I was contacted out of the blue today by L3 Resources regarding 24-07N-07W. They are looking to offer 4k an acre. Anyone dealt with them before, or any news on this section?

An offer is usually for a certain royalty or they will state that it is a net royalty offer normalized to 1/8th. Offers usually come “out of the blue” when increased density hearings pop up on the schedule or other activity is pending. Camino just filed a case on May 25. Looks like two horizontal wells so far. Multi-unit with 24 & 25.

This is what they emailed me:

9 net mineral acres

$4,000/acre (based on 3/16 royalty evaluation)

We have some mineral rights in 23-07N-07N that have been in our family and leased for years. We get a very small payment each month on an existing well but out of the blue received a proposal to buy our rights for $5000 and acre. I see we are right next door to the new well proposal in this topic, wondering what others thought are? Also, Martha, where could I get a map that shows the proposed well in Section 24?

Yeah I got another offer for 5k as well

23-7N-7W Camino just filed to drill a horizontal well in 23-7N-7W. If your name and address are properly filed in the county courthouse, you should get the mailings any day now. Your hearings are on July 5.

Camino is also the operator on 24/25-7N-7W. Maps for wells can sometimes be found on the permits for the wells, usually toward the bottom of the application. Test. Don’t see a permit yet.

I looked for a map on 24/25, but the hearings are not finished yet, so the exhibits are not posted. Supposed to be on June 20, 2022.

Offers to buy tend to go out when an increased density hearing is posted or when drilling seems to be soon. Offers should have a royalty amount with them as a pair.

Thank you! Will try and find the that info on 23-7N-7N.

The first horizontal well in a section tends to be either at the far east or the far west side of the section in order to leave room for more wells. A few years back, then tended to drill them in the middle of the section(s). Once the hearing exhibits are posted, one will be able to see the planned path. The permits usually have the surveyed maps with the path on it.

That seems right in this case. The Thomas 2-23H well runs right down the center of the section. That is the well we get a little royalty on right now, it produces about 2000 (I assume mcf?) a month. It’s an older horizontal well drilled in 2011, not really sure of the completion or how many stages were done. Like most early horizontal wells, it did pretty good for a few years. Martha, in order to do a reasonably accurate time value of money calculation, (up front cash payment for mineral rights vs. 1/8 royalty) what do you think a good average monthly production number would be to use for say a 10 year time period? I’m seeing production numbers from the newer horizontal wells in the area as high as 100,000 per month.

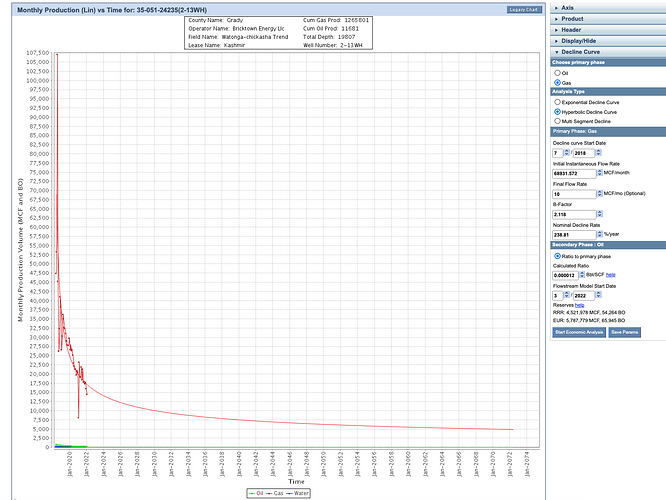

I would not use an average monthly production number over ten years as the production declines every month, so the out years would be disproportionately high if using an average. Horizontal wells come on strong in the first couple of years and then flatten out at a much lower rate, but a longer time. The shape is sometimes called a hockey stick. Here is an example from the Kashmir 2-13H well (Woodford). Echo/Bricktown also drilled a Kashmir 1-13H in the Miss. Has a similar profile

The newer wells have much improved completion techniques, so they tend to do better than the older wells (unless the pressure has been depleted too much by the parent well.) The Thomas well was a single section well and the new well is for sections 23&26. The Thomas 2-23H was in the Hoxbar reservoir. The new well is supposed to be in the Woodford or the Mississippian so it should be much better. Comparing the first well will not help much. Here is an article. A bit out of date, but useful to see the strat column and the drilling at the time. Hoxbar Formation - A look the best wells in Grady County, OK - OklahomaMinerals.com. A WHOLE lot has happened in the Woodford/ Miss since this article came out.

The Thomas 2-23H was considered a pretty good Hoxbar well with about 1BCF of gas over 10+ years. The Kashmir 1-13H nearby had 1.8 BCF in only 4 years. (Miss), Kashmir 2-13WH had 1.26 BCF in 4 years. (Woodford). The Kimber 17/20 (2 sec had almost 7BCF in 3 years-MISS). Woodford wells range from 1BCF-6 BCF depending upon their length and year of drilling, so robust!

When one thinks about an offer, most companies offer what the current well is valued at over a certain period of time. A few companies might offer some small upside. One must think about not just one future well, but potential for more than one. One can sell all, sell none, or sell some and keep some and split the risk.

I can not find the information on the new well. Can’t find a notice or application. Do you have a case number or something I could use to find it on the OCC site? Thanks for your thoughtful reply, good info there.

You may have to use the new and the old search systems. This set is on the new system since it is after March 2022.

https://oklahoma.gov/occ/court-dockets/electronic-case-filing.html

Use the blue option if you know the case numbers. Here they are. 2022-002211 Location Exception 2022-002212 Horizontal 2022-002213 Pooling

That’s what I needed! Thank you, you are amazingly helpful! I think I’m going to use that Kashmir well data to do a present value calculation breaking the decline curve into 1 year intervals over 5 and 10 years. Should be interesting. Will post it up when I finish it. Your point about the “next” well is a very good one also. Thanks again!

https://otcportal.tax.ok.gov/gpx/gp_displayPublicPUNListSearchDownload.php

You can see the last “12” months of production here, but can order the previous years for a small fee.

That will be an interesting exercise for you. It is wise to take a look at your options using comparable data. Don’t forget to take into account the taxes for royalties if you keep the minerals or the potential capital gains taxes if you sell.

Our family does a periodic full engineering evaluation of our holdings every so many years, usually due to a death in the family so mandated by probate requirements. It does take into account the historical production for every well and the predicted decline curves using standard engineering principles. They then assign a price deck to the volumes for each well and give a series of discounted cash flows for the wells, predicted dollar per acre for producing and non-producing acreage and a general sense of where future drilling might occur. A standard discount factor used is 10%, but various buyers use different scenarios of their own. We can then use our appraisals to evaluate different offers. As heirs have inherited, they have a fully vetted step up value ready if they ever need to sell.

The price deck assigned for a probate may be the oil and gas prices as of the date of death or six months later, depending upon which is lower and whether the federal estate tax limit is a factor. Or when no death, but our regular timing, the NYMEX price deck for five years can be used with appropriate discounts for sweet or sour crude and transportation costs and field level expenses.

Martha, I’ve made good progress on that present value calculation we discussed. Off the top of your head, do you have the names of any other recent wells in the area that would be considered comparable to the proposed Camino well and/or the Kashmir wells? Going to order production data from OKC Tax, the price is the same for 1 to 26. Would like to do multiple wells for comparison.

Here is a list of the horizontal wells in the township. The reservoir will make some difference, but you can download them and then decide which ones to use. One section wells will be less production than two section wells.

Hartley 1-7-6XH Woodford

Shockey 36-1-1XH Woodford

Hartley 7-7-7 1HX Woodford

Dansil 1-15-10XH Woodford

Holden 0707-16-21-1WH Woodford

Kimber 0707 17-20-1MHR Mississippian

Kashmir 2-12WH Woodford, Hunton

Commerce Comet 0707 11-2-1WH Woodford

Kashmir 1-13H Mississippian

Thanks! As always, just what I needed!

I got offer on 3 different parcels in Grady Co from L3. similar values as above Sec. 1-6N-7W; 20 acres on 1/8 royalty; $7,000/A Sec. 26-7N-7W; 29.45375 acres on 1/8 royalty; $4500 /A Sec. 27-7N-7W; 7.09375 acres on 3/16; $5,000 /A Anyone know what other offers are coming in on these parcels?

@Indigoernie - A couple of mineral deeds in Sec. 12-6N-7W for $15,000/acre on 1/5 royalty. That should be $9,375/acre on 1/8 royalty. Sold by a mineral buyer to several investors, i.e., individuals, trusts, LLC’s, trusts for IRA’s, etc. Bought for $12,000/acre on 1/5 royalty, which would be $7,500/acre on 1/8 royalty.

I saw no recent mineral deed sales for the other two sections.

NOTE: They are fracking the well now that ends in your Sec. 1-6N-7W. And pretty sure there is at least another well being proposed now for Sec. 1-6N-7W. You should have received the applications for it.