Does anyone know what the top terms Aethon is paying here? Have an offer for $300/ac and 1/5th royalty.

It depends on the area. Do you have an abstract or survey name?

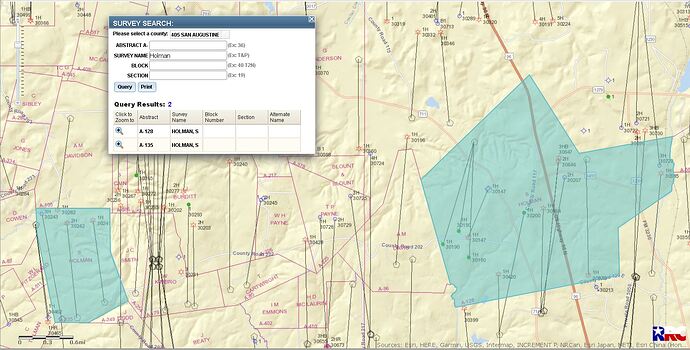

It’s in North San Aug. Think it’s Holman survey

There are 2 Holman Survey in Northern San Augustine County—Abstract 128 and Abstract 135. They are fairly close together. Some fantastic Haynesville Shale wells in this area and there are some James Lime and Huxley wells scattered about.

LEFT CLICK ON MAP TO ENLARGE

Any idea what the top terms are?

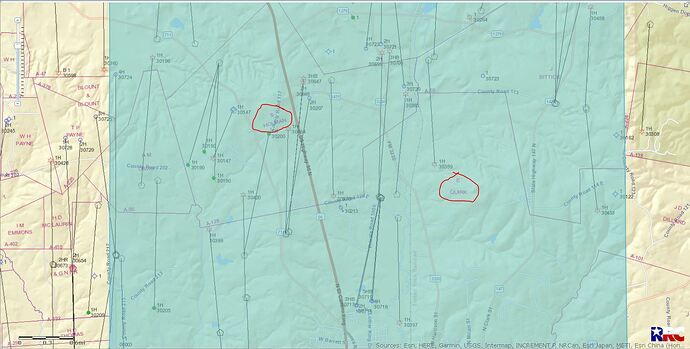

Activity appears to be heating up in San Augustine County. Interested in terms for the Edmund Quirk Survey. Back in 2010 offers were in the $2000.00 bonus range and 1/4% royalty interest. Thanks for any info.

Mike, the Quirk Survey(A-35) is next door East of the Holman Survey(A-128)

LEFT CLICK ON MAP TO ENLARGE

This area seems to be very hot as we are currently receiving a lot of offers to purchase our family’s mineral holdings in this area. $300 bonus consideration and 1/5th royalty rate seems very low from my past experiences in this area.

Clint: We are interested in terms being offered in the County. We are preparing for negotiations and we know there are impressive production reports in this area as displayed in the RR Commission Production Query and also permitted wells in the Quirk Survey. Thanks much for the info.

Hey Mike…One of the things to be aware of in a lease is the ‘Post Production Deductions’ in a lease. The producer will take a good part of your royalty check for producing, gathering, storing, separating, treating, dehydrating, compressing, processing, transporting, and marketing the oil/gas. This is a good link to read…https://mineralrightspodcast.com/mrp-72-what-you-should-know-about-post-production-costs/ Also, I would counter offer at $750 per acre bonus money and NEGOTIATE 20% royalty sounds good. Good luck with your lease…In my opinion you should find an oil /gas attorney to negotiate with you on your lease or a reputable landman. Clint

Clint: Thanks for the good info. Yes we have retained an Oil and Gas Attorney to negotiate the lease terms and take care of other important provisions such as post production costs. We are in the process of negotiating a higher royalty interest rate and the bonus terms are very low for such proven production in this area. Of note in 2010 the bonus rate was 2K an acre on the same lease which was allowed to expire.

The lease bonus’s and royalty rates everyone has been mentioning in here sound quite low, $750/ac and 20%. The lease bonus should certainly be over $1000 and the royalty should be at least 22.5% or 25%. We are currently buying royalties in this area for $8500/nRa and in some cases up to $14-15k/nRa. We don’t use this method of calculating what royalties are worth, but if you just use 5x the lease bonus, lease bonus’s should be in the $2000/nMa and royalty rates should be as close to 25% as possible. Just my two cents.

I concur. Some of the offers we have been receiving are upwards of $8,000 per Net Royalty Acre. We have some recent activity on one tract and those offers seem to be upwards of $12,000 per Net Royalty Acre. Hard for me to understand why lease bonuses would not be upwards of $2,000 per net acre.

Hello,

Just wanted to see if anyone received any better terms than the $300 per net acre and the 1/5th royalty that was originally discussed?

You can probably get a bit better bonus, but I would never sign a 1/5th lease. Especially not in San Augustine County. Always 1/4 royalty.

Quick question. If you are not in the federal forest they will likely pay more than if the property is in the forest. Another not is that the areas your are referring to is what the EP side calls Quad 1, Quad 2, Quad 3 and Quad 4. Quad 1 & 2 will get explored first since they are closer to proven shale. One note, the quality of the gas down there is considerably more with CO2 and H2S. With a bigger map I could explain further

I have been offered a lease in the James McCauley Survey, A-409. They are offering a 1/5 royalty, $50.00 bonus, 3yr. term, with a 2 yr. option. Does this bonus seem in line with what they should be offering me? I would appreciate any information you have.

Thank you

$50.00 an acre seems extremely low for this area! Are you sure it was only $50.00 and not $500? I have started to hear of things going for upwards of $1,000 per net acre in San Augustine.

It is a 1 acre tract. They offered $300 acre, but I only have a small amount of acreage which only brings me $50.00 bonus.

Based on lease location this is in the heart of the BP / Aethon development. I would try to get more but given your small surface ownership, you just need to realize that you don’t have a strong leg to stand on. Aethon has 80,000 acres to develop in the county under the deal with Blackstone and could select other locations with the same rock quality. This area is prospective in both the Haynesville and Bossier. Good luck!