My mom has been for years paid royalties on mineral rights her father left for her. Last year she received a 1099-NEC from Conoco Phillips for Powderhorn wells in Reeves County, TX. I realize that maybe this is a good problem to have as the money has been good. I don’t understand how a company can change her status from royalties to partner when her involvement hasn’t changed one iota. It also appears that Conoco has sold her production to Scout Energy Partners so her checks have been reduced and her JIBs have increased. When researching well production I can see the wells are still pumping but Scout shows “no RPT.” Scout doesn’t respond to my inquiries. Can I assume that there is a lag in pymts when changing producers? And that similar funds as last year will be delayed but forthcoming? API#s 42-389-39709, 42-389-39714 and 42-389-39715. Thanks in advance for any guidance and apologies if I misused the terminology, very new to this…

The issue turns on the lease status. If your mother is receiving revenues and paying JIB, then her minerals are not leased with respect to the Powerhorn wells. It may be because the shallow depths were leased and not the deeper depths, or that she was offered a new lease and did not sign. She is in effect a working interest owner in the wells. The check stub likely lists her revenues as NRI (net revenue interest) or WI (working interest), instead of RI (royalty). The 1099-NEC requires her to report the income and expenses on Schedule C. For royalties, she would receive a 1099-MISC and report on Schedule E. Scout reported only 2 bbl and 279 mcf for March in filing on May 1 and so may have shut-in the 3 wells. Little revenue would be due for that low production. The April volumes should be filed in June.

Looks like production on the three API wells you have listed has taken a major negative turn in 2025- all three wells were producing at steady rates in Dec 2024 but then production dropped to almost nothing in January 2025, then a slight increase in Feb 2025 and then back to very low production in March 2025. This is the last production info that is available.

Production on these three wells - all horizontals drilled from the same surface location - varied. One was at about 7500 BO & 40 million cf gas per month while the other two were much lower (3800 BO & 2 million cf gas / 2200 BO & 19 million cf gas per month(.

The fact that all three wells crashed at the same time indicates to me that there is some sort of production issue here that is impacting all three wellbores. This may be an issue of gas line pressure / need for compression - of it may be the operator shutting down the wells at this time due to the very low to negative gas prices in this area.

Production at such a low rate that revenues may not be sent out due to very low revenue totals.

Don’t expect to get replies from Scout Energy (just my opinion). They operate 125 wells in this part of Reeves County).

it is possible that the wells were shut in during a nearby frac job to protect them. Or they have a mechanical issue. Time will tell.

I looked at this area and didn’t see any nearby “new” wells that would have led Scout to shut in this production pad during frac operations. Plus, even if this did happen, it would have only been for at most a couple of weeks and not the three-month period of very low reported production.

My money as to the reasons for the production “low” is either ultra-low / negative gas prices as well as mechanical issues (including gas take away capabilities tied to line pressures and need for compression).

Thank you very much for your responses. My first thought was that Conoco pumped up the production last year just prior to the sale to Scout and now Scout is waiting on prices to rebound. One of her JIBs had a line item about reworking the well. I can’t seem to lay my eyes on it easily.

Thanks for posting this. Looks like very poor month in Jan 2025 and then wells back producing (as a whole / 3 wells total) after that.

Any new information on the status of the Powderhorn wells? Texas RRC shows not reports submitted by Scout for April/May. Of course, I cannot get Scout to respond to my inquiries. Note that will initiate a new forum post regarding this lease, as well.

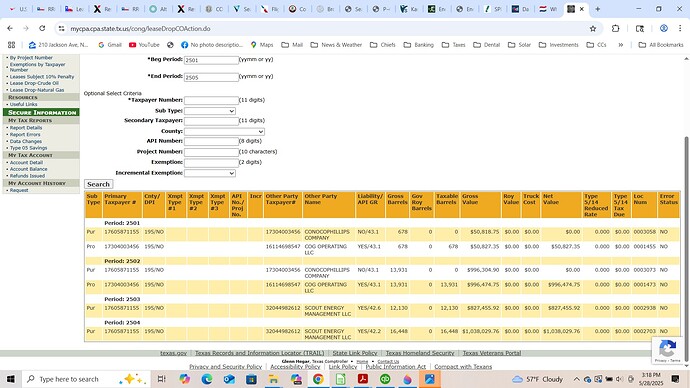

Nothing new to report. I am fairly new to this and the Texas state comptroller shows the wells are producing but Scout is not issuing reports and my mom’s checks have greatly diminished. Are you getting paid royalties or are you a working partner?

Update: 1st check generated from Scout Energy since the buyout of Conoco Phillips. It appears only 2 wells are producing and one of the jibs did show reworking operations. I’m still confused about why the CONG website (Texas State Comptroller) production reports don’t agree with the Texas State Railroad Commission production reports. It is nice to see some positive movement…

Good you are seeing something. Any comments on production volumes related to the revenues? As well as the type of work being done as per the JIB’s?

Rig, workover, hot oil treatment, new tubing, new pumping units, etc.

It looks like they are paying out on March '25 oil production 3101H @ 5299.50 bbl and 3102H @ 6830.10 bbl. 3103H is the workover rig. The JIB(Apr '25) has line items for workover rig, workover operations, fishing tools/srvc, fluids hauling, tubular inspection, acid stimulation. About $268K. Thanks for helping me learn the details of this stuff…

This agrees with the CONG production numbers for Mar '25.

Thanks for posting this info. The production from the two wells combines for almost 400 BOPD - not bad considering the age of these laterals.

Those JIB line items seem to point to some sort of downhole tubing failure that needed to be recovered / fished out. Assuming success, the acid stimulation may result in some better production for this lateral.

Next few months of production reports will be interesting to watch. Operator may even elect to acidize the other two producing laterals if the results of this one well are extremely successful

Good luck

This topic was automatically closed after 90 days. New replies are no longer allowed.