Rick,

From everything I have seen, this mineral is profitable. What happen, I have in my lease that any extension has to be mailed to me 30 days prior to the expiring lease. The land man called 10 days after the lease expired and said they wanted to extend the lease as they were only over a few days. This guy didn't know what was in my lease. He was even trying to lease some of my land that they were holding by a producing well they had just finished. I told him I would be glad to lease, but not for the amount they had offered me 3 year ago as leases have gone up. He got mad and never called me back. I later found out that most of the minerals on the land next to me are sold to oil companies and investor's. The mineral on this property has had 5 wells, one catch fire when they were pulling the casing. One was a good producer, but they decided to drill deeper and the salt water took it. It was a V well and made 50 bbd before they drilled deeper. So, when I deal with oil companies now, I look at them like snakes in the grass ready to bite. I have worked with many good oil companies, but some you wish you had never seen. I have invested in wells, some were good and the company were great. But, watch out for the snakes in the other companies.

Martha,

The ND oil & gas law was interesting. Thank you.

First, it stated- pooling clause- I have one, only to be over rode by OCC, so I got pooled.

Competition in area - their is a company in OK City that likes to lease 9 sq. miles at a time. They make an offer and it's take it or leave it. They will pool you if you don't lease, again OCC will decide what you get.

I have a very good lease that my attorney and I work on and I'm always willing to work with oil companies and their leases, but most want it their way or none nowadays. Seems like we only have one or 2 companies working an area, no competition.

Martha, the ND lease overview pages are a really great summary of issues. Nice find!

Martha McMorries said:

Have a dumb question:

What does WHX stand for?

I know what HX is, but I have been seeing spacing order with WHX lately.

Virginia,

Regarding the "pool of oil", the current trend of horizontal drilling into unconventional reservoirs (shales and limes) are going into rocks with a very high hydrocarbon saturation, but very low porosity and permeability. They must use multi-phase frac technology to open up the rocks and prop them open to allow the oil and gas to drain into the production tubing via the perforations. Think of a tube with about a 200'-350' diameter instead of a disc shaped "pool". That is all that can drain into the borehole. We are looking at giant regional shales or limes that have to be produced in a very different way from the more conventional reservoirs which are usually sands or very porous limestones. Those can sometimes be called "pools" and behave very differently. Their drainage patterns are quite different and usually limited in size due to their depositional pattern. In the SCOOP area, your mineral tracts can sit above up to 20 different reservoirs. Each one will have its own characteristics. The OCC will set the drainage area for the most efficient recovery of hydrocarbons for each zone (because the state wants their portion in taxes to be optimal and efficient as well!). Generally, the deeper you go, the larger the spacing will be. They started with square 640's for the Woodford but I suspect there will be some de-spacing going on as time goes on and they understand the reservoirs better. I wouldn't be surprised to see long skinny spacing coming soon as that matches the tube drainage patterns. Think of a whole bunch of logs lined up side by side. Much like the Branch and Casados wells. I am talking to my attorney about my lease clauses as well to take this into account.

Martha Barnes -geologist

Virginia Pflum said:

Martha,

I will agree we need some new clauses, but today's oil companies have got so big that they rule everything. I'm not sure that OCC works for the mineral owners anymore. Finding a good oil & gas attorney may be hard to do as the oil company has all of them on retainers, so they can't work for the mineral owner.

If the oil company doesn't like your lease, they will let you set. I have 320 A with H wells being drilled all around me. They didn't like my clauses, so they didn't want my lease. I keep thinking they are probably pulling the oil out from my land. Yet OCC tells me they can only pull 350 ft. Guess there isn't a pool of oil like their used to be. When one oil company has leased or purchases 9 square miles, they rule the area and you can just set if you don't like their leases.

M Barnes,

Thank you for explaining how the H wells are. I understand the multi-phase frac, but didn't realize that the shale & limes have to be produced different. Since I had a producing well in the Miss & Miss chad on this farm, I assumed they could drain the oil like we used to be able to with V drilling.

I hope we do see some different spacing real soon. I have (1) well spaced on 340 A and it does real good. Now they are spacing some of my other property on multi unit (1280), so I don't plan on getting a very good check, but maybe they will drill several wells to make the different. Since I already have signed a lease on the minerals with the multi unit spacing, it's to late. But, I will be working on clauses for any future lease. Things like multi unit spacing will require at least 2 or more wells to be drilled within a reusable time. But, again what is reusable time? It would depend on the time it takes to pay out the drilling cost of the first well. I have invested in wells that will never pay for themselves, other payed out in 2 years.

To my understanding until they change the law, even if there is a multi-unit well over 1280 acres, they still pay on each 640 separately. So if 60% of the perfs are in one section, that section gets 60% of the payout and the other section gets 40%. For most of the ones I have seen, they really try to get 50/50, but sometimes they just can't due to the geology like a fault, or mechanical difficulty.

I haven't heard the term "reusable time". I would use the term "reasonable time". For this new horizontal play, the wells pay out pretty quickly because the first production is pretty high for the first two years and then very low for the next 20-30. However, the timing of the next well has to be balanced by the vast amount of acreage which will be held by production and the limited number of rigs and frac crews that are available. If a company holds 180,000 acres, there just aren't enough crews around to drill 180,000 wells in two years. It will takes years and years. And they are competing with about many other companies for those same rigs, pipeline, electricity, road space, OCC hearing time, etc. Supply and demand for resources. Payout also depends upon the price of oil and gas which can vary as we all know.

Also, we are pretty early in the understanding of the true deliverability of these shales (and tight limes). Most of the big companies are investing millions to billions of dollars on small test areas trying to figure out the best ways to frac, how close to drill the parallel wells, what types of frac fluids to use, what types of sand or ceramic balls to use to hold the fractures open, microseismic listening, etc. This is a long term type of play and we are in the first early stages so lots to learn. I am just grateful and excited that we can be a part of it. Continental Resources and Newfield have some really good displays in their presentations if you want some visuals.

M Barnes,

I think I need to wake up before I write. The word is reasonable time. I know lots of leases will not get drill because of rig shortage and crews to run them. Most people don't want to work that hard today so they just take welfare. It's the early stages of H wells and a lot for most mineral owners to learn.

Thanks again for all the good information.

I think there are gremlins in the typing system of this software. I am sure it is not us!

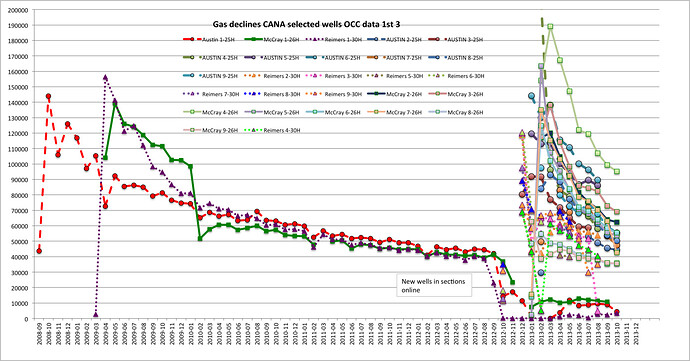

Here is a picture from three sections in the Canadian county Woodford (gas only), that show how long it took them to get the second phase of drilling going, but look how the production can stack up if we have patience! I need to update the last few months to see if they got the original wells back on line, but you get the idea.

M Barnes:

Is there enough data to project EUR on any of these wells? Also is your Y -axis metric BOE?, if so how do you calculate that?

Thanks!

Bob, there probably is enough data to project the EUR if they had not shut in the first three wells while they opened up the new ones. A good engineer with a good software program (or one of us with the patience to work out the math) could make a pretty good estimate.

The Y-axis is gas only in mcf. At the time I made these, the condensate data was not as available or reliable, but it should be added in. The Canadian County Woodford is in the gas zone. The SCOOP Woodford as drilling now is more in the condensate and oil zones, so recoveries will be different and economics will be different due to the price differential between gas and oil.

I go back about every quarter and update the wells with new production. The graph is mostly to illustrate that three sections were held by one well each for several years until Devon came back and drilled 8-9 more wells in each section to fully develop them. Interesting that some of the second set of wells were better and some were worse than the original wells. A centerline through the middle of the cluster would give a good average.

I sure got a whole bunch of offers to buy my acreage right before that second set of wells was drilled and the price per acre wasn't anywhere close to what those wells are giving in royalties now! When I get it updated, I will post again.

Question Re; Reversionary Rights or Rights of Reverter

Can anybody tell me if it's important to include this clause in a lease.

"This Lease shall not convey any interests in reversionary rights or rights of reverter"

And can someone explain this clause in layman's terms.

Thank you , Debbie

P.S. Rick, I like how you're trying to keep the different discussions organized. Next time I'll try to follow the system. Have a good day :)

I guess it depends on the actual situation.

This explains it more than I can.

http://legal-dictionary.thefreedictionary.com/reversion

Dear Ms. Storm,

I find it so unimportant that I include reversionary language in no form of mine. Without that language that you quoted, leases in most states have been held to include after acquired title.

A reverter, or possibility of reverter, is where title to property is acquired or reacquired upon the occurrence or non occurrence of certain events.

For example, a term mineral deed for 10 years for 10% of the minerals. The lease is taken on year 9 of the term and on year 10, you acquire that additional interest in the property. That would be a reverted or after acquired interest.

Another example (where there has been a court case) is where property was conveyed to a church for as long as it was used for church purposes only. A lease was granted by the church and the church got sued because the property was not being used "for church purposes only." The plaintiff lost. The judge correctly said, if you did not want the church to have the minerals, you could have reserved them. They still hold services, etc.

I might suggest that questions of such a broad scope be placed in the general forum, where more people have an opportunity to view the question and offer an answer or solution. Putting a general mineral law question into a county forum does not really get you the exposure needed to have a good opportunity to get your question answered.

Best

Buddy Cotten

Debbie Storm said:

Question Re; Reversionary Rights or Rights of Reverter

Can anybody tell me if it's important to include this clause in a lease.

"This Lease shall not convey any interests in reversionary rights or rights of reverter"

And can someone explain this clause in layman's terms.

Thank you , Debbie

P.S. Rick, I like how you're trying to keep the different discussions organized. Next time I'll try to follow the system. Have a good day :)

I wasn’t to sure how important it was to include the clause in a lease.

So, my understanding is that you (Buddy) don’t think it’s important.

That’s all I need to know.

Rick and Buddy your feedback was greatly appreciated!

Have a wonderful day!

Debbie Storm