I finally received a deed for my half acre in Roger Mills, Sec 7-12N-26W. It was executed in February 2020 but has an effective date of May 1, 2005. The Grantor (whom I work for) became owner of 5 mineral acres in 2004, signed a lease with Sierra Resources in 2007 and signed another lease with Forest Oil in 2010 when the first lease expired. He gave me a portion of the lease bonus and began paying me (for my half acre) from his revenue checks once production began in 2013 or 2014. I sent a copy of my recorded deed to Presidio, signed a W-9 and just received my first check directly but I believe it is incorrect and I did not receive a division order. Should I have received one since the acreage was HBP or do they just do a transfer of ownership? I have done so much research and found out so much information the Grantor did not share with me that my head is swimming. If I could afford to hire an attorney I would. I’m hoping maybe there is someone out there that’s just looking for a challenge and would be interested in helping me figure this mess out. I realize that’s a long shot but perhaps someone could suggest where to go from here. In the meantime I continue going through hundreds of documents trying to follow the chain.

I would contact their owner relations and ask to speak with a Division Order Analyst. They should be able to provide you with information and tell you how your decimal interest was calculated. If you think it is incorrect, then you can pass along what you found through your research. They will review it and let you know.

If that doesn’t work or if you don’t agree with them after that point, then perhaps you can find a mineral consultant to help out and provide a second opinion.

Good luck~

Thank you so much for the suggestion. I will try that.

You should ask for a division order from the analyst. In OK, you do not have to sign one, but I choose to do so or I send a letter with the same information on it. You should be getting paid on two horizontal wells. Davis 2-7H and Davis 3-7H

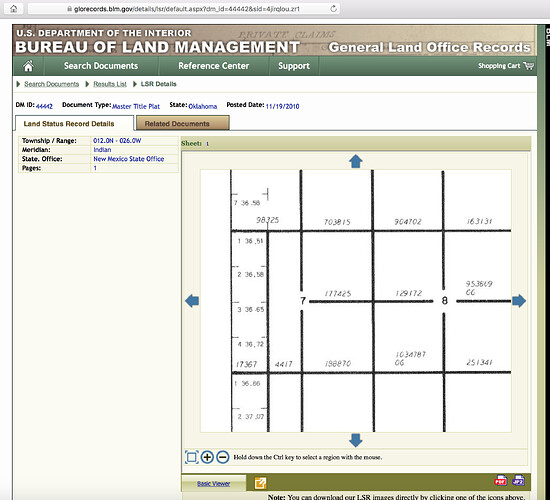

The equation for your decimal is net acres/spacing acres (actual) x royalty x % perforations in your section. In this case, the wells are 100% within section 7 so the last term is 1.0. The wells were spaced at 640 acres, but the section is not 640 acres since it is on the western side of the township and adjustments are made for the curvature of the earth.

i attached a picture of the section for you. You need to ask the division order analyst what the total section acreage is. The western side of the section has the acreage posted, the larger squares are 160, but the parcel 4417 looks thin to me, but doesn’t have the acreage on it.

If the effective date of the purchase was May 1, 2005, he probably owes you royalties from the first production of both of those wells.

This topic was automatically closed after 90 days. New replies are no longer allowed.