First, look at your check stub. The sales dates will be there.

Next you need to compare gross volume sale per month to see what the well is doing. Oil varied in price as much as 20% in the months of April, May, June, and July. That can throw your numbers off.

The first month will be a partial month and may not be relevant for 2 reasons. It may be only a partial month of even 1 day. And things go on in a well early into production that may impact the volume.

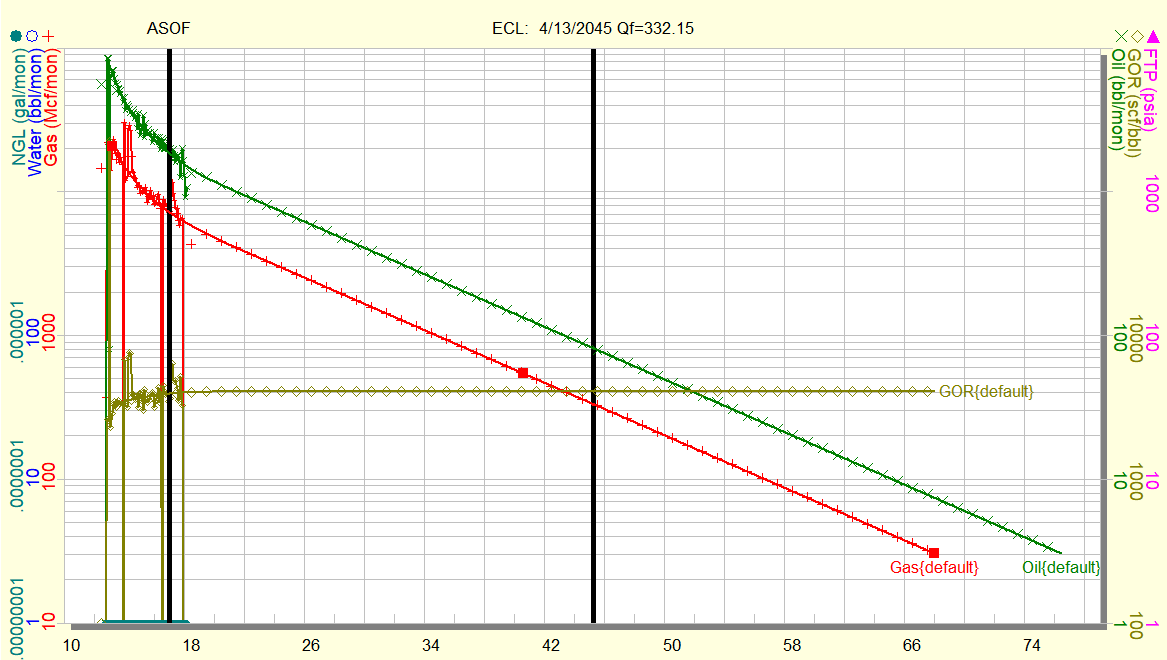

The well will decline in production, so even with production number you can’t average the first full 4 or 6 months of production and expect the well to continue to produce at that average rate. But you can use those number to create a decline model that will predict it. There are some more advanced engineering models that Jeffery is probably using that will help much more than this.

But let’s look at the production of a well within 2 miles.

| Sales |

Barrels |

Decline |

| Month |

Produced |

Rate |

| 2016-12 |

18,198 |

|

| 2017-01 |

27,171 |

|

| 2017-02 |

20,691 |

24% |

| 2017-03 |

19,256 |

7% |

| 2017-04 |

17,672 |

8% |

| 2017-05 |

16,355 |

7% |

| 2017-06 |

14,983 |

8% |

| 2017-07 |

13,765 |

8% |

| 2017-08 |

12,893 |

6% |

| 2017-09 |

12,217 |

5% |

| 2017-10 |

11,460 |

6% |

| 2017-11 |

11,174 |

2% |

| 2017-12 |

10,566 |

5% |

| 2018-01 |

9,826 |

7% |

| 2018-02 |

8,713 |

11% |

| 2018-03 |

9,562 |

-10% |

| 2018-04 |

8,489 |

11% |

If I average the first 4 months of production or start with the 4 full months I still get about 21,300 for the month of April or May. Both would be off by 4000-5000 barrels. Or around 25% off. So the above estimate (if actually based on 4 months) would be closer to $1300 IF the price of the oil had remained consistent through that period.

Now if we take the percentages and toss that first big drop, the production is dropping about 6.5% a month.

So let’s start in May of 2017 and toss that number at it.

So the middle column is actual and the rest are calculated based on the 6.5% per month decline.

| Sales |

Barrels |

Calculated |

| Month |

Produced |

|

| 2016-12 |

18,198 |

|

| 2017-01 |

27,171 |

|

| 2017-02 |

20,691 |

|

| 2017-03 |

19,256 |

|

| 2017-04 |

17,672 |

18004 |

| 2017-05 |

16,355 |

16523 |

| 2017-06 |

14,983 |

15292 |

| 2017-07 |

13,765 |

14009 |

| 2017-08 |

12,893 |

12870 |

| 2017-09 |

12,217 |

12055 |

| 2017-10 |

11,460 |

11423 |

| 2017-11 |

11,174 |

10715 |

| 2017-12 |

10,566 |

10448 |

| 2018-01 |

9,826 |

9879 |

| 2018-02 |

8,713 |

9187 |

| 2018-03 |

9,562 |

8147 |

| 2018-04 |

8,489 |

8940 |

Now you have to factor in your guess for the price of oil changing in that time. And a guess may be the correct term there. But let’s say it did remain constant. Let’s show the decline in $ and say the price of oil was exaction the same and use that $1750 number.

This is what it would look like for 20 months.

$1,750.00

$1,636.25

$1,529.89

$1,430.45

$1,337.47

$1,250.54

$1,169.25

$1,093.25

$1,022.19

$955.75

$893.62

$835.54

$781.23

$730.45

$682.97

$638.58

$597.07

$558.26

$521.97

$488.04

Now, this percentage rate drop will change as these well reach 24-36 months of production.

Please be careful, I have seen people buy houses with a new well production thinking the income was going to remain fairly consistent. It put them in financial hardship, made even worse when Oil prices dropped from $100 a barrel to $35 a barrel