Hi Pat,

You’ll need an appraisal of the minerals as of 1985, often called a “retrospective” appraisal. The mineral appraiser (usually an engineer or geologist with appraisal experience or certification; that’s what the IRS likes to see best) will determine what the market value of the minerals were on the date of aqcuisition. Here is a post that has more information: Question About Capital Gains Tax and the Value of Inherited Mineral Rights

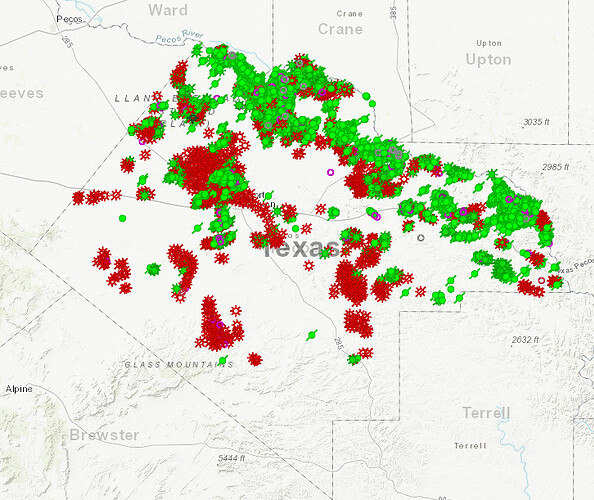

There are some resources listed on the directory of this site as a starting point, but any appraiser should know exactly what you need. It is a fairly in depth report though (to satisfy the IRS) so expect to pay at least $2000 and up to $10,000 depending on the size and complexity of your minerals. If you have more than a few nma in Pecos county, it’s probably well worth it to you based on how much activity and value is there.

pecos county wells as of 1985

-Tracy