your name.

Set up a file for this property. Put a copy of your deed in it and any information that you can find. Royalties, get anything your dad has, etc.