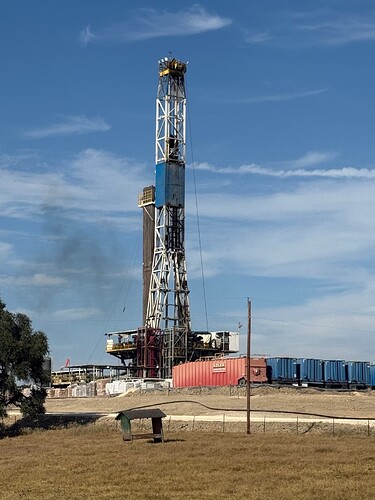

Nabors 1205 at Pecan Farm

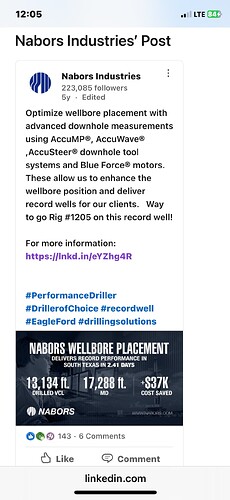

Some interesting trivia on Nabors rig 1205:

I

This was Nabors rig 1205’s record back in 2019, (2.41days) For this rig to be pulled out of a hotbed play (south Texas) and come to an unproven speculative area, sounds like RedHawk (EOG) wants the best poker player at the table.

Does anyone know which unit they are drilling? Reimers or Monster Rock?

Monster Rock / officially spud 9/23

I got curious and was looking at leasing to the NE of Monster/Reimers. Went in and researched courthouse filings and found some interesting things.

Acaval Land Co. filed 29 leases on 081823. The large majority of these leases are located east of US 77 and south of IH 10 but some go as far as Dubina. And then… Acaval promptly sold those leases on 101023 to a couple of DFW companies, Peregrine Petroleum Partners and AHW Petroleum. (As an aside, AHW is for Alinda Hill Wikert, granddaughter of H.L. Hunt. Very interesting person.)

KEW Drilling filed 86 leases 042424 - 033125. Like Acaval, their leases are primarily east of 77 but go as far as Bell and Bostick to the west and even Anderson north of SBG.

My Guy told me companies that drill and operate the wells like to get 75% minimum so if the mineral owner gets 22%, that only leaves 3% to pay out to intermediate companies. Pretty tight margins.

But my main takeaway is that Acaval and KEW seemed to be really interested in the area east of 77 and south of 10.

FWIW.

IMO they thought following the AC trail N/NE of Schulenburg going south could pay out. Starting very early in 2023 EOG, Redhawk, San Luis, Gulftex were leasing the areas EOG is in now…but not to many people thought this area was anything special. I have quite a few parcels and could not get anything going in that area since Penn V leased in 2012…until EOG came along….and of course they held the leases to record them for months….as they are still doing right now in the general area you are talking about….plus no one was giving the EOG bonus of $1200 at 22% or $1400 at 20%. so that is my guess….and we will see if EOG decides to capture any of these to the E/NE.

Also drove by the pads today, looked like Parr has finished the frac since no longer had trucks lined up…but some still coming and going..very few. Pecan farm rig was not drilling, no pipes I could see, so not sure if they are done with Monster and getting ready to move to the side for drill #2 ?? About ready to break ground for pipeline…fences are down and gates going up…just waiting for the crew and the excavators and pipes to arrive…have not heard one thing as far what they are seeing during the drill….extremely extremely hush hush.

Not sure if I shared this but I had heard Parr’s well logs were not as good as expected but they were cautiously optimistic….and had some issues during drilling and fracking…they did not elaborate any further. …but heard even if Parr is somewhat disappointing they are still planning the 4 units that go between Blackshear and Pecan farm… the 2 units that are south of Pecan farm pad will be determined by the 2 well results…small concern that they might be too far east on their NE direction…that is why he told me they are called “test” wells…

I mentioned this in an above comment, but KEW and Acaval have been involved in the area the last several rounds of leasing. KEW took ownership of 50% of Santa Rosa’s leases last time around and really wanted to drill a well but never pulled the trigger. They tried finding a partner to drill the acreage but timing wasn’t right in the market.

Now, KEW is back again and still believes in the area.

As for the 75% NRI. In nearly every developed area, royalty rates are no lower than 25%, so a 75% NRI is the norm across the Eagle Ford, Permian, Haynesville, etc. In these speculative areas that we are talking about, royalties ranging from 20-22.5% leave a significant margin for a company to sell their leases and carve out a 2.5-5% override. That is a healthy healthy overriding royalty interest if the wells are good. So, I would respectfully disagree that the margins are tight. Now, if KEW, EOG, et al have units where their NRI is 77.5-80%, those extra percentage points can make a massive difference in the economics of the wells and sway them to drill more speculative acreage.

Two points

I agree 100% that royalties of less than 25% allow the players to make good deals and retain some “gravy” for key parties.

Secondly, KEW is not a group that will take on operations - especially deep horizontal wells like are being drilled here. Their MO is “flipping” acreage for more money than they acquired it for and ideally retaining a small override in the process.

Agreed. I think they will take on a non-op interest but they’re not going to risk trying to drill a well in this area. Best outcome for them is to work a deal with EOG and have them drill (if Reimers/Monster are good)

And EOG controls the game here - no other operators ready to jump in and compete with them (at least right now).

So EOG sets the “price” for acquiring any acreage from KEW and others.

Comstock has done this (i.e. control pricing) in their Western Haynesville / Bossier deep gas play in Robertson and Leon Counties.

Big dog controls the playing field

And candidly, in my opinion at least, there’s no one better to see if this rock works or not. We don’t need another trashed wellbore condemning the acreage (ie Cypress!)

100% agree - EOG is the best in the industry right now to optimize the potential in this new trend. Or determine if it is not viable

I got a report from FSNN about ‘oil company surveyors’ in a hay field just south of Schulenburg. Normally I’d discount the report because it just doesn’t seem valid, but this person knows what cooks and was one of the first to know about the pecan farm. We’ll see what happens but don’t hold your breath.

Could be well location, could be pipeline

Could be property sale / re-plating

I have a general question for those of you who have experience along those lines. Who makes the final decision as to the surface location? The geologists? The land department? Legal?

I guess with modern technology the specific surface location is not as important as it used to be. Just idle curiosity. Thanks.

In these horizontal plays, the primary forced behind surface location selection NOW is the land department - but in concert with the drilling and reservoir engineers.

The geologists have already identified the general trend for the play. But if there are concerns @ faulting or other subsurface “hazards”, the geos (geophysicists and geologist) are part of the surface location selection since this impacts where the laterals will be drilled.

But remember that this is a total “team” effort - it is not someone in Land Dept acting like “god” and stating “Drill here”

The wells horizontal lateral lengths are usually positioned to take advantage of the naturally occurring fracture patterns in the zone of interest so that the frac patterns are enhanced to encourage more fluid flow. The surface location has to take into account the surface topography-big issue in mountainous areas and not so much in flat lands. Also, it takes about 1/4-1/2 mile to make the turn from vertical to horizontal, so many times the surface location is outside the drilling unit spacing so that the turn is mostly in the non-perforated acreage and the maximum perfs can be in the allowed spacing unit. Takes a combo of the many departments to get the alignment to save money on drilling, get the best performance, cut down on pad costs, avoid other well paths, etc. The drilling can be adjusted to start out in one direction and then spiral to the optimal alignment for the lateral portion of the well path.

I was a landman for 12 years. A lot depends on if the minerals and surface are severed or not. If they aren’t, then interests are a lot more aligned between landowner and operator. When you work in areas with larger tracts of land, you will always want to negotiate a lease and surface use agreement simultaneously to avoid issues down the line.

If you have a situation where the minerals are severed, surface owners can become very difficult to work with. That being said, in Texas, the surface is subordinate to the minerals, so an operator has the legal right to “force” their way onto a surface owner’s property to build a surface location. Those are not fun situations to deal with (trust me!!)

So, as Rock Man said, it’s a team effort across all departments on the optimal location for a surface location. Technical will point out the optimal location and the land department will provide insight as to easier landowners to work with or any existing contracts that make the process easier. Now, with better drilling technology, surface locations have a bit more flexibility to be located in spots that may not be ideal, but can still accommodate an optimal well path etc.

Thanks to all for the informative responses.