My parents have a family partial share of NW section of S35 T14N R20W in Custer County. My great grandfather purchased the land in 1895, hung onto mineral rights after gov bought him out in anticipation of dam construction and split this among his 5 children. They’re now scattered all over, and the cousins are aging and don’t keep in the best touch, but my father and his sister-in-law (wife of deceased brother) and brother have coordinated on lease terms together when there is well activity in the past. It sounds like a new rig is coming in February and they’ve all gotten a number of calls to get “leased up” with most recent offer being 700/acre at 3/16 or 500 at 1/5 and the statement “happy to add any additional clauses to your lease as well such as a Pugh Clause, Depth Clause, Shut-in Royalty and No Deductions Clause.” I imagine that a number of these clauses are somewhat key to profit after production costs and while I believe they usually just let things play out and take the best terms offered, given the amount of attention they’ve gotten over the past several months, I wonder if it’s worth getting an expert to take a look at the deal. Sounds like it’s a new horizontal well? I know absolutely nothing about this domain - just learned about it a few weeks ago and want to help secure the best rates for my family - they could really use the income! Many thanks for any info or advice for a total newbie!

Welcome to the show!

Yes it is a good idea to have the lease terms reviewed. The “standard” lease offered by a company can be altered, usually by an exhibit that spells out those additional items. The first contract offered is almost always strongly in the operator’s favor.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Thanks Richard,

Who generally reviews lease terms? Is it an attorney who would represent all 3 siblings (collectively have about 30 acres) or should we reach out to larger extended family to see if we can find all the relatives with interests - does it benefit mineral rights holders to bargain as a family? We just got another offer today for 850 and 1/5. Each offer is better than the last. Is there a way to find out when pooling will occur and should we wait and act then, or get guidance and act sooner. I have so many questions. Thanks for your expertise!

If everyone of the family members or heirs would work together and use the same lease form it would be to everyone’s benefit.

Thank you! This is very helpful. We’ll try to gather some of my dad’s cousins.

As to the question of whether to wait for the pooling, one could do that. Typically, one gets the highest and best value at that point. However, if a) wells were drilled nearby and they were marginal, b) oil prices go down to 30/bbl, c) the company loses its financing or its investors decide to pull out, or d) a combination of the above, the pooling may never happen.

If that happens, are you going to kick yourself for not taking the money now? Further, if there are provisions that you desire in a lease, you won’t necessarily get those in a pooling. About 15 years ago, I’m aware of a situation where a family banded together and asked for almost double what the lessee was proposing. The company declined to take the deal. The company drilled two marginal wells nearby and the company condemned the prospect. The family lost out on almost $500k.

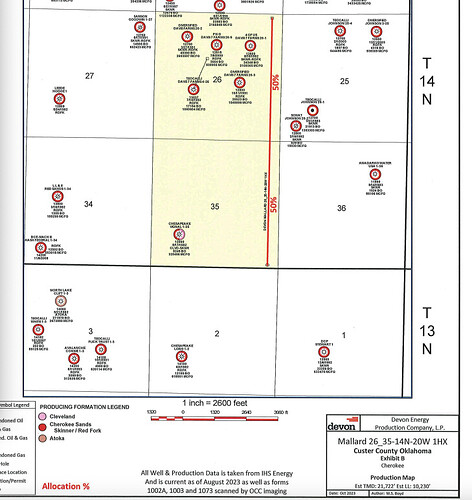

If your names and addresses are properly filed with title documents such as probate, sales deeds or affidavits of heirship at the county courthouse, then you will be send any pooling documents well ahead of the date. The well is Mallard 26_35-14N-20W 1HX. It is a horizontal well.

You should have already received OCC mailings from Devon for case 2023-002840 and 2841, If not, then contact the attorney for Devon.

Like all answers, it all depends. If you have a cohesive group you can work together. The problem with bringing in distant relatives is the coordination becomes more complex. Typically, one family member ends up paying for the legal fees.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

This topic was automatically closed after 90 days. New replies are no longer allowed.