I have had several offers to buy mineral rights that are currently on a lease. Would seem to be a conflict, can one even do that?

Don, I don’t understand why you would feel it might be a conflict to buy leased mineral? It is not much different than selling a building that has a current tenant. The new owner is still held by the terms of any existing leases.

OK, I guess one would need to be sure they disclosed the lease to the buyer.to avoid a nasty surprise.

Absolutely! Chances are that if they are cold calling you trying to buy it, they know as much or more about than you do. You still want to make sure you inform them of everything you know and document as such. Preferably in the deed itself. And prevent them from coming back on you for sloppy title work on their part.

It is usually a good idea to spend a couple hours of attorney fees to draft or review the instrument of conveyance.

I have no intention to sell.

Good! The value of your mineral estate is at least 10X what you have been offered. Never jump on an early offer unless you are in dire straights. EX. I have mineral interests in Glasscock Co., Texas for which I have been offered over the years between 650K to 125K as the price of oil changes from the same people. I worked 55 years in the industry, the last 10 in all these shale plays. I know the value placed on minerals throughout the Permian basin. The offers increased (value and frequency) last quarter when 6 horizontal wells were permitted from the RRC. If you own it, they will come. It’s like vultures to a carcass. I keep a list of the companies that offer to buy and send them my workup based on hard data. They are never heard from again. Remember, its yours, they want it so be a tough trader. I recommend that you never sell.

You sound like a very experienced man in the permian. Our acres are in Lea Co. NM, we have 2330 acres that we get 1percent ORRI if I have heard things right on this Forum that is almost 4 square miles we have been offered 2 Million for that. I believe its worth much more and after reading your comments at least 20 million. our acres are in 26-19S-32E-23-19S-32E- 22-19S-32 We have another section in same area and the oil and gas lease is NM 12412 . I know big things are happening around us but would like your take on true valuation right now and possibilities in the future. Thanks in advance. Timmy D.

Is there an easy way to determine market value when you own an overriding royalty interest (ORRI)? I know it’s not as easy to determine as when you own net mineral acres, since an ORRI is specific to a lease. Is there a general rule of thumb?..such as so many months of production?, lifespan left of producing wells?

Kathy, almost all of the new, higher offers are based on speculation for future horizontal drilling. So, to answer your question, as long as the lease is solidly HBP (held by production), there is no real concern about any existing, older production on the lease and it does not typically affect the amount of the offer. What does matter is the potential future economics on the lands. The top mineral buyers all employ an engineer who will look at the surrounding area and try to estimate the potential recovery of oil on the lands. For a general rule of thumb, if the potential future development is imminent, the offer will be higher. If it looks like you are in the path of development, but it is not there yet, I think you are much better off to hang on to your interest until an operator has located new wells either on or nearby your lands.

Dave

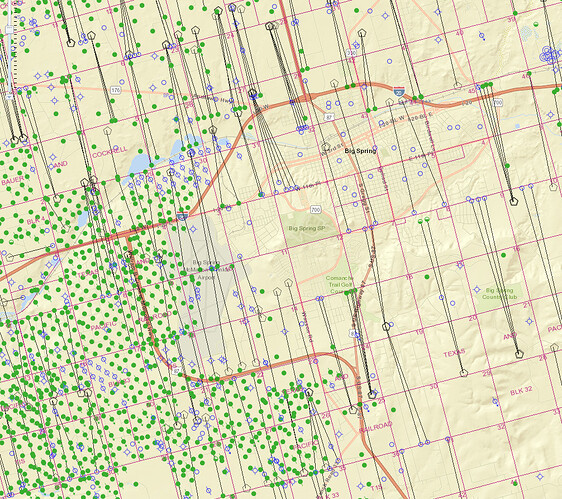

I am trying to determine the difference in bonus paid per NMA in 2014 vs 2018 as a way of evaluating value basis. Any help appreciated. acreage is 2 mi SW of big spring east of 87 .

It is more the price of oil at that time (and this time) which is relevant. Activity in the area can also be a factor in your favor. The location of your minerals needs to be checked with regard to current activity at the RRC, using their browser and data. You are surrounded by horizontal activity/wells. http://wwwgisp.rrc.texas.gov/GISViewer2/

Let me add one more thing to think about.

Twenty years ago, there was NO SUCH THING as horizontal drilling (aka Fracking).

As of right NOW in the Permian Basin the people taking the oil out of the ground are able to recover 10% of what is there.

TWENTY YEARS FROM NOW, I suspect that technologies will progress that the amount of oil that will be recoverable may surpass 75%. That is six times more than can be recovered now. So it makes great sense to hang onto your minerals because in the future there may be even more oil ($$$) pulled out of the ground.

Just something to think about.

To answer the last question, we got $500 per NMA in bonus back in 2017. That lease will be done in Mar 2020.

Guess what else happens in summer 2020? The pipeline that is being laid from Midland for the past two years. They should be completed by May/June 2020. Then costs to ship the oil from New Mexico drops. Everybody will be happy about that.

Including some of the big boys who have been watching that occur and most probably will get into the ‘deep end’ once that pipline is finished and operational.

William, think you need to reconsider that last comment.

I think you’ll find any bonafide offer to buy mineral interest would take into account the royalty percentage of any existing lease and the amount of the offer wouldn’t be factored based on that mineral interest being leased.