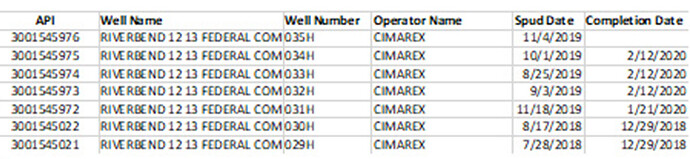

Let’s just consider things on your Cimarex acreage in Sec 12. You should be getting paid on the Riverbend 29H and 30H. And the Illlustrated Man Fee 1H.

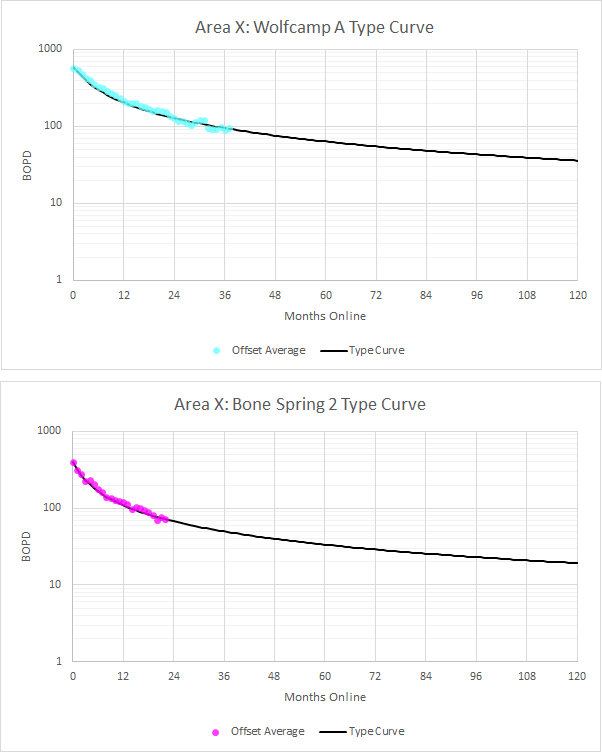

You have two things working against you right now. The two Riverbend wells are newer and thus are declining pretty quickly. Then you have oil price being terrible.

Lets talk about pricing first. Your January production was getting paid around $57/bo. March production was likely getting paid around $29/bo. Your May production was maybe getting paid $15-16/bo. At least that is what kind of pricing I have been seeing on some small interests that I have in Eddy County. WTI oil price is back around $40/bo but I would guess you will be getting paid about 75% of that in June and July. That’s better than $15/bo, but it’s not great.

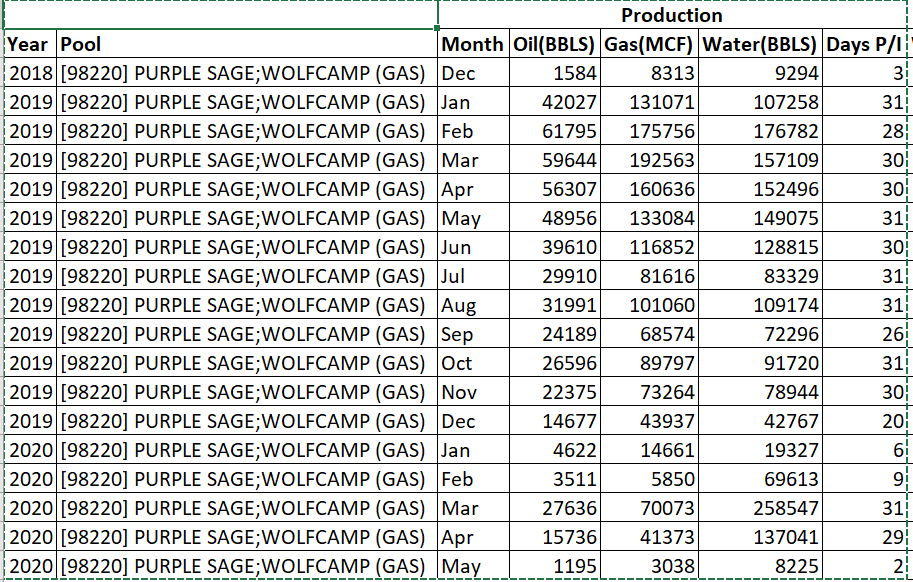

Ok, then lets look at volumes. Oh my. Your 29H and 30H wells barely were online at all in May 2020 according to NMOCD. The 29H produced just 4 days and the 30H produced just 2 days. Combined they made about 10% of the oil in May that they made in April. So yeah your May check probably really sucked. That is likely not going to be the case going forward. I would guess the wells were either down because the facility is full from the new wells or because Cimarex was shutting in production due to low prices. So you would expect the wells to get back on their historical production profile in the future. So, yeah I’d expect June to be more like March than like May.

I’d always encourage folks to look at the volume of oil on their checks, not just the net amount you get paid. See how much oil the wells are making. New Mexico is nice in that everyone who wants to dig enough can see exactly how much oil and gas their wells have made over time.

https://wwwapps.emnrd.state.nm.us/ocd/ocdpermitting/Data/WellDetails.aspx?api=30-015-45022

Scroll down to Production/Injection and export data to excel. You can see that the 30H was way down in Jan and February (barely online) and then made a whole bunch of oil in March 2020, likely pressured up from the other Wolfcamp fracs, made decent oil in April, and then barely produced in May as mentioned above.

The new wells coming online will have a major affect on your cash flow. When you start getting paid for the 5 new wells I would expect your checks to be about 3-4 times higher than your early 2020 checks. Hooray! Then the volumes from those wells will drop off rapidly.

I have no insider information. There are more wells that Cimarex could drill here. They have mostly drilled up the upper Wolfcamp (30H, 31H, 32H…35H). They could also drill more in the Deep Wolfcamp (like 29H) and then they could drill in the 3rd BoneSpring and the Avalon formations. I kind of doubt any of that will happen soon as they have dropped most of their rigs with oil price crash, but when they do in 5-10-15 years it will help.

I used to have a job working for a large oil and gas company as an engineer. The land department would get phone calls all the time from royalty owners, they would forward them to us, we’d answer them. Wasn’t a big deal. Feel free to ask Cimarex what they have going on.

I’d ask them if the 31H, 32H, 33H, 34H, and 35H are online. And I would ask them why the old wells (29H and 30H) barely produced in May. If the new wells are online ask them how if they are good producers and if they say yes then ask them if they are going to drill more wells.

Ok, enough rambling. Good luck.