We have 320 acres of minerals in Logan county- 13 17N 3W NE and SE - that has not produced in over 14 months. I have written Contango requesting the lease be released. They have told me that they are attempting to sell the wells and will not release the lease. Several months have passed- the wells have not been sold and there still is no production. They are telling me the lease is not expired because the wells are capable of producing- yet they will not produce them. Do oil companies not have a fiduciary responsibilty to produce leased minerals? What can I do?

Does your lease define operations, reworking, etc? You might also want to review the Tres C v. Raker case: Link here

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Did they pay the shut in payment? If they are late, you may have a leg to stand on.

In my email from Contango I asked about shut in payment but he said our lease has no shut in clause. It has been 14 months now with no production- ContangoleaseNE.pdf (264.9 KB)

Here are both leases- 1 for the NE 120 and 1 for the SE 120 .

ContangoleaseNE.pdf (264.9 KB) ContangoleaseSE.pdf (266.4 KB)

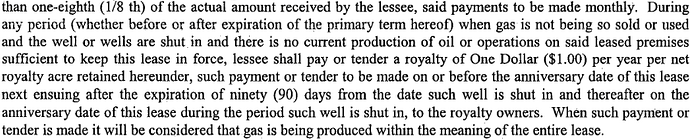

Paragraph two. Beginning with “During any period…” and following is generally considered the Shut in clause.

Does that mean since they did not pay us a shut in fee - the lease is voided?

Thank you for the link. I am not sure about the operations portion. I will read over them again.

Check your lease and see what your continuing operations clause says. You could send a certified letter demanding an accounting for each well to prove that each one is economic. One of them has to be to continue the lease. But if they have done no continuing operations which meet your lease terms and they have not paid the shut in payments, it may be time to consult an attorney,

Thank you. I did consult an attorney- and he wanted to charge $450.00 per hour to research everything. He said it could take several days. That could add up quickly. So frustrated. Thank you- I will read over that part.

That is frustrating! The wells are not that great, so you might just want to wait it out.

When’s the last time you were paid on the wells, doesnt matter the amount, just received payment? On the anniversary date of your lease, you should have received a $1 per acre payment if there has not been production from the last anniversary date of your lease. If you didnt receive this payment, the minerals are “open”

No one has asked the key question, are these oil wells or gas wells? A shut-in provision will not apply to oil wells. There are many other issues you can pursue, but answer this question first. You can always file an affidavit of non-production just stating the facts that you have not been paid during a time period and the OCC records indicate no sales or production during the time period. Limit the affidavit to these facts only and do not interject any personal opinions.

The shut in clause wording may apply only to gas wells or might also include oil wells. I have seen both.

The lease is for both oil and gas. I have attached them both below . I did ask for shut in payment - the land manager for Contango told me there is no shut in payment required. He told me no, he would not release the lease because he is trying to sell the wells. He said they are not economic enough to produce - yet in the same email told me they are economic enough to sell - which does not make any sense to me.

So - our 360 acres just sit. I feel like they have a fiduciary obligation to produce . So so frustrating and the Land Manager is less than helpful.

ContangoleaseSE.pdf (266.4 KB) ContangoleaseNE.pdf (264.9 KB)

Although a shut in oil clause is something that could be included in an OGL, the Shut-In Clause was originally intended for gas wells where a market (pipeline) was not readily available. Since oil has more transportation options, then a shut-in would not be applicable.

The land manager has now told you the wells are non-economic for production. Production and sales are a requirement to extend the term of the OGL beyond the primary term. There is also an economic component to the production to the OGL that can apply, but this always proves to be a more difficult issue to test. If there is no production/sales from the wells and the primary term of the OGL has been passed, then the OGL has expired. The operator will still own the related well equipment, but the right to produce the wells will have ceased. The Company is attempting to add value to their sale of the property by including your OGL as a part of that sale. An Affidavit of Non-Production filed in the county will serve as notice that you consider the OGL expired. Any title exam related to a sale by the Company will have to address the issue of the Affidavit.

I agree on your statement regarding the original intent of the shut in clause history. Also on the oil comment. However, I have seen newer draft leases with an oil shut in clause, so newer intent by some operators. Also, some operators have shut in questionably economic wells late in life, paid the shut in fee to save a 1/8th lease on a vertical well and then flipped to a horizontal driller who then drilled a deeper quite prolific horizontal well and thereby avoided having to lease again at more competitive rates. Many of us are stuck with the old 1/8th lease.

I had tried to sell 160 acres with a broker and he told me they were only worth $30,000- my offer from him directly was $30,000.00. Is that because the lease is tied up like this - or because they are not producing? If I file that affidavit - will that help with the value? 160 acres of the 320- 13 17N 3W

November of 2022 was our last payment from Contango