In 2023, I transferred all of my mineral interests in McClain County, OK from a partnership into an LLC.. One producer, Charter Oak Production Co LLC, was sent a copy of the deed transferring my interest, but made a substantial reduction of my decimal interest which it assigned to my LLC. I don’t know why the reduction occurred. Charter Oak says that they have overpaid me and as such, have placed a large negative suspense on my interests in both the transferor Partnership and the transferee LLC. Is this overpayment and subsequent suspense allowable? It seems that the overpayment occurred through no fault of mine.

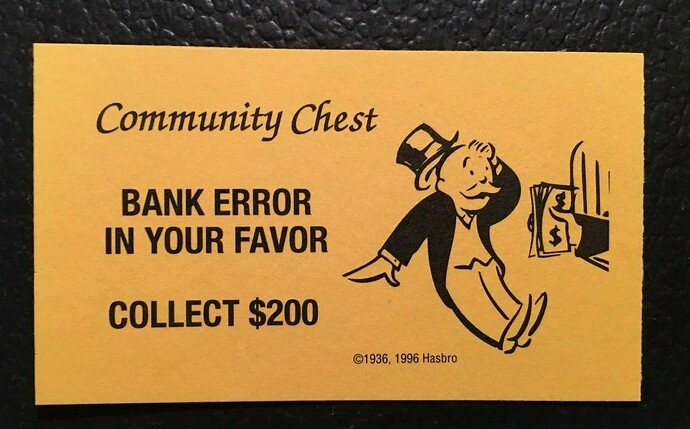

Bank error in you favor where the monopoly player gets to keep the money doesn’t work in real life. Similar to a situation where a bank accidentally credited your bank account with extra money through no fault of your own, you don’t get to keep the overpayment.

Send a request by certified mail return receipt to Charter Oak asking for the paragraph of the title opinion that belongs to you so that you can update your records. Ask them why the decimal was decreased and ask for a spreadsheet of the overpayments and how long until you will be back in pay. Was there a typo in the new deed compared to the old deed? New title information may have arisen to cause the change. It happens sometimes.

This topic was automatically closed after 90 days. New replies are no longer allowed.