What would be typical long term development for Comstock play in Haynesville Shale?

I would like to know that answer as well.

If you search in topics for an article that I submitted several weeks ago about Comstock’s quarterly report it shows you how to listen in on Comstock’s 3rd quarter , 2025 financial results. Follow those directions and listen in on the phone call November 4th,2025. You will receive a lot of information on their future plans. Blessings!

The topic is called Comstock Resources 3rd quarter Earnings and Conference Call.

How can one get the development plan for a field owned by a company that’s not publicly traded?

Here the link to get log in. Jerry pretty open with his plan I guess.

Welcome to the forum Trisha!

You can ask the operator for the plan, but highly unlikely that they will share it as it is proprietary competitive information. if you want to see where current wells are, then you can look up the well locations and permits on the state oil and gas website. Do you need the link for the Texas Railroad Commission?

Thankyou for posting this link!

Hart energy had a great article on Comstock and the western haynesville today.

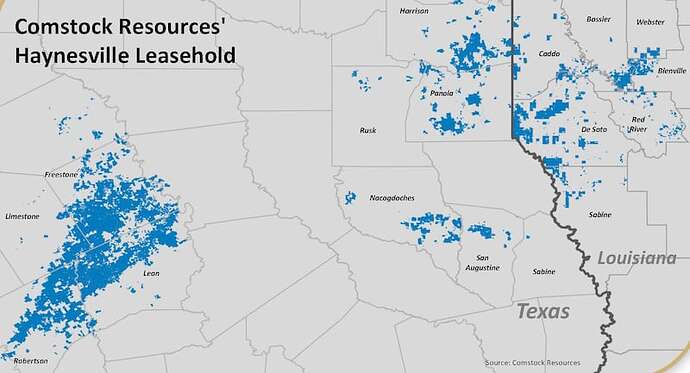

When Comstock Resources bought Covey Park Energy in 2019, it was a bolt-on to the longtime northwestern Louisiana operator’s Haynesville portfolio along the Texas and Louisiana border.

Not noted by markets was Covey’s leasehold north of Houston in the John Amoruso (Bossier sandstone) Field that was HBP’ed by old verticals it bought from Encana Corp. (now known as Ovintiv) in 2014.

While the original Haynesville play is Comstock’s “mothership,” as it calls it, that far western Haynesville property was the genesis of Comstock’s future: a new U.S. tight-gas play, owned mostly by Comstock.

And not a Wild West play like the early days of the original Haynesville.

Logs and cores from the area were publicly available from vertical wells that had long ago penetrated the new play’s targets—the Bossier and Haynesville shales—while seeking underlying limestone pay.

Comstock mapped it and got to work leasing, eventually capturing Bossier and Haynesville shale rights in 705,160 gross and 524,488 net acres—or nearly 90% of the prospective subsurface.

And it did this for an average of $600 a net acre, unlike the up to $30,000-an-acre deals its peers signed in 2008 across the border in the original Haynesville play.

Further, a high-pressure pipeline already ran through it. Comstock, which is majority held by Dallas Cowboys owner Jerry Jones, bought that as well as a gas-treating plant.

In an exclusive first interview on the new play, Jay Allison, CEO; Roland Burns, president and CFO; and Dan Harrison, COO, visited with Hart Energy.

“We have $300 million in our acreage and 3,000 or 3,500 locations,” Allison said. “There may be 99 Tcf of reserves. If only 25% works out, it’s a lot.

“We’re already in the money. We just have to continue to optimize the well cost.”

Comstock Resources has more than 300,000 net acres for Haynesville pay along the Texas-Louisiana border where it’s become boxed in by steep M&A prices for bolt-ons, but more than 500,000 net in a new Haynesville play north of Houston. (Comstock Resources)

Nissa Darbonne, executive editor-at-large, Hart Energy: What kind of depth and temperature are you dealing with?

Dan Harrison, COO, Comstock Resources: Depth-wise, there’s a lot more range here than you see in the core Haynesville. We’ve TD’ed almost 35 wells so far. The deepest one is about 19,200 feet, true vertical depth. We are around 14,000 feet on the shallowest we’ve drilled.

The temperature on the shallow end, you’re probably about 350 degrees and, on the deep end, you’re at about 400 degrees.

That’s what we see when we’re drilling, while we’re circulating, but the bottomhole temperature, if you can measure it, can probably add another 20 or 25 degrees. So, it’s probably 425 actual bottomhole temperature.

ND: Does depth trend shallower to deeper, west to east?

DH: It trends shallower northwest and deeper southeast. There are some faults in the area that set up some of this.

Some will be between 13,000 and 14,000 feet. We don’t really have anything that we’re going to drill any deeper than 19,000 feet. That’s about as deep as it gets.

ND: How about stratigraphic rights? Do you own it all from top to basement? Or is it split?

Roland Burns, president and CFO, Comstock Resources: We typically just have the Haynesville and Bossier shale intervals. Some of our large acreage acquisitions in this play were with [Hilcorp Energy and Diversified Energy] that specialize in old production, which could be above or below the Haynesville.

If it’s Cotton Valley Lime or those Pinnacle Reef wells, they’re deeper. The Bossier sand, they’re shallower.

So, those producing wells, which hold all that acreage, they own rights above or below the Bossier and Haynesville shales. But any undeveloped rights in the Haynesville and Bossier shale are what we acquired.

Now, we do have some acres where we have all the rights, especially our new leased area.

ND: So, you’re underlying or overlying Hilcorp and Diversified in some of it?

RB: We acquired from Hilcorp all of the Haynesville/Bossier rights when they bought the old XTO Energy acreage [in 2024]. That’s probably our largest deal.

And we’ve done that with Diversified in several transactions. They own the Legacy Reserves property [they bought in 2022 and Crescent Pass Energy property, bought in 2024].

We had them buy all the production because we didn’t want to operate those thousands and thousands of deep vertical wells with low production.

Those companies are really good at that. We’re really good in the shale. So, we have a kind of perfect relationship.

We want them to keep that held by production forever if they can. That’s in our best interest. We don’t have a drilling clock [running] until they come back and say, “Well, this is going to be released. We’re going to have to plug the well.”

That’s when we better drill ours to hold the acreage.

ND: You did a similar deal with Diversified in the legacy Haynesville, too.

RB: When they bought Tanos Energy in 2021 in the core, we got all their undeveloped Haynesville/Bossier shale rights.

People can get confused on this because they see Diversified out there [in the core], but we own all their Haynesville/Bossier, so they always underestimate our acreage inventory.

ND: How much of your new-play Haynesville acreage is HBP by the underlying or overlying wells?

Jay Allison, CEO, Comstock Resources: All but 100,000 acres. We maybe have to drill another 60 wells over the next four or five years to HBP all of it, which is not many. It’s manageable. Twenty a year.

RB: If all of our acreage had been new leases, it would be super difficult to maintain that in any timeframe that a lease would cover. It would be like the Wild West of the old Haynesville.

We were there. We saw how all of the mistakes happened back then. We avoided them there and we tried to avoid them in this new play.

ND: That’s why you bought your own takeaway?

RB: Don’t let the midstream destroy you, like it destroyed Chesapeake [Energy, now known as Expand Energy]. That’s what took them bankrupt. It took Exco Resources bankrupt, too.

They had great properties. The mistakes just got you caught up in lower gas prices, high midstream costs and having to drill to hold your acreage.

All those things combined to destroy those companies.

We were in the middle of all that. We avoided those mistakes then. So, when we built the western Haynesville, we said, “How do we do this without re-creating that?”

ND: Nabors Industries and Eagle Ford operator Caturus Energy collaborated on a super-spec rig with greater capability. Is this size rig something you need in the western Haynesville?

DH: We have seven western Haynesville-capable rigs right now, although we’re just running four in the [new play].

We’ve been in discussions for a while with all of our rig partners to upgrade one or more to, basically, the Nabors rig specs. It’s very likely we’re going to have one or more of our rigs upgraded.

We do think it will help us shave some days off our drill time here.

ND: The new rig’s pipe-handling capacity is greater. Is your lateral length, when you’re at as much as 19,000 feet in depth, for example, limited now by the maximum capacity of the rig fleet?

DH: Not by the rigs. The rigs can definitely go longer. Our longest one to date is about 12,700 feet. We’ve had to drill some shorter ones, mainly just because of our acreage footprint and a fault here or there. A lot of the areas that are HBP, those are where we’re going to be able to drill wells over 15,000 feet long. But we don’t need to drill there right now.

ND: Would you go past 15,000 feet?

DH: We’re not going to try to bite off anything over a 15,000-foot lateral in the deeper pay. It’s more problematic, much more risky. Obviously, as you get longer, the temperatures get even hotter at the drillbit.

Maybe after two or three years out, when we’re drilling some of the shallow acreage, I think we’ll see some laterals beyond 15,000 feet.

But we’re not looking to do that in the near term.

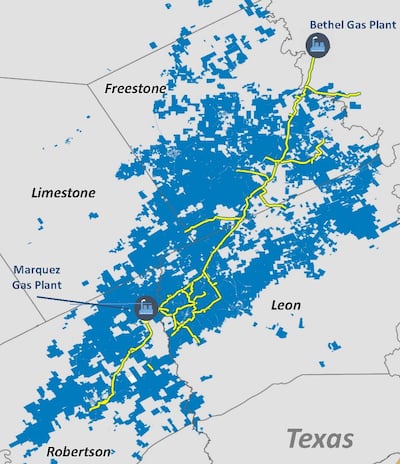

ND: The takeaway. The Pinnacle system you bought is a 145-mile trunkline.

DH: It runs right down the spine of all this new acreage we acquired. You could not have put a pipeline in a better spot than where it is. That was a real game changer for us getting started.

JA: Had we not been able to buy that, our whole drilling schedule would be changed right now.

RB: And it would have cost hundreds and hundreds of millions of dollars to create it.

ND: How did this start? Someone walked into your office with a map and said, “We should drill this?”

JA: When we’re buying something, we look at the geology everywhere.

RB: The prospect was there with the Covey Park assets. Obviously, their private equity owner did not have an appetite for exploration. The prospect, the theory and the old EnCana wells came with buying that company. So, that’s the genesis.

ND: You bought it in 2019. You had it in your pocket. The legacy Haynesville’s become all leased up. Were you feeling boxed in there and said, “Well, let’s go here?”

RB: Covey Park was our largest acquisition and, then, people wanted to consolidate the basin or get in or get back in.

It’s become so expensive in the Haynesville Shale M&A world that you just can’t even see how you get to the numbers that new players are bidding for properties.

Of course, they’re looking at it differently. They have deeper markets. They’re tying it to LNG. They’re big trading houses that own storage.

And they’re not coming into any other gas basin. They don’t want to be trying to tie Appalachia to the Gulf Coast.

It’s created a hyper-competitive M&A market for the legacy Haynesville. It’s a pretty hard place to be if you’re trying to grow by consolidating the basin.

Comstock Resources bought the 145-mile Pinnacle trunkline that travels down the center of the new Haynesville play to the Bethel, Texas, gas hub. (Comstock Resources)

ND: So, you’ve chosen organic growth rather than through M&A.

RB: The success with the Circle M [#1H, Comstock’s first well in the new play] probably was the turning point where, instead of buying the next big deal out there, which we were in a final group to do, we came back and said, “Well, we’re spending so much money and we’re maybe getting 100 new locations.”

We said, “We’re going to go grow the company through this exploration program.”

ND: You’re actually participating in that hot market on the seller side of the table instead.

RB: We’re selling some non-core areas we weren’t going to focus on anymore. The western Haynesville is taking a large part of our time and budget now.

These properties had been on the shelf; they really have no value in the company. We don’t have many reserves or production tied to them.

The western Haynesville has a huge opportunity set and the market’s calling for legacy Haynesville drilling locations.

JA: It’s good inventory, but we wouldn’t drill it for a long time. Whoever buys it can drill it. And we can take those dollars and pay down borrowings from our credit line, so it helps our balance sheet.

But our core in the Haynesville is the mothership. It’s 300,000 net acres. We have more than 1,000 locations and we’ve added 149 horseshoe-well locations.

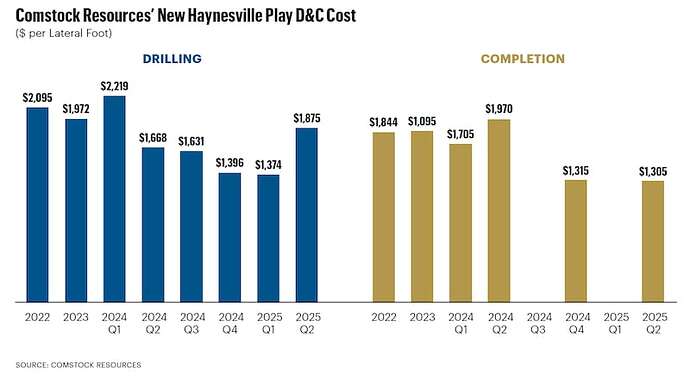

ND: Any more progress on getting D&C costs down per lateral foot in the new play? You’re at about $25 million a well now for a 7,900-footer.

DH: It’s not smooth. It’s just the nature of drilling deeper wells. It’s a little bit lumpy. The numbers can change with where the rigs are drilling. These depths—from 14,000 to 19,000 feet—greatly affect what they’re going to cost, like anywhere else.

RB: And then a shorter lateral is higher cost per foot, no matter how efficient you were.

Comstock Resources has been paring D&C costs in its new Haynesville play that kicked off at $3,900 per lateral foot and varies quarterly by lateral length and formation depth. (Comstock Resources)

ND: Would you say you’re still in delineation now or you’ve advanced to manufacturing mode?

DH: The southwestern third of the acreage, that’s pretty much de-risked. We do feel like it’s all going to be similar and pretty good.

But the acreage on the northeastern end where our Olajuwon [Pickens #1H] is, we just have one well, but a lot of acreage. We still need to drill some additional wells in that area to really call it de-risked.

ND: Is the Bossier looking better than the Haynesville or vice versa? Or does it just depend on where you are in the property?

DH: We have 27 wells producing, about half and half. The production’s been pretty comparable.

I’d still give the edge on well performance to the Haynesville a little bit. But with the Haynesville being deeper, they’re a little bit more expensive.

From an economic standpoint, the two are very comparable.

ND: Besides a roughly straight line to Gulf Coast LNG export plants, you’re looking into direct sales to power developers for data centers.

JA: We’re collaborating with NextEra in the western Haynesville.

RB: The area of the [Pinnacle system’s] Bethel [Texas] gas plant is a big gas hub and it’s very close to the grid. It also has water resources. It’s a perfect location for a behind-the-meter solution.

You don’t want to build this in a gas field that’s on its last leg. These are 30- and 40-year deals.

You have to ask, “What will the current gas plays be like 30 years from now, especially the traditional Haynesville in Louisiana?”

That’s not the ideal place to be, whereas the western Haynesville has all its good days ahead.

It’s a brand-new play.

This board is highly censored. Very frustrating. I have important information on this and I bet it just waits on moderator indefinitly like last time I tried and it never published.

I don’t know what triggers the censorship on this board so I can’t give details. I have mutiple posts that do give some detail and they await moderation permanently. If you have any say on who you sign with in the far Western Haynesville, Do not sign with C______k, sign with A____n! I realize you probably don’t have much choice, but if you do…

Also, Thursday’s Wall Street Journal had an interesting article on Jerry Jones, Comstock and the Western Haynesville.

Another thing you can do is look at the hearing dockets for Louisiana and hearing files for Texas to get an idea of what’s going on in an area.

I thank God we did not sign with Comstock and I am a Cowboy fan! We signed with Atheon. Our property butts up against the Circle M Alloc mentioned in this interview. We are in the KODA well next door. All of Comstock’s wells come in with a bang and then fizzle quickly as most all gas wells do. Circle M is quickly dropping production. Atheon runs a dynamically variable choke on thier wells that maintains the well pressure and prevents the fractures from collapsing and closing like they do in other wells. This just keeps their wells going and going at full steam like the energizer bunny. Our well produced more last month than it has for the last 18 months. Atheons 1st well Curry #2 started around the same time as the Circle M Alloc and produced like 5x to 6x last month what Circle M did. Curry is still going as strong today AFTER 3 YEARS as it was on day one. I do not believe you will find a single Comstock well producing anything like that.

Thanks for the post!

My Comstock interest was recently sold to Brookston Energy and now my monthly royalties check has decreased greatly. Does anyone know why?

No, but when you find out please let us know.

Not knowing the well names or locations, we cannot really comment. If you want to share we may be able to tell you if frac’ing is nearby. Normal declines in volume combined with price drops in oil and gas can also be a reason.

This topic was automatically closed after 90 days. New replies are no longer allowed.