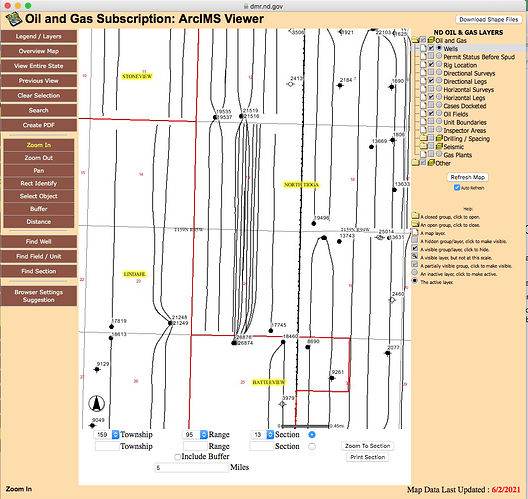

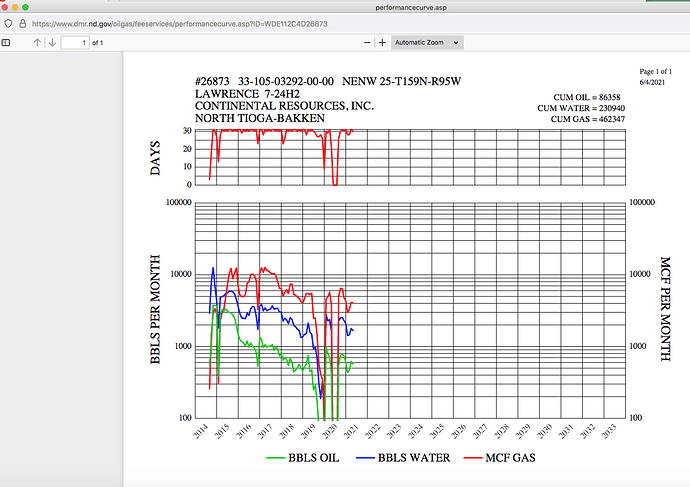

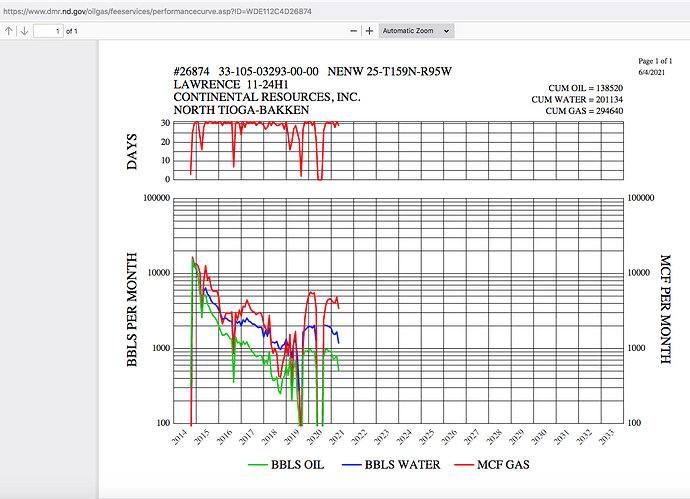

Recently considered selling my mineral rights. Im at a loss for even knowing where to start. I attempted to research “The going rate” in the area where the minerals are located to no avail. There are a few wells that are producing on the sections. 159N95W s13 & s24. I’m confused as to the prices I HAVE found offering X$/Acre. Is that per net acre, or per mineral acre? Ive also seen numbers anywhere from $1000/per to $8000/per… it IS confusing, and to make any kind of decision will be worse. And, though production of the current wells have fallen off over the years, to me there is still an enormous value for future production not only to me but any future buyer. I’m not concerned about how long it will take them to profit from a sale, so I can hold till I breathe my last breath. I have had offers before 8-10 years ago, but how does that hold up today? I get it, buyers want to snatch it up for dirt cheap. But my loss/gain can be interpreted from both sides equally. I’ve researched drilling permits in the area which there are few. But thats probly because they are already grabbed up. What if another boom comes along, what if these wells are re-fraccd, what if some new fangled technology makes drilling half the cost and barrels twice the price? What im getting at is that i havent the slightest clue what my mineral rights appraise for or even where to begin. Any help would be appreciated. Or if youve sold some in the area, let me know what I might expect…

TIA