Would anyone please point me to information I could read to find general fair market value for selling mineral rights for 640 acres? This property has been in my mother’s family since 1965 and is now owned by myself and four other siblings.

As stated, this could be in one of three differing surveys. Mineral values are highly, highly specific to the exact section, and even differ within sections often.

The more informative statement is that there is no such thing as “general fair market value” when it comes to mineral pricing. It’s akin to asking, “what’s the general fair market value for cars ($10 to $300,000??) or for houses (10,000 to $10,000,000??)”.

I know everyone wants to think there is such a thing, but I"m afraid there is not. There are far too many details that must be understood in order for an informed value to be placed on minerals.

Like with any asset of value that you own, get educated, and use lots of common sense.

Best way to get fair market value (from what I’ve seen) is to shop it to several different well-respected mineral firms who will give you a bid on your minerals. If you are only talking to one person/company, then they are going to negotiate the price as low as possible and tell you it isn’t worth anything. Shopping it gets you several different valuations and gives you the option to withdraw (if you decide you would rather hold the minerals).

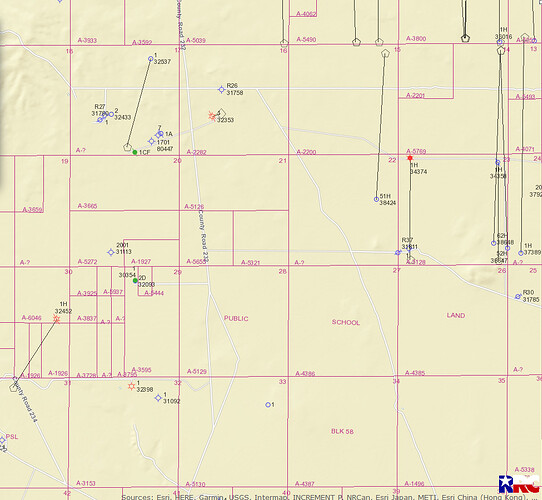

Fair market value is only determined after you agree on a price. If you are talking about Block 58 in Reeves, (not Block 58T1 or 58T2 in Reeves and Culberson counties) there is no production in these lands. Do you know why no operators ever drilled here? There are a lot of dry holes and wells that have been plugged and abandoned from the 40’s through the 80’s that are located in nearby sections within this block. Are you aware of any geological issues? Your position isn’t necessarily limited to 5K horizontal well production but i suspect there is something wrong with the rock in these lands. Contact a mineral purchaser who is an end buyer if you want an accurate valuation of your position.

The reason I was concerned is the trust was administered by that stagecoach bank. The land has been leased several times in the past by Gulf Oil and others. Just under three years ago the trust leased the entire section for around $1400 per acre. A week later the lease was resold to another company and a special memorandum was filed with options for another three years. I guess we siblings will need an attorney to look after our best interests to hopefully avoid a repeat. Yes I have no clue about these business dealings.

Sherm, What John Clark said above about no production in Block 58 is not true. That is if you are referring to Block 58 north of Toyah approximately 12 miles or West of Pecos about 18-20. We had a well drilled in August and has been producing since October. We are in Block 58 section 15-16. We got a lease 3 years ago, thanks to an awesome attorney, for $4000. per acre.

Mr. Haag,

I was referring specifically to section 33 in Block 58. No wells have been drilled there. In fact, it would appear that only eight horizontal wells have been drilled in the entire block while over 100 horizontal wells have been drilled in block 57 just to the north. Why do you think operators are reluctant to drill in Block 58? Also, congrats on your lease and production. Not all of your neighbors seem to be as fortunate. Enjoy your royalties while they last.

A few miles can make a world of difference in terms of geology and well economics. Haag’s well is right on the fringe where activity drops off significantly. Thus, your location is not as good and would bring a much lower price without any permits. Also, did you notice Haag said “3 years ago” when the mineral market was peaking and operators were slamming wells anywhere they could? Things have changed immensely since then as this industry is extremely dynamic. Take what you hear on here with a grain of salt. I’ve seen people be convinced to hold out for higher lease bonuses or sale prices, only to be sorely disappointed later on by a rapidly declining market.

Kenneth, Re: Reeves County, TX My family and I were recently was contacted by a representative of the oil company offering a leasing contract not far from your property. Subdivision 12, Section 24, Block 58. I did notice you were kind enough to share some of the info and negotiations you had in finalizing your contract. Before contacting an attorney (who was the awesome attorney?) I was wondering if you could share a little more information on what the “per net mineral acre bonus/option means”? Thanks, Steve

Were you approached prior to or after oil falling by 50%? Given the recent market downturn, it’s doubtful that Kenneth’s lease offer is of significance since it was before oil tanked recently. Same with mineral/royalty offers, they have seen a large reduction in value.

On the contract there mention of “per net mineral acre bonus/option”, what does that mean and cover?

That’s the rate at which they lease your minerals, and if an “option to extend” is included, then it sounds like they are offering the same rate. It’s likely a “3+2” lease, meaning they have a primary lease term of 3 years, followed by the option to extend the lease for another 2 years. They should pay you a “bonus” for the primary term based on a rate per net mineral acre (example, $1,000/net mineral acre, so if you own 5 NMA, your lease bonus is $5,000). Then, if they haven’t drilled a well during the primary term, they have the option to extend the lease another 2 years by paying you the same amount as before, being $5,000.00.

The legal description will cover gross mineral acres in which you own an interest. The net mineral acres is your share of the total acres. For example, suppose you own a fractional interest in a section of 640 acres. The legal description will be the entire 640 acres. If you are are one of 100 equal owners, then your share is 1/100 X 640 = 6.4 net mineral acres. If you own 1/1000, then you own 0.64 net mineral acre. The bonus will be paid on your net mineral acres. It is important to understand exactly what you own when the minerals have been split up over the years to multiple heirs.

I looked through the contract and could not find any mention of multiple heirs. I do have pretty good idea on the number of heirs. It is reasonable to assume some heirs will sign original offer and others like myself will negotiate. Is there a way to find out how “the minerals have been split up over the years”?

You run the title or hire a landman to do it for you. It’s the only way to know for sure.

Unless you have a title opinion or an affidavit of heirship, your contract should not mention anybody other than the Grantee/Grantor. Majority of modern deeds/leases do not show net acreage, the acreage on your contract is most likely the gross acreage.

Seems like everyone else is giving the right advice. Only thing you can do now, if you cant run title yourself, hire a landman.

Best chance of finding a document w/ your net acreage is a source document or an AOH.

This topic was automatically closed after 90 days. New replies are no longer allowed.