This is always a tough process. First Rule of Selling - If people are contacting you to buy your property, then it is worth more than they are offering. Trying to assess the future potential of a property is very difficult even for a professional. If they fully develop the property in the near future, you are most likely better off to keep the property. Just because a company drill 1 or 2 well does not mean the will continue with development. Best advice is to get a professional involved whom you pay a fee for the assessment, not a commission. So many mistakes are made by people that do not perform research and do not want to pay for solid advice. Patience is in your favor. Good luck.

That makes sense. If you really need the cash, then it may make sense to sell for you. There is a lot of development activity in the area, but keep in mind that that area is very large. Comstock, one of the largest players in the Western Haynesville (where your acreage is located), is only planning to drill 20 wells there in 2025. There is no guarantee your acreage will get developed any time soon. If you need cash now, you may want to entertain the market for the highest offer. Feel free to let us know what you find out.

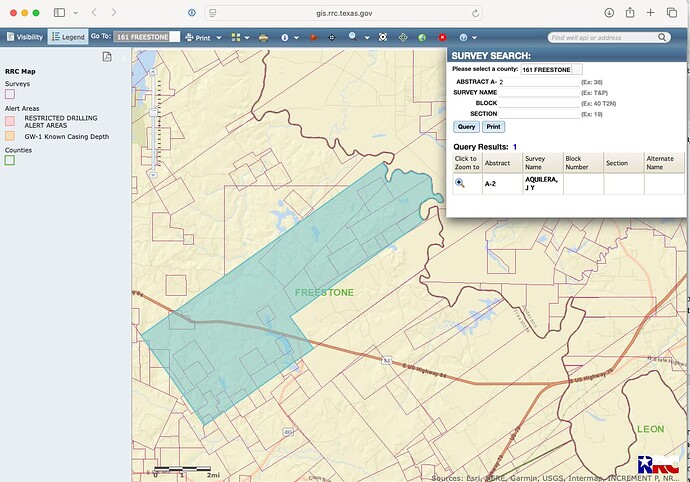

Use the County link on the upper left and pick your county. Then use the magnifying glass to go to Surveys. Put in your abstract number, block and section. Be sure and spell the abstract correctly. I typed in A-2. You may be in a smaller section of the larger abstract. if you zoom in, you can see the current wells in the area. https://gis.rrc.texas.gov/GISViewer/

Thank you for taking the time to do that. I am still unsure of what the map is saying. Is the whole turquoise area just the Aguilera area and what are the squiggly blue lines for?

The blue area is the whole Abstract for Aguilera Survey. It is subdivided into smaller sections. You may have a more specific location listed in a deed or probate documents with the section number listed. Since we are so many generations away from the original patent grant at statehood, most folks only have a small amount of acreage in a specific section.

I have worked with many people trying to sell this type of package. You are trying to sell something that has not been leased in several years to a likely market that will be professional mineral buyers. The no leasing during a very active period indicates a low value for future development. You should prepare yourself for limited and low value responses. Pros look for returns on their investments and subject the analysis to strict parameters.

I still have properties in my portfolio that I purchased 40 years ago that have no development. If you receive low offers, you may want to consider retaining the properties for their limited speculative value. Good luck in your efforts.

Find done hot property or properties in your portfolio (I have interests in the same area), and tell buyers they can get the hot stuff if they buy your other stuff that’s not so valuable.

Thank you for the suggestions.

We are also trying to sell in Bastrop county 677 acres

@Twinee On a practical basis with your proposal the Seller receives the same price for the “pasture” properties and sells the more valuable properties as an inducement. I can tell you as a buyer, I have people make the same proposals to me. My response is generally the same. Unless they have to sell the properties for very little value or for some other purpose, they are better off holding them for the speculative value.

Why don’t you discuss it with your children. If you are intent on selling give them the first chance to meet or beat the best written offer you got. Most of the buyers don’t have the money to start with and can’t close the deal most likely.

Could you suggest an attorney or someone in this area of Texas who would charge just for the assessment and look over sales agreement?

My adult children all have families and are struggling like most people in our country today, there is no way they could do this.

Several Texas attorneys are listed in the Directories tab above.

The Assessment review - possibly Tracy Lenz who is a member of this forum. Caveat, if your property is out side of activity, then you should be prepared for minimal Buyer interest. For the Sales Agreement, then I would suggest Rick Strange who is an attorney in Midland, TX.

Thank you for the suggestions.

One thing to consider is that you do not have to sell all of your minerals. You can sell a portion for needs now and keep a portion to see if you get them developed with the new play. Once they are gone, they are gone.

This can be a frustrating process for many people. I am on the other side of the transaction and witnessed the frustration that many Sellers exhibit. Buyers and consultants need to develop better processes to walk people through this process. Be diligent and assume you are working with people that are wanting to get the job done in the best possible manner.

Lady, your mineral rights are in a great place. This is a real Hot Area presently. Comstock, Mitsusi and Expand are the main companies trying to develop this area. Your minerals a worth a fortune. Just “back off” for a while and it will come to you. It cost nearly $30,000,000 to drill, complete and get one of these Bossier/Haynesville horizontal wells into production. Don’t sell your mineral rights for nothing. Say some prayers!

What area are you talking about please?