I just found out about a property in Grant district, Wetzel, WV in which I have a small interest. I’m trying to understand how these leases work. From what I have read there seems to be a dollar value per acre ($2000 - $5000/acre) and then a percentage (12.5% - 20%) of gross production. Are these lease rates annually or monthly? We were contacted recently about a company wanting to do a horizontal well. Does this mean they will be drilling into the land below our property and extracting from a well head on a separate property? Would all the production from that head be considered “gross production”?

Hi Dave, the details always depend on the particular lease and situation, but typically the per acre amounts are a one-time payment only. The royalty percentage is typically paid monthly, but can be less often during times of low production. There are several possibilities with a horizontal well, but the situation you describe is one possible situation. Yes, the production from the well is considered the gross production for that particular well. Hope this helps and welcome to the forum.

Dave, Welcome to the forum. The initial lease bonus will be based on the net acres (NA) you own. There may be other mineral owners of the same acreage who share hence the division results in NA for each lease holder. The bonus is a one time payment as incentive to get you to sign a lease. Depending on where your parcel is located in Wentzel Co and the company you are dealing with will determine the value of the bonus. EQT is the most prominent operator in the Grant District of Wentzel. Checkout the map on the DEP website. As to royalty interest (RI) that should be your priority. A 12.5% RI is the minimum by WV law. Try to get 16 to 18% RI at a minimum which will pay monthly once they drill and operate the well or wells. Only agree to a max of 5 years in the lease with no automatic extension. A sample Addendum to a lease is attached. With horizontal drilling the actual pad could be located quite a distance from your interest. If the drill path crosses or is closely adjancent to your acreage it will determine the amount of your NA’s payment. It is also normal to be part of a pool of other RI owners and possibly multiple wells that determines your final interest. Hope this helps. A mineral rights lawyer is always a good source for professional assistance with a lease.

ADDENDUM

-

EIGHTEEN PERCENT (18%) GROSS ROYALTY: The Lessee shall pay to the Lessor free of cost, a royalty equal to eighteen percent (18%) of all oil produced and saved from the leased premises, and shall pay Lessor eighteen percent (18%) of the gross proceeds received by Lessee for the sale of all gas produced and sold from the leased premises, payable monthly. It is agreed between the Lessor and Lessee that, notwithstanding any language herein to the contrary, all oil, gas or other proceeds accruing to the Lessor under the subject lease or by state law shall be without deduction, directly or indirectly, for the cost of producing, gathering, separating, treating, dehydrating, compressing, processing, transporting, and marketing the oil, gas and other products produced and sold hereunder.

-

NO STORAGE RIGHTS: Notwithstanding anything herein contained to the contrary, Lessee agrees the herein described leased premises shall not be used for the purpose of gas storage as defined by the Federal Energy Regulatory Commission. Any reference to gas storage contained in this lease is hereby deleted. If Lessor wishes to enter into an agreement regarding gas storage using the leased premises with a third party, Lessor shall first give Lessee written notice of the identity of the third party, the price or the consideration for which the third party is prepared to offer, the effective date and closing date of the transaction and any other information respecting the transaction which Lessee believes would be material to the exercise of the offering. Lessor does hereby grant Lessee the first option and right to purchase the gas storage rights by matching and tendering to the Lessor any third party’s offering within 30 days of receipt of notice from Lessor.

-

NO COALBED METHANE: Not withstanding anything contained herein, this Lease shall not include the right to produce coalbed methane.

-

COMPLIANCE: Lessee’s operations on said land shall comply with all applicable federal and state regulations.

-

HOLD HARMLESS: Lessee agrees it will protect and save and keep Lessor harmless and indemnified against and from any penalty or damage or charges imposed for any violation of any laws or ordinances, whether occasioned by the neglect of Lessee or those holding under Lessee, and Lessee will at all times protect, indemnify and save and keep harmless the Lessor against and from any and all loss, damage or expense, including any injury to any person or property whomsoever or whatsoever arising out of or caused by any negligence of the Lessee or those holding under Lessee.

-

WARRANTY OF TITLE: It is understood that Lessor warrants title to said property only with respect that the title is good to the best of Lessor’s knowledge and Lessee agrees that no claims will be made against Lessor pertaining to warranty of title.

-

AD VALOREM: Lessee agrees to pay a proportionate share of any increase in ad valorem taxes assessed against the leased premises, which is based upon the value of oil and gas production from, or reserves under, the leased premises.

-

SHUT-IN LIMITATIONS: Lessee agrees that the shut-in royalty payment will be $25.00 per net mineral acre, per year. Notwithstanding anything to the contrary herein, it is understood and agreed that this lease may not be maintained in force for any one continuous period of time longer than five (5) consecutive years after the expiration of the primary term hereof solely by the provisions of the shut-in royalty clause.

-

EXTENSION OF PRIMARY TERM: The paragraph contained in the Lease, to which this addendum is attached, providing for an extension of the primary term for one additional term of five (5) years from the expiration of the primary term by payment of an amount equal to the initial consideration, is deleted in its entirety.

Dave, There is more to the lease, and understand the lease. The lease will hold your interest in a unit. Yes, you get a per net acre (NMA) bonus for signing the lease which is a one-time payment for the 5-year lease. For example, If you own 1.50 acres out of a 40-acre tract, you would get paid on the 1.50 net acres you own. For example, if the operator is paying you $1000 per acre, you would take $1000 x 1.50 acres equals your total bonus payment. The lease will be in effect for 5 yrs until they unitize the lease in a pooling unit, once one leg is spudded, it ties your lease/interest in the unit for the life of the wells, meaning no more renewing the lease and/or paying you another bonus. With that said, now for the royalty. The royalty the operator offers you is a NET not gross. Read the Royalty paragraph in the lease. They offer you 12.5 percent or some companies will add an addendum to raise that to 15%, but if you read the paragraph, you as the lessor are giving the Lessee the right to take “post-production cost” from your royalty. So if you have 15% net, you have to minus the 7 to 8% of fees from your 15% and you only collect 8%. I would hire an attorney because there are a lot more issues you will need out of the said lease. You can negotiate for a 15% gross by adding a “NON POST PRODUCTION” addendum. You will also want to add a PUGH clause, DEPTH Clause, Hold Harmless, Warranty of Title, better Shut-In, etc… Contact an attorney, you want the lease to benefit you, and right now the lease benefits the company.

I hope this helps.

Wow! Thank you everyone for your responses, this is all very helpful information. Is there any information available on what the typical gas production is per acre in Grant District? Is there any information on what the land and mineral rights sell for per acre in Grant District? I found some acreage in the county searching online but it was without mineral rights.

Dave,

There are definitely some good pieces of advice here but I am going to urge you to talk to a professional about your specific lease. They can likely point you in the direction of someone who can help you determine a $/acre value for your specific parcel. There are so many variables that I would urge you to look for specifics of your property rather than general advice.

Hope this helps,

Rachel

Hello Rachel, Thanks for the response, I very much appreciate your time. There are a LOT of issues around the deed of the property which I don’t even want to get into, but I’m trying to determine if it is worth paying a lawyer to get involved and straighten out the deed before even engaging in an attorney regarding the lease. If the property will only generate $10k a year, it is so not worth dealing with. If it will generate $100k a year then it may be worth dealing with, but still not that interesting. If it will generate $1mm a year then it is definitely worth dealing with. So I’m trying to get an order of magnitude of what an acre of property in that district produces for gas revenue, $1k/year, $10k/year or $100k/year? The same thing goes for the sale of the property. Is it worth $1k an acre, $10k an acre or $100k an acre? I can see from the plat map that it does not appear to be accessible from the road and therefore would need to be accessed from a neighboring property on which there is a well head.

Hi Dave,

I understand exactly the hurdles that you are referencing and it is smart to consider both the potential costs and benefits. The best advice I can give is to try to pool resources with other owners. If you have inherited around one acre, then family members have likely inherited other portions. Sharing costs and knowledge is always adventageous to royalty owners. Finding the right professionals might not be as expensive as you think as well.

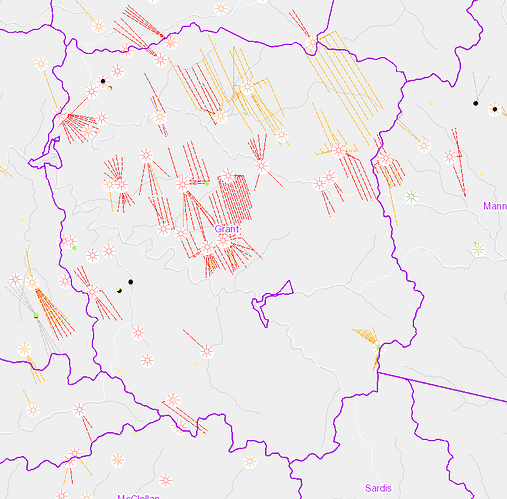

I want to show you why it is hard to say what the going rate in Grant District is. Here is a map. The red lines are active horizontal wells and the orange ones are permitted (planned) wells. As you can see there are significant areas in the district where there is no development. Depending where the parcel is located, that could mean the difference between $1,000/acre and $10,000/acre. Those are sale prices and not likely monthly income.

I don’t think you will find acreage that will generate $100,000/year of income on a one acre basis. There is a lot of potential out there, but that isn’t a realtistic expectation in a majority of areas. Making an investment into getting the best clauses in your leases could make a 25-50% difference in your yearly income though.

Hope this helps,

Rachel

Thanks again for the information. I was contacted about a lease for a horizontal well that is in the area in the upper right of your map where the orange planned wells are. It looks like it would not be on the largest, furthest upper right planned set of wells, the ones where the fork tines are facing downward, but on the slightly smaller one just to the left of that with the tines facing upward. I will give the contact landman a call and see what he has to say.

Dave, Please ask the Landman to show you any proposed unit maps he can provide. This will help you with negotiating the lease.

Thx for the advice Nick.

So just as a follow up, the company is offering what sounds like a poor deal to me (low signing bonus and 15% new production). But apparently all they need is 75% of the owners to sign and the deal is done. Can you tell me is this 75% of the acreage or 75% of the partial owners? I can only guess it would have to be 75% of the acreage ownership.

Dave, good old force pooling in WV. So, if you own say 2.00 acres out of a 25.00-acre tract (Parcel), as long as the operator has 75% of that interest in that 25-acre parcel leased, they can pool into the unit. It’s called Co-Tenancy” statute.

Dave,

A 15% gross lease (with absolutely no deductions nor taxes) and provisions for good pas prices is not a bad lease. Bonuses have been low for a while. You might be able to get a better bonus if you allow them yearly payments instead of being an upfront basis. I strongly urge to fight for better royalty payments rather than lease bonus money.

There are a few things that you should research before letting that pressure to sign now get to you.

Here is an excerpt from a link that I am going to post below: Known as the Co-Tenancy Modernization and Majority Protection Act, the law permits non-consenting owners to receive a pro-rata share of lease bonuses and royalties or become a working interest owner in the natural gas well.

Just because you are “force pooled” doesn’t mean you won’t get any royalties. You should be given an opportunity to speak in front of the Oil & Gas Commission. You might need to retain council and that might be expensive. I am not 100% of the details but can help you look into it.

You’ll want to do research about if the unit has been formed and if the operator has had the unit approved through the oil and gas commission. They will have to if they envoke co-tenancy.

I would also suggest negotiating with other people who own an interest in your parcel(s). It always strengthens your negotiating position.

Hope this helps,

Rachel

Hey Rachel, Sorry for my typo, I tried to write 15% net production but mistyped. I would agree, 15% gross would be a fine lease is there are absolutely no deductions. As I spoke with the landman I mentioned that since it is a net lease then you are wanting the land owners to pay for the extraction costs out of their 15% instead of the company paying for it out of their 85%. And he acknowledged that is what the lease stated.

As I do my research I see a lot of work (recorded affidavits) into them establishing ownership of the property. Title is very clouded due to the deed still being in a long dead mans name. Fortunately my mother did a lot of genealogy work so we have contacts to a lot of the people in the lineage.

So as I understand “force pooled”, it requires 75% of the total acreage ownership. So, for instance, if it is a 10 acre parcel, it would require ownership rights for 7.5 acres. Based on my research, I have within arms length, control of around 25% of the acreage. The landman told me he has gotten a bunch of signed leases back already and I don’t want him to get to 75% and force us into a 15% net lease. I would rather get reasonable terms for the lease for all shareholders. I can only guess that the people who signed didn’t do their research and simply want the signing bonus since the landman told me that most people didn’t know anything about their ownership of the land. And because the signing bonus was so small none of these people individually would hire an attorney to ask their advice. They don’t realize what they are giving away.

Hi Dave,

If there are a lot of affidavits and such, make sure that you have a clause that says you are not at fault for a “wrong” title and that you don’t have to pay back royalties. Unfortunately, that is more common than you would think.

Having that genealogy work will be invaluable.

I’m glad you brought up the exact lease that would result in a forced pooling situation. It is not what they are offering you. My understanding is that they have to offer you an “average” of what is typically found for the other owners in the pool. I did warn about a cost associated with having representation.

I did a little more research. In addition to the company having leased 75% of the parcel, the parcel must have seven or more owners.

Here is a link that I think will be valuable: https://wvsoro.org/what-the-2018-cotenancy-law-means-for-wv-mineral-owners-leasing/ . As I re-read this article, I think it is the perfect reference for you!

Hope this helps,

Rachel

This topic was automatically closed after 90 days. New replies are no longer allowed.