@Brock_Presgrove Harold G. Hamm took Continental over in November 2022. Since then checks have been excessively less. So this is new since he took over.

Does anyone what gas plant is buying gas from them?

" …anyone knows what…"

@Scout Harold G. Hamm took Continental Resources private when he took it over last year. It is no longer on the stock market.

Continental Resources Becomes Private, Harold Hamm Purchases it for $4.3 Billion.

I see Banner Pipeline is one of CLR’s subsidiaries. Maybe CLR uses Banner Pipeline to move their oil/gas. That may lead to some other connections of CLR to gas plant products plants.

Sometimes I have heard that some companies blame it on their computer programs.

Don Bray, have you looked at the “Gas History 2023” pdf? Based on it, is correct for them to say they just sell gas and oil on the well head and nothing more?

I have looked at the pdf file. Don’t know whether Continental is correct or not. You may want to consult with a good oil & gas attorney. Wish I had way back when… ![]()

So I learned today that, according to Camino; “We chose to show our residue and NGLs as the revenue stream where other operators only show their wellhead. The royalty owner is going to get the same settlement regardless of if they are getting residue separated from NGLs or if they are getting the wellhead gas sales. It’s all wellhead gas sales, it’s just a preference on how the operator would like to record their revenue.”

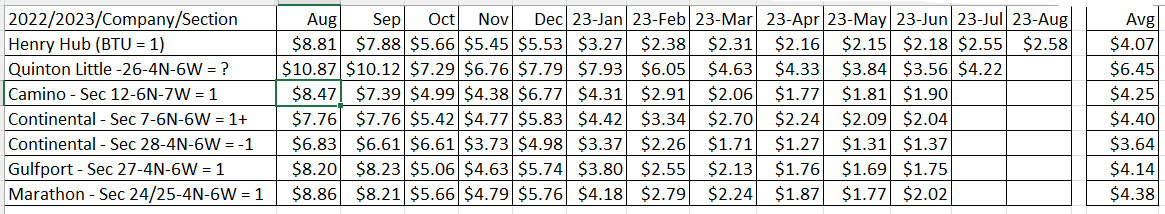

Okay… The Quintin Little Company only shows their wellhead gas, yet their price is considerably more than what Continental reports on their settlement sheets for their “wellhead” gas. Reference my spreadsheet snip… It seems to me the price Continental is getting should be closer to what The Quintin Little Company gets. Even more since Continental is a considerably bigger company.

Each company has their own contracts with the gathering and marketing companies. Your examples are quite a distance apart, so may not be relevant. Henry Hub is a generic blend for Lousiana, so not relevant for Oklahoma. Location, location, location and the blend of liquids in the gas stream plus de-watering, compression, gas separation, etc. are very important.

Don you show all different wells. This issue is about several months from the same well. The BTU factor with Camino was 1.285 in January & February. Then CRL in March was 1.307. But then went down to 1.259. Does that make any difference as far as monthly payments?

Brock - I would think It would make a difference, but there are other factors as Martha mentioned above. Surprised the BTU factor with Camino is as high as it is since they separate the gas from the liquids. My settlement sheets from Camino show the BTU factor barely over 1. Same with Marathon and Gulfport who also report NGL’s separate from the gas.

Martha - I am a layman, but I understood the settlement prices at Henry Hub were used as benchmarks for the entire North American natural gas market, which would include Grady County. It’s odd to me that a small company like Quintin Little does a much better job of marketing it’s “wellhead” gas than a large company like Continental.

The Camino well (Section 12-6N-7W) and the Continental well (Section 7-6N-6W) are very close to each other. The other Continental well (Section 28-4N-6W) and the Quintin Little well (Section 26-4N-6W) are a couple of miles apart.

FYI -

DCP OPERATING COMPANY, LP is the reporting company for Quintin Little’s “wellhead” gas.

CONTINENTAL RESOURCES, INC. is the reporting company for Continental’s “wellhead” gas.

CAMINO NATURAL RESOURCES, LLC is the reporting company for Camino’s “wellhead” gas.

From Investopedia

"Henry Hub is a natural gas pipeline located in Erath, Louisiana, that serves as the official delivery location for futures contracts on the New York Mercantile Exchange (NYMEX). The hub is owned by Sabine Pipe Line LLC and has access to many of the major gas markets in the United States. The hub connects to four intrastate and nine interstate pipelines, including the Transcontinental, Acadian and Sabine pipelines.

Understanding Henry Hub

The Henry Hub pipeline is the pricing point for natural gas futures on the New York Mercantile Exchange. The NYMEX contract for deliveries at Henry Hub began trading in 1990 and is deliverable 18 months in the future. The settlement prices at Henry Hub are used as benchmarks for the entire North American natural gas market and parts of the global liquid natural gas (LNG) market.

Importance of Hub Pricing

Henry Hub is an important market clearing pricing concept because it is based on the actual supply and demand of natural gas as a stand-alone commodity. Other natural gas markets like Europe have fragmented hub pricing points. This means natural gas prices are often indexed to crude oil, which can have very different supply and demand factors affecting its price. Attempts are being made to develop European hub pricing points in the Netherlands and the UK, but this has proved difficult so far due to competition from national hubs. Asian natural gas markets are even more fragmented and have no defined hub pricing point, although Singapore would like to serve this regional role. Consequently, all Asian natural gas prices are either indexed to crude oil or linked to Henry Hub.

Henry Hub and Liquid Natural Gas

Henry Hub is also used in delivery contracts for LNG on a global basis, despite being a spot price for natural gas that is very specific to the North American gas market. Some global gas producers like Qatar and Australia prefer to base the pricing mechanism of their natural gas deliveries on spot prices rather than indexing to the price of oil. This is especially true when crude oil prices are falling. Gas producers can rely on Henry Hub as a source of natural gas spot pricing to meet this need because of its large trading volume, clear pricing transparency, and high liquidity. Henry Hub prices are widely quoted by futures exchanges and other media sources, so parties to a contact can easily obtain this pricing data."

Pricing at Henry Hub is a basic metric spot price used for a certain purpose priced at the Louisiana hub. OK prices are going to be a bit different (usually lower) due to the pipelines they go into, transportation costs, etc.

Don- from my experience, most “contracts” in Oklahoma, use as their basis, a blend of Henry Hub and Chicago City Gate prices. The price of NG on the last trading day of the month, not always the last day of the month, determines the price paid for delivered gas for the next 30 days.

Quintin Little sells to the first purchaser. Continental sells to one of its own subsidiaries who then sells to the first purchaser.

The gas markets were quite above board a number of years ago. Now, operators have found a new, valuable revenue stream so they build their own pipelines to a major trunk line. All perfectly legal, so I don’t blame them. However, the mineral owner takes it in the shorts. That is what most of the class action lawsuits are about. It is so lucrative, they keep on doing it, only having to cough up a small portion of what they are making.

If Continental is selling to affiliate at below-market price, then royalty owners are underpaid while Continental pockets the difference between affiliate price and subsequent sale at market price. Chesapeake was famous for this tactic. Maybe OK law will override this practice. In Texas one cure is to specify pricing in detail in royalty clause and to require value be based on sale to independent third party.

@TennisDaze After talking with certain employees at Continental I can confirm they “do it the same as Chesapeake did”. That’s a quote from every Continental employee I and my sibling have talked with since having Continental take over our Chesapeake leases.

Todd, can a subsidiary be called a third party, legally speaking?

Todd, how can I contact you to speed privately?

This topic was automatically closed after 90 days. New replies are no longer allowed.