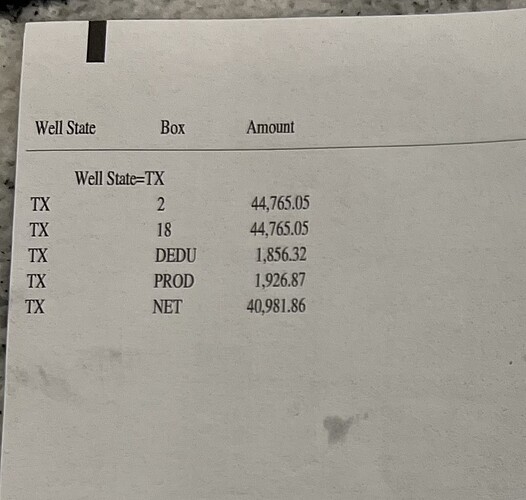

I receive a 1099 from Chesapeake Energy for mineral rights in Texas. The only Boxes that have any numbers are Box #2 and Box #18. On the back side of the 1099, there are amounts noted as PROD and DEDUC and finally NET INCOME. My tax program only asks for the amounts shown on the front? Kinda confused.

Box 2 is the gross royalties or revenues and you use that for calculation of the percentage depletion. The Deduction is the costs charged (could be transportation, processing, marketing, gathering ot others) and the Prod is most likely the severance taxes. Both of those reduced your net royalties paid to the Net. These figures should match your year-to-date summary on your December check. The charges are deductible on Schedule E. You may need to change tax programs.

That is correct. Your tax program only cares about the numbers on the front of the 1099-MISC. Severance Taxes, Production Costs, Percentage Depletion and any Royalty Property taxes have to be entered by you manually as expenses for Sch E. I usually list Production Costs as a miscellaneous expense on Sch E Line 19. I combine Severance Taxes and Property taxes and list on Sch E Line 16 Taxes expense.

Those numbers on the back may not be correct, and the IRS does not use that information to reconcile your return. It is only supplemental information; that is why it is on the back. At least for XTO it is not usually correct. XTO reports interest on check stubs as a negative deduction under Deductions, however, they always send a 1099-INT for the interest amounts and the amounts for statutory interest has been subtracted out from the data on back of 1099-MISC. Because XTO makes so many retroactive deductions dating back years, they usually list a Reimbursement amount and the Production Tax and Other Deductions (Production costs) list on back of 1099 do not match my check stub data because of those retroactive corrections, but the Net Income shown is always correct. Instead I use the data from my check stubs. XTO also does not list a year-to-date amount on check stubs for Gross, Tax, Deducts, and Net.

Also, it doesn’t matter that there have been reimbursement in previous years. You report what has been paid to you during the current tax year on a cash basis. You do not go back and amend past returns.

Just some clarifications based on my experience.

This topic was automatically closed after 90 days. New replies are no longer allowed.