New investor presentation from Energen ( 8/12/2014).

Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:

New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

Oil production in Permian causes pipeline bottleneck in Texas

...The Permian Basin is set to produce about 1.72 million barrels per day in September, 38,000 bpd more than August, according to the Energy Information Administration's drilling productivity report.

"The bottom line is that the incremental growth is slightly more than the market expected," Barclays Plc Analyst Michael Cohen said....

http://www.reuters.com/article/2014/08/12/oil-crude-permian-infrastructure-idUSL2N0QH1XQ20140812

As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:

Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

Good article. Pipeline / transportation issues have been touted as a potential Achilles Heel for the Permian for the past year or so.

The first companies that can develop a solid route the west coast for alternative market will make a killing in the long run. Surprised that these efforts have not taken off yet.

Rail transport option has been severely hampered by recent rash of accidents across the US. This is still the best option for west coast IMO.

Craig Wascom said:

Oil production in Permian causes pipeline bottleneck in Texas

...The Permian Basin is set to produce about 1.72 million barrels per day in September, 38,000 bpd more than August, according to the Energy Information Administration's drilling productivity report.

"The bottom line is that the incremental growth is slightly more than the market expected," Barclays Plc Analyst Michael Cohen said....

http://www.reuters.com/article/2014/08/12/oil-crude-permian-infrast...

Rock Man is that definition of un-risked correct?

Rock Man said:

As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

There are many definitions for unrisked - but based on how Energen is laying out their total number of laterals in the various formations, I am pretty sure that they are looking at acreage utilization (i.e. how many wells / laterals can be put on acreage) and are not addressing the economics / EUR's for the laterals being discussed.

The list of wells tied to lateral length points pretty strongly to acreage utilization approach.

If they were to have followed up this potential well summary with an EUR total or summary, I would think differently. But I don't see that in this presentation.

As always, just my opinion on this issue based on my own personal experience.

Craig Wascom said:

Rock Man is that definition of un-risked correct?

Rock Man said:As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

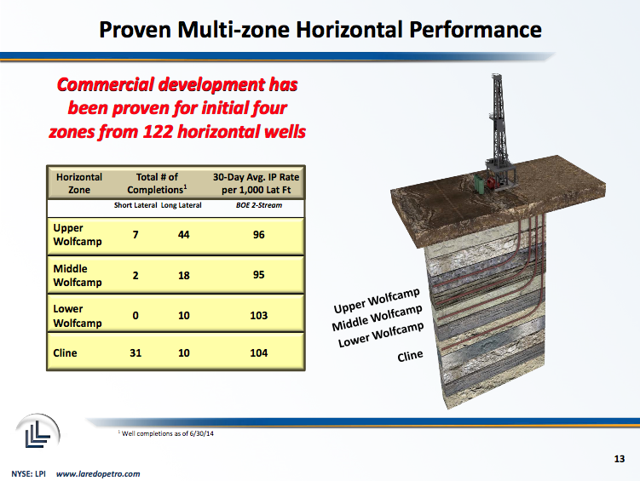

Good slide / attachment from Laredo.

The 30 day IP per 1000' of lateral is a good normalization viewpoint of the various benches. I am sure that hey have 60 / 90 / additional rate comparisons (would love to see this since it would show comparative declines). Maybe that will be put out at later date.

Cline numbers are surprising and point to a "sweet spot" for Laredo - but the fact that over 75% of their Cline laterals are "short" hurts the economics for this program.

Longer wells / laterals = more capital cost = higher reserves and normally better economics (not a one to one ratio as to capital cost versus additional EUR versus longer laterals IMO).

I agree about Mitchell and possibly Sterling. Not Glasscock though. They have several sections near St. Laurence between Apache and Laredo. I have seen this on the ground. Check RRC drilling permits for Energen in Glasscock, submitted 8-1-14 through 8-14-14. Worth your trouble.

Apache Ed Books 2 #5 in Glasscock is submitted 8-7-14 and has a Cline log if you look at the attachments with the permit. Would you comment about the log?

For Sterling a huge pad is being constructed NW of Sterling City. Don't know the operator yet.

Rock Man said:

As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

Is Energen the only company using this map it seems further east and south then I am used to?

j richard said:

I agree about Mitchell and possibly Sterling. Not Glasscock though. They have several sections near St. Laurence between Apache and Laredo. I have seen this on the ground. Check RRC drilling permits for Energen in Glasscock, submitted 8-1-14 through 8-14-14. Worth your trouble.

Apache Ed Books 2 #5 in Glasscock is submitted 8-7-14 and has a Cline log if you look at the attachments with the permit. Would you comment about the log?

For Sterling a huge pad is being constructed NW of Sterling City. Don't know the operator yet.

Rock Man said:As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

Cline outline looks very similar to what I have seen in the past but I have not sat down to do a point to point comparison.

But in a general sense the outline appears the same as to both eastern shelf extent and area in southern part of Midland Basin.

Craig Wascom said:

Is Energen the only company using this map it seems further east and south then I am used to?

j richard said:I agree about Mitchell and possibly Sterling. Not Glasscock though. They have several sections near St. Laurence between Apache and Laredo. I have seen this on the ground. Check RRC drilling permits for Energen in Glasscock, submitted 8-1-14 through 8-14-14. Worth your trouble.

Apache Ed Books 2 #5 in Glasscock is submitted 8-7-14 and has a Cline log if you look at the attachments with the permit. Would you comment about the log?

For Sterling a huge pad is being constructed NW of Sterling City. Don't know the operator yet.

Rock Man said:As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

J Richard

Thanks for the head's up on the Energen permit filings.

The Books 2 D well looks to be a probable multi stage frac well that will most likely be completed in section from Spraberry thru Wolfcamp and Cline and into the Strawn.

Interesting info included with the filing (someone screwed up on that issue).

The Rule 38 Engineering page (need this since this new well will be within field regulations limits to the next closest well - need an exception as per Tx RRC rules) has some great data at the bottom that puts a lot of the issues associated with the present drilling plays into perspective.

Note the reservoir parameters and recoverable oil in place per 640 acres - although this is a big number 3.2 MMBO - it only represents a 5% recovery factor.

That means there is over 64 MMBO that will be left behind in this section from this pay interval after primary recovery has been achieved.

I was excited to see the Cline log after reading your but was disappointed - Energen only included LAS plots (digital data) for Gamma Ray and resistivity. One really would like to see the porosity info to get a complete view of the section.

I will say that the data on the two well section does indicate (to me at least) that Lower Cline is much more prospective than the Upper Cline due to the presence of hotter gamma ray and more resistivity in the Lower interval.

So although one has over 600' of Cline interval, only about half has any prospectivity - and it is so think that one would probably need two horizontals to tap the entire section (too thick on frac over 300' in one hz wellbore IMO).

The multiple new hz permits on the Ranch are very interesting - three 2 mile long horizontals from same pad, Permits show same depth but I would not be surprised to see Energen lay these horizontals in three different intervals to see how this part of the section performs.

This ranch has historically produced vertically from over 2500' of interval, so there are multiple potential landing zones in this section for Energen to look at as horizontal viability.

Good stuff! Something to watch in the coming months.Peloec altionto

j richard said:

I agree about Mitchell and possibly Sterling. Not Glasscock though. They have several sections near St. Laurence between Apache and Laredo. I have seen this on the ground. Check RRC drilling permits for Energen in Glasscock, submitted 8-1-14 through 8-14-14. Worth your trouble.

Apache Ed Books 2 #5 in Glasscock is submitted 8-7-14 and has a Cline log if you look at the attachments with the permit. Would you comment about the log?

For Sterling a huge pad is being constructed NW of Sterling City. Don't know the operator yet.

Rock Man said:As I normally do, I tend to discount some of what is presented by operators as to various plays and results. Same approach here.

With respect to the Cline, looks like Energen is using the same old Cline outline that has been touted in historical presentations. Their acreage in the Mitchell / Sterling / Eastern Shelf area is in same area as recent poor Cline performance by many operators (e.g. Devon, Firewheel, etc.).

Wonder if Energen thinks they can crack the code here where others have not.

Their summary of Cline locations is "un risked" , i.e. no degree of probable economic success tied to any well that may be drilled. All they did here as I see is take their Cline acreage position and figure our how many laterals can be drilled in these areas. They have not ranked / risk weighted any of these locations.

I like the fact that they have listed some Wolfcamp A results in the Midland Basin but sure do wish that they would put out specific details on the Cline wells that they have drilled as per their presentation.

Craig Wascom said:Thanks Earnest, looks like the outline of the Cline is expanding according to Energen.

Earnest said:New investor presentation from Energen ( 8/12/2014).

http://phx.corporate-ir.net/External.File?t=1&item=VHlwZT0yfFBh...

Thanks j Richard and Rock Man for helping us understand what is going on there it sounds encouraging

Alon mulls more light crude runs at Big Spring, Texas, refinery: CEO

Following a a recent turnaround at its 73,000 b/d Big Spring refinery in Texas, Alon USA Energy is now about to embark on a naphtha-gasoline blending project enable it to run more light, sweet West Texas Intermediate crude there, the company's CEO said Friday....

Just finished listening to the RSP Permian call. Here is a link to the new presentation.

http://rsppermian.investorroom.com/download/RSP+Permian+August+Investor+Presentation.pdf

Interesting analysis of the future of crude, its production and its cost.

http://econweb.ucsd.edu/~jhamilto/IAEE_2014.pdf

The Changing Face of World Oil Markets

James D. Hamilton

jhamilton@ucsd.edu

Department of Economics

University of California, San Diego

More recently, the decline in U.S. production has turned around dramatically with

the exploitation of tight oil formations, whose 2.9 mb/d increase since 2005 more than

offset the combined 0.6 mb/d drop in conventional lower 48, Alaska, and offshore

production. Indeed, the net gain in U.S. production of 2.3 mb/d since 2005 by itself

accounts for all of the increase in field production worldwide discussed in Section 3

above. Tight oil plays in the Bakken in North Dakota and the Niobrara in Colorado have

brought production in those states to all-time highs (Table 1). Many analysts are

optimistic that the trend of growing production from this resource will continue for the

next several years, with the EIA’s Annual Energy Outlook 2014 predicting that tight oil

could bring total U.S. oil production back near or above the 1970 peak before resuming

its long-term decline.

But even if this forecast proves accurate, it is abundantly clear that it would not

return real oil prices to their values of a decade ago. One reason is that it is much more

costly to produce oil with these methods.

Finishing out the paragraph you shared,"Although estimates of the break-even cost vary, we do know that most of the companies producing from the tight oil formations have a negative cash flow (Sandrea, 2014)—they are spending more than they are bringing in at current prices. Although companies are presumably doing so in order to acquire an asset that will be productive in the future, it’s also well documented that production from typical tight-oil wells falls to 20 % of peak production within two years."

Interesting analysis of the future of crude, its production and its cost.

http://econweb.ucsd.edu/~jhamilto/IAEE_2014.pdf

The Changing Face of World Oil Markets

James D. Hamilton

jhamilton@ucsd.edu

Department of Economics

University of California, San DiegoMore recently, the decline in U.S. production has turned around dramatically with

the exploitation of tight oil formations, whose 2.9 mb/d increase since 2005 more than

offset the combined 0.6 mb/d drop in conventional lower 48, Alaska, and offshore

production. Indeed, the net gain in U.S. production of 2.3 mb/d since 2005 by itself

accounts for all of the increase in field production worldwide discussed in Section 3

above. Tight oil plays in the Bakken in North Dakota and the Niobrara in Colorado have

brought production in those states to all-time highs (Table 1). Many analysts are

optimistic that the trend of growing production from this resource will continue for the

next several years, with the EIA’s Annual Energy Outlook 2014 predicting that tight oil

could bring total U.S. oil production back near or above the 1970 peak before resuming

its long-term decline.

But even if this forecast proves accurate, it is abundantly clear that it would not

return real oil prices to their values of a decade ago. One reason is that it is much more

costly to produce oil with these methods.

AJ,

I saw that too. I suppose the success of the horizontal frak'ing "era" will hinge upon whether techniques can be derived to drive down development costs and the decline issue. Anyone have a firm answer on what tight oil companies out there operate in the black?

The tight oil companies may know that $100 oil is cheap compared to what could be coming down the road. But they might not be allowing for disruptive technologies,