I’m trying to determine the number of mineral acres my mother owns in Section 18, T5N, R11W. I’m familiar with the E2 NW4 designations but I’m not sure what Lots 1 & 2 are referring to. The full description is: Undivided 82/100 of 1/16 interest in the oil, gas, and minerals lying in and under Lots 1 and 2, and the E/2 NW/4 Sec 18, T5N, R11W.

Without spending time on looking at old plats, there must be a river a running through the section. It looks like Lots 1 and 2, and the E/2 NW/4= 159.02 acres give or take. So she’d own 82/100 x 1/16 x 159.02= 8.15 acres

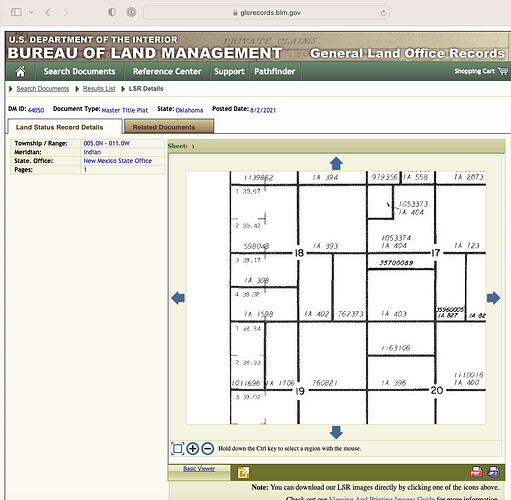

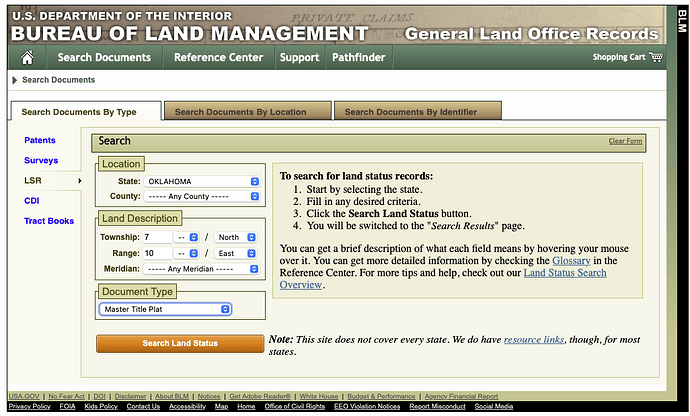

Sections on the northern and western tiers of townships are frequently not a regular 640 acres due to corrections for the curvature of the earth. The BLM has the plats. (Sometimes a river can also result in irregular lots.) In this case, it is the curvature correction. Lot 1 has 39.67 acres and Lot 2 has 39.42 acres. Otherwise known as the West Half of the Northwest Quarter. (W/2 NW4) Those two add up to 79.09 acres. The east half of the northwest quarter is the regular 80 acres. The whole quarter section is 159.09 acres instead of the usual 160 acres. 82/100 x 1/16 x 159.09=8.1533625 acres close to what Bob did at a quick glance. You also need to look for language in the description to see if there was any further divisions of the acreage. Best to use the acreage with as many decimals as it calculates out to be. More royalties if they apply.

Thank you both so much for the quick response! It makes total sense. I always find great help and new resources on this site. Thanks again!

I too am trying to determine NMA for the various properties that my mother owns the mineral rights for. I don’t know where the 82/100 in the previous calculation comes from.

I have a Mineral Deed from 2006 in which my grandfather deeded to my mother and her sister:

“one-half each interest in and to all of the oil, gas and other minerals in and under and that may be produced from the following described lands situated in HUGHES County, State of Oklahoma, to-wit:

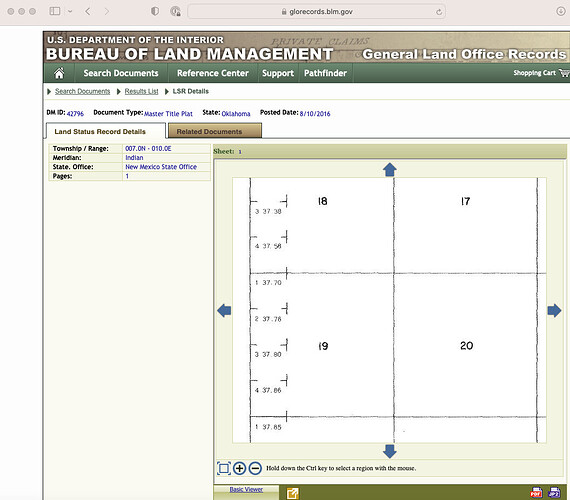

Lots 1 + 2 and SE/4 NW/4 of Section 19, Township 7N, Range 10 East containing 115.4600 acres, more or less…”. Does that mean that my mother inherited 57.7300 acres.

I’ve been told that you can’t get the NMA from a Lease Agreement but you can from an offer to Lease request. My mother was not a good records keeper and both she and her sister have declined mentally. We’re considering selling all of her Mineral Rights to a distant family member for a nominal cost. Do we need the NMAs for each property? If so, how would that be calculated.

Thanks so much for any help you can provide.

All rights, title and interest in the described tracts more or less.

That would be correct if your grandfather owned 100% of the mineral rights in the 115.46 acres at the time, if he did not, then it would be proportionately reduced, ie if he owned 1/2 interest, divide that by 2 etc

Before you consider selling, you need to make a list of each property and find out if they have old activity, pending royalties held by the operator or the state or possibly new activity. If the funds are to be used in a Medicaid situation, then you may need advice from an elder care attorney as it can get complicated.

For this one:

Lot 1 37.70, Lot 2 37.76 SSE NW 40 acres = 115.46 acres. Divided by two = 57.73 so the math is correct.

At the moment, the value of the section is very low as the old wells are plugged and abandoned. However… There is horizontal drilling for the Woodford two miles to the east. Mulitple wells per section. Gas prices are low right now, but predicted to increase in the next few years, so you might consider holding onto the acreage to see what happens.

All deeds and leases describe the gross acreage. Your grandfather’s NMA (fractional interest in gross mineral acres) would depend on how the acreage was subdivided over the years. A title search of all the deeds would determine this. Landmen do that research before a lease offer is made. And oil companies have title opinions done to determine the number of owners and their fractional interests to be able to correctly pay royalties.

This topic was automatically closed after 90 days. New replies are no longer allowed.