David,

The decline on your wells should flatten out as they get older. Currently you are in the situation where the production is declining fast on the two newer wells (2H and 3H) and the oil price has cratered (extremely so for April and May production). So it probably seems even worse.

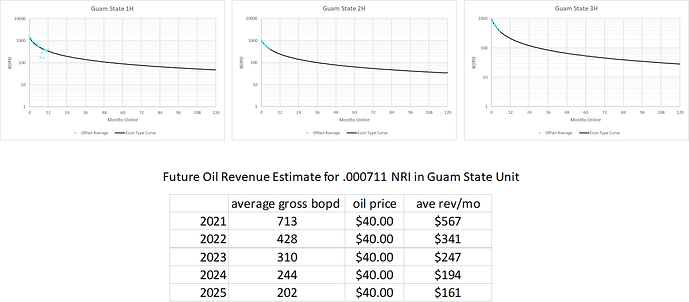

You should have something like .000711 NRI in the existing wells. Here is a possible forecast of how each of the 3 wells should decline. I stuck that in a table for $40 oil (w/8% taxes) and got this kind of expected monthly revenue from 2021-2025 for a .000711 decimal. Assuming nothing else ever happens I would guess your brother could sell for about 48 times your 2021 monthly revenue. So that would be 48 x $567 = $27k.

At > $50 oil drilling more of these wells is likely economic. These wells are drilled along the West and East edges of the Guam unit, there are no wells in the middle. There could be another, say, 10 wells drilled here over the next 30 years. Which in terms of today’s dollars isn’t worth a ton, but is something to consider.

I have no idea what your ad valorem appraisal is, but it could be quite high/low depending on when they appraised it. I would not take that as a reflection of a representative sales value. It might be, might not be.

Best of luck