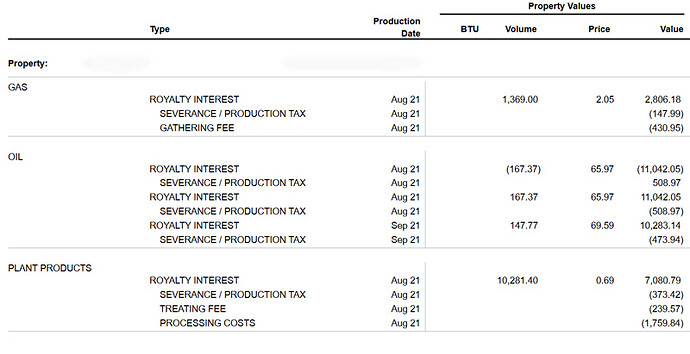

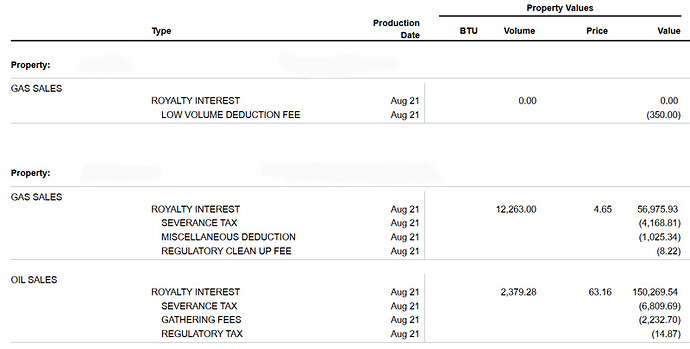

August Gas Value on Royalty Statements. We receive royalties from 2 different Operators. Why does one operator have a gas value of $2.05 for August 21 and the other has a gas value of $4.65 for August 21? Both of the minerals are in the same area in Howard County, TX.

Hi Donnal., it is possible that one producer is in a long term contract to sell at a more stable price, while the other is selling more on a current market price basis. Only a guess, I suspect there are several possible explanations.

@DonnaL, @PeteR is correct in that his answer is one of the more likely options, probably the most likely given a difference of the magnitude you state.

Another is that the particular wells (although close) are selling/delivering into a different gathering system, which implies a different first purchaser.

Maybe others here have even possibilities.

You should request the BTU value. That can have a huge difference although this seems to be more than that.

When ‘wet’ gas is processed, the plant products / liquids are separated from the gas and sold separately. These are ethane, propane, butane, etc. The remaining (shrunken volume) ‘dry’ gas is sold at the tailgate of the plant. Most often, the operator will report the residue volume along with the residue gas sales. The volumes and resulting values of liquid products varies in gas streams from different formations and wells within a formation. Some operators, such as your first example, report the gas sales and products sales separately on royalty checks. Other operators, such as your second example, report the combined gas and products sales as gas sales. They will use the higher pipeline gas volume. To compare the ‘gas’ prices, you need to add the gas and products sales together and divide the total sales by the volume reported on RRC website as going into the pipeline - for operator #1. Then take the gas sales (actually residue gas and products) from operator #2 and divide that by the gas volume into the pipeline. You will find the resulting gas price to be much closer.

That makes sense.Thank you for the detailed information.

This topic was automatically closed after 90 days. New replies are no longer allowed.