We own some mineral rights in Township 1 North, Range 64. There’s obviously lots of action in this area as we are contacted often with offers to sell. Any advice? One recent offer is $5300 per Nma. Is this decent? Or should we hold tight? Tia.

Many offers to purchase come when production is around the corner. You should carefully consider offer to sell as a royalty check may coming very close. Sales of mineral rights are highly competitive and prices can change drastically. It is often beneficial to reach out to several buyers to see what prices might be. You should also talk with your accountant as there could be tax implications for a sale.

Jenna! Thank you so much for your reply. I am so hungry for information about all this. Yes, you are correct I believe they are going to start producing in this area. And while I am not particularly seeking to sell, it seems at some point it’s beneficial to entertain offers, that may be better than waiting for checks from production, that May or may not come, or match the price I can receive now. I think of “the bird in the hand versus one in the bush”! I am new at this, obviously. And I do like your idea of seeking different offers. I would love information if this offer seems competitive, for this area, or if people are holding tight to wait for production checks that will exceed these offers. Seems like a gamble either way! Thanks again! Are you at mineral right owner As well?

Oh, and yes. I was told Selling the mineral rights is taxed at a rate lower than royalty income? As the latter counts as income and the former as capital gains? Does anyone know if that is correct?!

sales may result in a capital gain an taxed accordingly. Royalties are treated as ordinary passive income.

SO depending on your income level, you may or may not have to pay capital gains, under the tax laws, if your ordinary income is low, you may not have to pay any capital gains tax.

https://www.putnam.com/literature/pdf/II963.pdf

Capital Gain Tax Rates

If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term “net capital gain” means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term “net long-term capital gain” means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years. The tax rate on most net capital gain is no higher than 15% for most taxpayers. Some or all net capital gain may be taxed at 0% if you’re in the 10% or 15% ordinary income tax brackets. However, a 20% tax rate on net capital gain applies to the extent that a taxpayer’s taxable income exceeds the thresholds set for the 39.6% ordinary tax rate ($418,400 for single; $470,700 for married filing jointly or qualifying widow(er); $444,550 for head of household, and $235,350 for married filing separately).

There are a few other exceptions where capital gains may be taxed at rates greater than 15%:

- The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Thank you for your thorough answer Jeffrey! Cl

Not a problem, love doing analysis and try to present a fair and balanced answer (Gosh that sounded like a news channel’s by line).

Another very important item for you to keep an eye on are the various anti-drilling items on the ballot. If those go through, interest in Colorado minerals will materially decrease if not disappear. It could spell the end to most of drilling and development in Weld and surrounding counties.

Not sure if you have offers in the table already, but in general the quality of the rock where you are is orettt dang good. Have you evaluated the potential etc? Would be happy to take a look at it with/for you if you would like.

Just pm me.

If you are being offered $5300 per Nma the last thing you should do is sell. The only reason you have been offered this amount is that your minerals will fetch much much more. Wait for production, and then you’ll see that $5300 is a ludicrous offer.

“If you are being offered $5300 per Nma the last thing you should do is sell.”

No offense, but that was a pretty scary response in my opinion. I’m not sure you are considering the many factors that influence production, nor did Carrie provide sufficient information to evaluate whether $5300 is reasonable - I don’t see a mention of the specific section, the royalty rate, what unit or units she’s pooled into, or any of the specific items you would need to judge whether the offer is ludicrous or reasonable. Big difference in economics between a 1/8 net lease and a 20% gross less. So while the buyer certainly is looking to make a return on their investment, there is a relatively competitive market for minerals in the DJ (although political forces are brewing as mentioned below) that decreases the chance of a buyer getting a ludicrous deal.

I think that a more thorough review is in order. I think there are several items to consider - including your typical oil/gas related components as well as the overall political situation.

Starting with the political overview, we once again find the oil and gas industry in the cross hairs heading into this November’s election. If the anti-industry petitions are approved, it will be the end of oil and gas development across the majority (like 95%) of Colorado. Even if existing permits are grandfathered and companies can develop/drill those permits, the companies might find it difficult raising capital in order to drill them prior to expiration. In summary, the political situation potential creates a binary outcome as it relates to the value of your minerals. If passed, the current value will drop to whatever the value of existing production with no upside is trading for in the market. If the ballot measures do not pass, then there are some items that you need to consider.

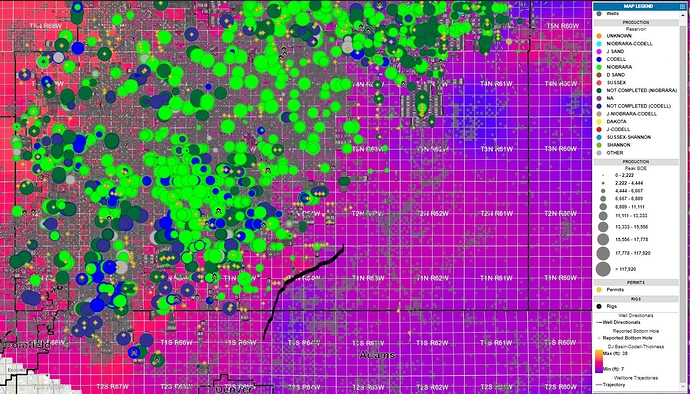

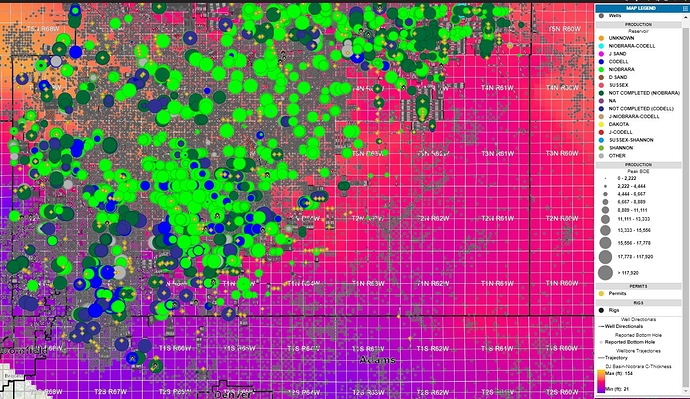

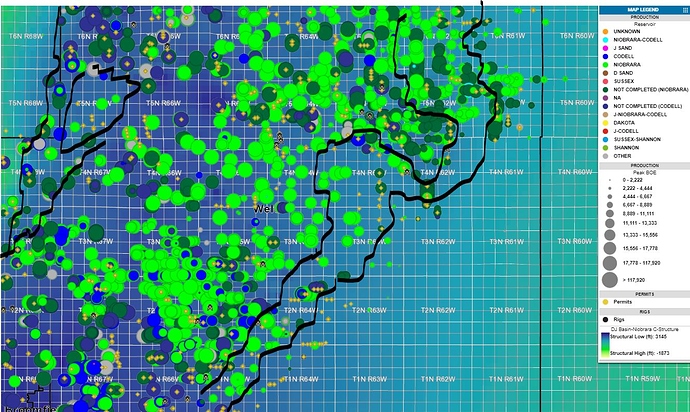

If you review the following two maps of the southern Wattenberg, you will see the legend on the right which provides insight into the different symbols, colors, etc. Essentially the color of the circles denotes the formation, the size of the circle is based on first 6 months production (BOW 6:1 dual stream), the gold diamonds are permit filed within the prior 2 years.

Hopefully the maps visually display some of the challenges you face when it comes to valuation in this area.

Essentially you are on the productive edge of the play. Furthermore, you lie in very close proximity to the Lafayette Wrench Fault. These faults influence production throughout the basin, if I get some time, I will look through my files for the various research papers I have and upload them.

The color shading in the background on the first map is a generic Codell thickness overlay. The black line cutting across 1N 64W indicates where the Codell gross very thin. You will note there are no permits SW of the black line, and relatively few permits NW of the black line.

The following map has a Nio C thickness overlay, once again you will note that the formation is relatively thin across 1N 64W.

The following maps show depth (sub sea level) - you will note that the areas of higher production correlate to areas where the formations are deeper. The depth influences production in a couple of ways, most notable is higher pressure. Further, in the Wattenberg the areas where the formations are deeper also general correspond to the Mineral belt and areas of a higher thermal gradient.

In summary…your acreage is what we would call fringe as in, its on the edge and would be very speculative. Depending on your royalty rate, whether you are in a permitted or drilled unit, etc the value could materially vary. Furthermore, without having the royalty rate, and specific section, I think it would be relatively reckless for someone to say that $5300 is cheap and the minerals will be worth 5 times as much in the future. If the prospective buyer is intelligent, they will have done their home work and analyzed the potential and most likely, your acreage will deliver cash flows in excess of the purchase price over time. But don’t consider that holding period to be riskless…similar to the weather here in Colorado, things can change quickly.

Thank you so much for your information! The map is very helpful! Where did that come from, May I ask??

Jeffrey, Thank you for chiming in. I appreciate the flow of information. You sound quite knowledgeable. Thanks for taking time out for my question.

I haven’t had time yet to study your maps. I will certainly do so tomorrow. Here’s more specifics on location…

Township 1 North, Range 64 West, 6th P.M.

Section 20: W/2NE/4; E/2NW/4

Thank you so much… What an amazing community here.

Oh yes, We have a lease until October of next year, but no production/ income.

We are in a different area. We got the mineral rights when my mom passed. The rights were divided between 4 kids. My brother and I did not sell. My other brother and sister sold their rights for a total of $19,000 each. A month and a half later My brother and I each got a check for about $7,000. Plus it looks like 8 more well are going in. We are glad we did not take the bird in the hand.

Carrie,

It appears you’re getting an awful lot of information thrown at you quickly. When I began our family journey into mineral rights, around 2011/12, this forum was different on the policies of “free advice” and the policing of such. I have no idea of your comfort level, experience and understanding of the rights you own, let alone the area and activities. I’m certainly no expert in the minerals field at all, however I urge you to move slower than a Sloth, study items like the face of a Koala in deep thought and finalize at a pace equal to a Turtle when you’re at the dotted line.

Best Regards, John

Amen! and well said.

I have a property located in this area and the royalties have been held in suspension (20 years), recently signed the long overdue division order and awaiting backpay of those royalties in suspension and I see that production has been steady. My question is are the royalties to be calculated on the rates of those time periods or by today’s market?

I have22 acres of mineral rights in weld county and haven’t received anything for royalties for the property I am owner of but noblel energy offered me 1500 bucks for my 22 acres of mineral rights I don’t know much about this kind of thing but feel like I’m being ripped off by these people my grandmother left this to me as an inheritance and told me it would be of good value to me.i don’t plan on selling but could certainly use the money can anyone help me or offer any advice

Would need to know the section, township, and range of your minerals to offer any sort of opinion/advice. If that $1500/acre is to purchase that sounds way too low, if it is to lease only then maybe not

How can you tell someone $1500 is way too low without the legal? You can’t. Certain areas of weld aren’t even worth that, while yes, others are worth a lot more. And with all these changes this year, it’s not helping prices.

Agreed, if you can provide the legal description then we can help answer your question!. Tx, Michelle