Hello. Would appreciate a reality check on a recent offer to sell my entire five acres.

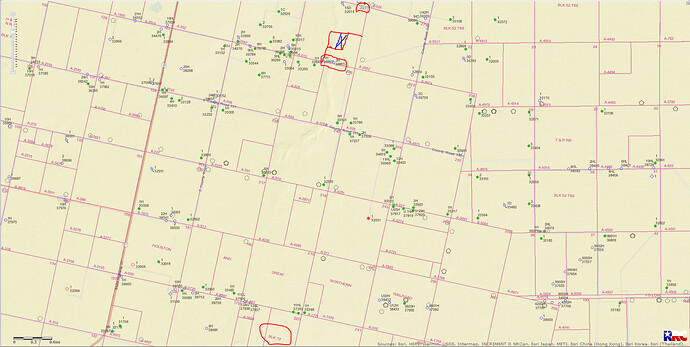

(E/2) of the (NW/4) of the (NW/4) of the (SE/4) of Section 247, Block 13, H & GN RR Co. Survey

There is currently a lease on the property which expires in June. Was originally paid $10,500 per nma bonus and 25%. The offer I recently received was to immediately sell the property for $25,000 per nma ($125,000) total. Any thoughts on this? Is there much activity in this specific area? Thank you.

The acreage you identified is good acreage that will eventually be drilled. If the lease is expiring then the operator either has to drill or lose the lease. If that occurs then Centennial (permitted operator) will have to pay to re-lease. If you are lucky, Noble will lease your acreage and pay you again for a lease so that 10,000’ laterals can be drilled based on there acreage position. As far as what it’s worth, it’s worth at least $50,000 /nma. They will not want to pay that because they want it on the cheap. If you do not need to sell then you shouldn’t. There is too much upside in the future to sell.

2 Likes

Thank you everyone for the replies. There seems to be a lot of interest over the last few months in this acreage, I guess just for that reason. I don’t need to sell. The company making the proposal was extremely eager to close the transaction as quickly as possible.

1 Like

‘The company making the proposal was extremely eager to close the transaction as quickly as possible.’

Always a reason to be skeptical of a proposal.

This is good acreage and I wouldn’t sell if I was you, but if you do you should use one of the public auction websites (there are a couple good ones, but whenever I suggest specific sites they block my posts…). That being said, at $25,000 per net mineral acre its actually a solid offer.

That June lease expiration date is nice. You might be getting a new lease bonus or some wells drilled there by then.

We have 5 acres in the same section. I would not sell, if you don’t have too. Also think of the capital gains, owch

I think I will hold out for a while and see what happens, unless an offer I just couldn’t refuse comes along…

Jeff,

I guess I responded the other day to the email notification which made my response undeliverable. So, I’m just resending it inside the forum. Anyway, your best offer will come from the Operator right before completion. However that will not be good enough at least for me. I know what my property is worth. Oxy offered $33K but I told them “No Thank You”. They were not surprised. It’s worth almost twice that and still giving them a 50% profit. The mineral buyers are a shady lot, mostly bad and some just okay. I talk to them all the time for fun. The younger guys release info inadvertently since they are trying to reel you in at 20 cents or less on the dollar. The ultimate determinant on the value of the land is the quality of the area and the number of benches or productive horizons.

Mike

1 Like

Mike. Thanks. I am learning more about the buyers every day. It has become apparent why they are interested in my property, even though it is only 5 acres.

Great info mike, Jpeterson what have you learn about why they want your 5 acres?

They all want the same thing, but it depends on who it is. If the company approaching you is the Operator (Centennial) then they want to drill and get you out of the way so that they can enhance their profit on the wells they would drill. If its a separate mineral purchaser, then they most likely are trying to flip minerals and make a quick profit by offering you a sub-standard price.

1 Like

Its not the operator, so I’m guessing you are likely correct

Hopefully the 2 permits will be approved

I was contacted by the group again regarding their offer. Their justification for the pricing they are offering is as follows:

> > > > > * Here is our undiscounted 10-year numbers for the permitted well - essentially this is exactly what we believe this well is going to produce over the next 10 years (numbers are based on comparable new wells drilled by Centennial near where your acreage is located): 426,306 barrels of oil // 640,458 cubic feet of gas

> > > > > * Using $65 oil and $2.50 gas - the pretax 10-year number for your share of production would be $108,241 for oil and $6,254 for gas.

Hence the offer for 125k for the five acres. What do you all think about this?

Thanks again for all of the input. Jeff

1 Like

I have been following this conversation with great interest. Our property description is N/2 Section 27 and N/2 Section 30, Block 4, H&GN Ry. Co. survey, each of the five siblings owning 7.5… net mineral acres. There is currently a producing well - Grady State Unit 2730 #1. We continue to receive many offers to purchase our rights. The revenue from the well has dropped quite a bit in the last year. Everyone is wondering if they should hang on or sell. I always question why there is so much interest in purchasing with revenue falling. Makes me wonder!? Also, we have no idea if any of these offers are even in the ball park. Any thoughts?

1 Like

I heard larger numbers , it is based on two wells , on our are 5 acres I would say double that. What is the pooled unit and what is your lease at 1/8 or 1/4

1 Like

Dear Jpeterson,

Ask the purchasing group if they would make their offer as to the currently producing formation in the currently producing well only, with you retaining all other rights to other acreage, other horizons, and other densifying wells which may or may not be drilled in the unit.

I suspect that the answer will be no. In that case, why did they only share information as to one well in the currently producing formation? We all know the answer to that rhetorical question.

Best wishes,

Buddy Cotten

1 Like

Projections for 10 years are of minimal value in my opinion. Oil leases go on for infinity With Reeves county rivaling the oil in Saudi Arabia, I would not sell. If you have loved ones that could benefit in the future, let them enjoy the fruits of this massive oil find. Technology could advance to reap even more oil in the future. I inherited my royalties over 30 years ago and have received small income until a few years ago. Centennial just sent me a check for $60K a couple of months ago. The future is bright.

1 Like

All, thank you for the responses. I have obviously been torn on selling or keeping. It amazes me how valuable this property has become compared to what I paid for it a number of years ago. I guess thats why I have entertained offers. I was even wary of the lease bonus I received a few years ago.

Well, I received another offer at 40k/NMA from an alleged “end buyer” as well as additional initial offer letters in my mailbox this week. Seems to be a lot of interest here.