I am in need of some help. My brother and I are in a partnership and I was contacted by a company who is interested in buying the mineral rights we own. I would like to know if there is any activity on my property? Township 22 South Range 27 East, N.M.P.M, Section 28: SE/4SE, East of the main Canal of the Carlsbad project U.S.R.S. Oil, Gas and Minerals In and Under containing 16.88 acres. A number of years ago my mom leased the mineral rights to a company who may still be drilling and I am not sure where to find a record of that. Suggestions and comments are appreciated.

Hi Brad, I also owned rights in the exact same township, section and range and over a period of about 6 months sold for a total of $310,000 for 33.3 mineral acres to two companies. That’s around $10,000 per mineral acre. The companies (who don’t jerk you around and actually pay what they agree upon) were Permico and Mason Oaks. I have a mineral manager who handles all this stuff for me for around 20% of the take. I don’t come on this forum often. In the old days I was insulted by idiots on here so this is all I can tell you (and others)… That area is hot right now. if you can get more from a legitimate company who won’t agree to something then back down, good luck!

Brad I would never pay a Mineral manager a dime, I knew nothing about this business a year and a half ago and first offer our family got was 150k for 1% of our ORRI on 186 NRA with common sense and help on this forum (by the way minerals in Lea Co. NM) we sold less than half of our interest for 1 million and still have great future ahead of us. Caution is the key, saw report on Bloomberg where U.S. will surpass Saudi Arabia in World exports of oil in 5-6 years most coming from Permian thats why the Big boys are coming in Warren Buffett puting in 10 Billion of his own money that says alot

Thanks Tim! I appreciate your message.

Lynn thanks for your insight!

Brad, there will always be differing opinions. Different mineral rights owners operate different ways depending upon their lifestyles, available time to handle business matters, etc. You need to choose a way that works well for you and your family. All the best…Lynn B.

Brad,

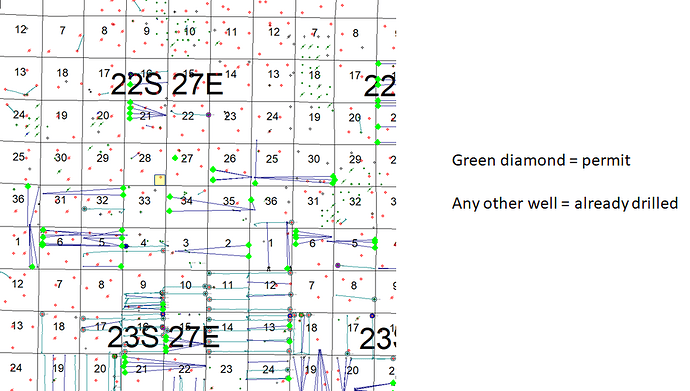

There is no new activity on your property. You look to be held by a Morrow well drilled in 2004 that is now operated by Chi Operating. Unsure if that is who has your BSpring/Wolfcamp rights or not. Development is moving up this way, there are a number of permits nearby.

Its not great, its not terrible.

Where should I start researching to find out if there is a lease on my land? My mom received a lump sum payment back in 2004 or so from some company. I want to find out which company and what the lease states on the contract. I am not receiving any royalties from it.

I was just offered $200K to sell our mineral rights where you posted. What are your thoughts? I am not sure if selling is the best plan right now. We also got a lease agreement which gives so much per acre and a royalty amount.

I would lease. Remember if you sell typically 20% goes to taxes for capital gaines.

Not advocating selling necessarily but lease bonus and royalties are taxed as ordinary income (so at your marginal rate), which exceeds the cap gain rate.

NMoilboy makes a good point here. All decisions regarding leasing and/or selling need to be run through the grid of tax implications - and these of course are specific to each person’s situation.

As far as the $200k vs lease agreement goes:

I’m assuming you were already leased and HBP by the Marathon (was Chi Operating) Skeen #2 well (API 3001533527). That lease was signed in 2001 at 3/16ths (18.75%) royalty by someone with your last name. If that is the case, you would have:

16.88nma * 18.75%/12.5% = 25.32 net royalty acres. $200k for 25.32 net royalty acres isn’t terrible, IMO.

If your acreage is really unleased, I’d pursue that first. Lease info near you is sparse. While 25% royalty is the norm in the Delaware, this area is still the fringe of the play, but I see a number of 25% royalty leases and would suspect that is what you could get for a new lease. If you can get a new 25% lease, you would have 33.76 nra. In which case I would think a fair offer would be > $200k.

So, in short, I’m not sure about a 200k offer without more details on your lease situation. On the surface it doesn’t seem insultingly low, but you should be in this to maximize and not just avoid insult. ![]()

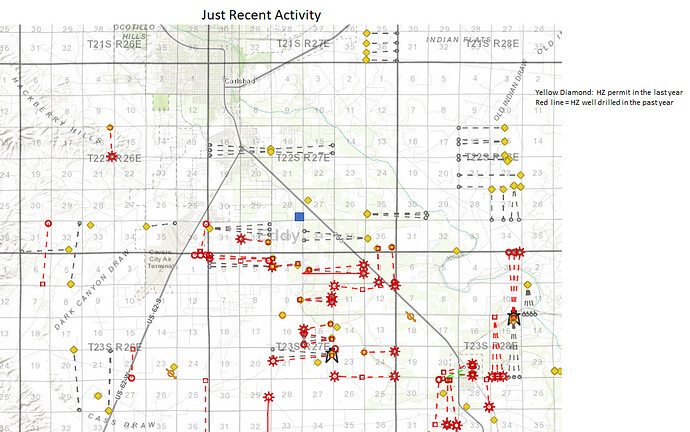

Map below shows recent things in your area.

Some random math associated with that. There have been about 50 wells drilled in a 180 mi2 area around you in the last 12 months. Assuming that area is roughly chopped up into drilling units that are 1.5 mi2 (1.5 x 1), there are 120 units that could get a well in this area. So, on average, each unit gets 50/120 = .4 wells drilled a year. So maybe you should expect a well drilled on your property every 2.5 years. Total # of wells would probably be 8-12, so that could take 30 years. That is just averages, but that is some idea of what the activity might look like down the road. If one was inclined one could attempt to calculate the value of those future cash flows discounted back to the present.

Can you recommend a lawyer that can look at my offer and help me with the taxes? I want to see if leasing is the better option. Thank you for your help this far.