I own 40 Mineral Acres, 1/16th interest in Martin County: All of section 30, block 36, township 3 north, T&P RY. CO. How do I determine its value? Endeavor currently has a lease. Should I consider using a title company?

I don’t think a title company will be much help with a mineral sale. They typically deal more with land and other real estate. That’s a good area with a lot of potential and, if you’ve been getting a lot of solicitations recently, there may be some horizontal drilling activity coming soon to that section. The current market value is what buyers are paying right now but, depending on the lease royalty rate, those minerals could reasonably be worth as much as $20,000 per acre.

Also be aware that you may have to pay capital gains tax on the sale.

How do you determine it’s value? One simple way is to have a whole bunch of people who might buy minerals give you an offer on it. You are in pay status on tax rolls for the Endeavor Nance lease, publicly available info. If eventually Endeavor starts putting some permits there, you’ll start getting offers from folks. But that may take a long while. You are clearly getting some offers now, you’d guess that without any permits they might be pretty low. Unfortunately Endeavor has a whole lot of acreage that is HBP by vertical wells and very little inclination to drill horizontals. Maybe they sell to somebody else, but they have been doing this for a long time.

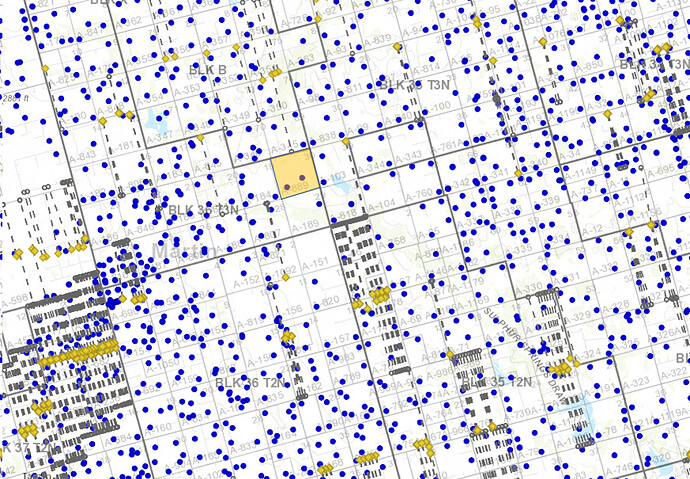

Take a look at that map, a whole lot of area with no horizontal wells, some with a whole lot of horizontal wells. What somebody is gonna offer you is somewhere between the value for no horizontal wells (not much at all) and the value for a whole lot of horizontal wells (quite a bit). Right now you are stuck with a below average operator in terms of development, so that price is gonna be on the lower end of that range. I don’t know what your lease royalty is. I’d guess that your acreage is worth about $9-10k/NRA (18-20k/NMA if at 25% royalty) under Endeavor, where the odds of getting a whole bunch of wells soon is not real high. If it suddenly starts looking like the unit to the SE that is covered with permits, than its gonna be worth a good bit more. May take a whole lot of patience. Maybe I’m wrong but that is my guess on all of this.

Like Marcus said I don’t think a title company does anything for you here.

Thank you so much for your help!

Thank you so much for your response. Valuable info!

Value can be determined by a number of variables. Who operates the lease? What are their future development plans? How are their current wells doing? Other important variables are determined by who your potential buyer is - are they a broker or end buyer? Are they equity backed? Each group may have different financial goals which affects pricing.

I work for a family office that owns interests in the area.

I expect that you will get offers just by saying something on the forum. My suggestion is to get several offers and pick the best one. Never turn over a deed without getting a check-ever…

I would suggest that you search for mineral buyers on your search engine and look up their reputations on BBB as well.

We do not buy nor sell, so I do not know what the market is looking like In Martin County.

Joe,

I guess you might get offers here on the forum, not sure how many people want a working interest.

Call XOM in Spring. Ask to speak to the land department for East Texas (may have to ask for Upstream, Uncoventional, XTO, East Texas, land…because it is Exxon after all ![]() ) Get ahold of a landperson. Tell them you want to sell your interest in XTO’s XXYY lease, and would like an offer or you are going to sell to a group of environmental lawyers who made a bid. They will move like molasses, but in general they will pay more than anybody else.

) Get ahold of a landperson. Tell them you want to sell your interest in XTO’s XXYY lease, and would like an offer or you are going to sell to a group of environmental lawyers who made a bid. They will move like molasses, but in general they will pay more than anybody else.

That or call EnergyNet and list it there.

Some of this depends on how big/small this is. May not be worth much hassle if it’s tiny. Sorry I realize I am replying to a Gregg county question in a Martin county thread. But the PM feature seems to be disabled (at least for me, shrug).

Martin County is one of the hottest Counties in Texas. If you are truly interested in selling you would probably be wise to put it up with an auction house and let the potential buyers bid against each other. The Oil and Gas Clearinghouse is such a company and do all the work. Commission is maybe 6%. They did a great job for me a number of years ago in leasing some acreage I had in the Eagleford play.

Ask for Matt Dapra at OGCH. He is a friend of a geologist friend of mine who retired at that company. Good luck.

Doug V

By the way, I am aware that leases in the area where I own minerals in Martin County can go for $12,000 per net mineral acre. I have heard of higher amounts being offered in other areas. Be careful.

If you want full value for your minerals you should definitely use a listing site. Oil & Gas Clearinghouse is ok, but I think you will get a higher sale price by using EnergyNet or US Mineral Exchange.

I bet you could get $25,000-$30,000 per acre for this.

Sorry I did not specify the unit, per net mineral acre, or a total consideration of $1,200,000.00.