I recently received a form letter from Presidio Petroleum indicating they are changing to mandatory automatic deposit of revenue. Is this legal? It seems this topic has come up before in various discussions here and elsewhere but I can’t recall the comments. Input please.

Here is the post from a different thread. It was regarding charging $15 for a statement.

“We just received a letter from a royalty payor on Oklahoma properties informing us that they would be deducting $15 to process a check as a paper check. Our minerals are in a trust administered by a bank who does not accept ACH payments or direct deposit. Is there any statutory authority or Oklahoma case law allowing this deduction? Also, received notice from another payor that the only way to see a check stub is if we sign up for direct deposit. Is anyone else experiencing this?”

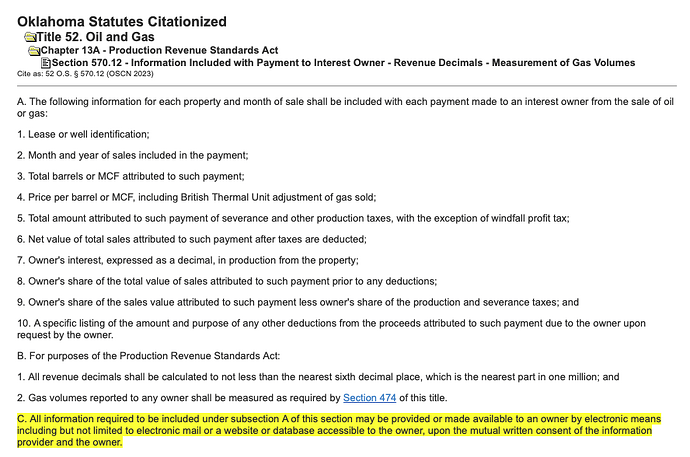

We just had an OK NARO board meeting and I asked this question. One of the directors answered and said to send a copy of the OK statute with the pertinent section highlighted and say something along the lines of "I do not agree to the electronic means. I request that I receive a paper check and a complete paper statement without charge. The PSRA (Production Revenue Standards Act) allows for electronic means but only under mutual written consent which I am hereby withholding under Title 52, Chapter 13A Section 570.12. "

Cite as: 52 O.S. § 570.12 (OSCN 2023).

Send by certified mail return receipt so that you have a copy of the letter.

Send the following Statute section in your letter.

PS- I am not giving legal advice but see if this works.

Texas NARO is working on an answer with similar language.

Will I have to say that this is very interesting, good read , I believe in this new technology the old world ways is getting left behind! Thanks for sharing

Personally, I like direct deposit since the money gets to me faster and avoids potential theft at the post office. (We have had multiple incidents). I just got off the phone last week with an operator who has issues with a certain post office in OKC. (Happens to be the same one where we have issues.).

In conversations with a certain trust bank, they turn off all automatic deposits when onboarding a new account to their system if they take over minerals management for a family. They turn them back on after verifying decimals, etc. So that can cause chaos for a few months.

However, in OK, the operators cannot charge for the statement.

Thank you for your response Ms. Barnes. Since Presidio is based in TX, some of the info you have shared may not apply in my case. I’m hoping to get some feedback from other royalty owners doing business with Presidio or other companies attempting to force royalty owners into direct deposit. Direct deposit does not always help the royalty owner as some smaller operators do not use it.

My royalty & working interests revenue with Presidio is paid to me using direct/deposit. Never a problem. I still get the check statements e-mailed every time there is a deposit. The state the producing property is in determines rules & regulations. Not where someone lives or where some company is located.

The point of my post is that it shouldn’t be mandatory for an operator to impose mandatory direct deposit. Many small operators do not even offer direct deposit. Has there been any new legislation passed in TX which allows mandatory direct deposit by operators? I hope to hear from royalty owners who have received communication from Presidio or other operators.

This topic was automatically closed after 90 days. New replies are no longer allowed.