Any drilling activity near this lot? Blk: 45 Tract: 37 AB 3498 SEC 37 BLK 45 PSL Acres: 19.430 near Pecos Reeves County, TX

Zenia…as surface owner you can collect an overriding royalty on operations of businesses such as a Saltwater Disposal Well or a Brine Station supplying 10 pound brine to drilling operations…or the operation of a fresh water supply station to supply drilling and frack water to drilling operations. With the surface, for which you can collect ‘damages’ for pipeline Rights of Way across your property, you also own the fresh water in the aquifers under your property. Developers will sell that water by the 42 gallon barrel to drillers for about 50 cents per barrel…and typically they don’t want to pay you over 15 cents per barrel sold…Most will try to get you to take 5 to 10 cents per barrel.

IF your property is close to the city of Pecos city limits, you might get a surface owner’s offer to locate a drilling pad on your property from Colgate or one of the other drilling/production companies that are drilling horizontal wells for gas and oil production under the city of Pecos.

IF you get any offers…ALWAYS get a lawyer to represent you in any negotiations. There are several good legal representatives associated with this forum…I recommend you seek them out before you agree to anything.

, Tx

Thanks for this valueable info Lawrence.

How will I know if I own the mineral rights? Is there a way to find out who owns the mineral rights of this lot?

Send a message to the Reeves County Tax Assessor Collector’s office (RCTAC) in Pecos, Texas (79772 zip) giving them the description of the property…they

will have the mineral owners of record mailing addresses…ask them and see if you are listed as a mineral owner.

,Tx

Often the Appraisal Office does not have a list of mineral owners unless the minerals are producing as nonproducing minerals are not taxed. They always have list of surface owners and, for wells, the royalty and overriding royalty interest owners.

FYI; New well spudded on north boundary of Block 13, Section 217 the 4th of August by Henry Oil Company. Horizontal well…no particulars on it yet. Mineral owner is member of this forum. Location is about 2.4 miles east of Hwy 17 near the east extension of Reeves CR330.

Thanks Lawrence. Got your new info just now.

I recently had to do this on my dad’s properties. You have to look on the deeds to see if any previous owner reserved mineral rights. You can find the deed history on Appraisal Dist website under the details of the property. It notes the file and page number of the recorded deed, which you can order from County Recorders office via email or use a website like Texasfile.com. It does get a little expensive though if you have to go back a few owners or there are several pages. Good luck

Any drilling information for Section 38, Block 52, T7S, T&P RR Co Survey?

Received an offer to sell today from Concentric Mineral Partners out of Midland for 38K per net mineral acre owned. Largest I’ve seen.

This amendment and permit approved April 04, 2019. Centennial Resources/Drill pad in Section 47 and ending in Section 35.

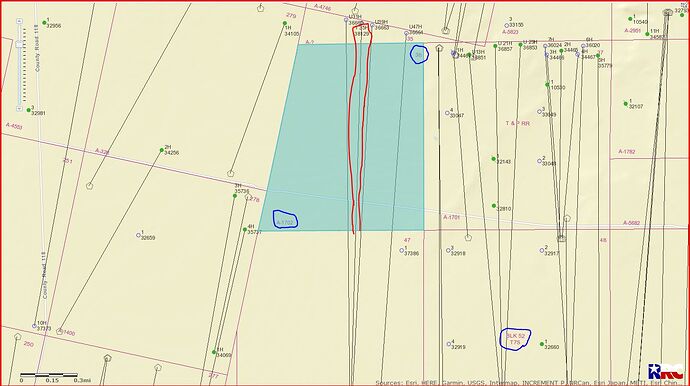

GIS Map of Reeves County Section 38/Block 52 T7S/A-1702:

DOUBLE LEFT CLICK TO ENLARGE MAP

ALSO:

Approved permit 389-36663 spud date 03/21/2019

Approved permit 389-36664 spud date 08/25/2018

Approved permit 389-36665 No spud date noticed

Clint Liles

Centennial has 3 Barracuda wells permitted with surface location close to the south line of section 47 and running north to the north line of Sec 38. Two of the 3 were permitted 01/04/18 and haven’t been completed or produced that I can tell. The third permit was approved 11/17/2018. Don’t know if they had gone forward and are drilling or not. Anyone else have any better info? I’d say that’s a low number for them to offer and yet it’s big enough that it may indicate they expect these wells/area to produce well.

Why would they offer 38k per mama unless they could flip it from more? Or perhaps they want to drill in which case just lease the mineral rights?

Thanks Clint, this is invaluable information.

I found the completion info for the Barracuda B well spud in 2018 on the RRC site. Looks like a very good oil/gas producer. Hence the 2nd well? Wonder what my 20 acres in Section 38 will bring in? ![]()

I have a question. If a well runs thru my Section as Clint posted above, I’m entitles to royalties. right? The top hole and the bottom hole are in two different sections than ours are in, in Section 38 Block 52, T7S, T&P RR Co Survey. This is for the Barracuda well completed in December 2018. Thanks.

Hey Clint, could you find permit information on this area. PLEASE E/2 of Section 295, Block 13, H&GN Ry. Co. Survey, Reeves County, TX

If the wellbore is producing from your property’s minerals, as in a horizontal extension going through your property that has perforated and fractured your portion of the horizontal extension you are definitely entitled to a royalty if you own the mineral rights. I can not believe, however, that any company would take on the risk of developing and producing properties that they had not leased from the owner(s) of that property.

If they did, I suggest that you simply take the whole company over through the courts. Of course, you will be liable to pay what is owed each month to the other mineral rights owners once you take over.

Thanks Stephen,

Section 38 was leased by us in August of 2018. I’m still confused about Clints post above showing the Barracuda wells going thru Section 38. Bottom hole is section 35 and top hole is section 47. The wells run the entire length of sections 47 and 38. See Clints post above to see what I’m talking about. Also does Texas have any laws on when Division Orders should be received? I’ve heard 6 months. Thanks.

DIf the acreage of the lease where a well has been drilled is 1240 acres and I own 20 acres in the lease does that mean my royalty is multiplied like so: 20 divided by 1240 multiplied by my lease Royalty of 25%? My figure is .0040322. Can that equation be right? Thanks.